This Superior Value ETF uses Buffett's Owners Earnings concept to beat S&P 500

There's a saying, "revenue is vanity, profits is sanity and cash is reality."

This means that while high revenue or profits may make a business look good on paper, what really matters is having enough cash on hand to pay bills and keep the business running in the real world.

Cash is the lifeblood of any business. Without it, even the most successful company can quickly run into trouble. Cash allows a business to pay suppliers, employees, rent, and other expenses, and to invest in new opportunities.

In evaluating a business, one of the most important factors is its ability to generate cash. This shows whether the company is financially sustainable and can withstand economic downturns or other challenges. Revenue and profits are important, but they are not enough on their own.

Warren Buffett's use of owner's earnings highlights the importance of focusing on cash flows rather than just accounting profits when valuing a company.

To calculate owner's earnings, you start with the net income of the business and add back any non-cash expenses, such as depreciation and amortization. Then, you subtract any capital expenditures and working capital investments required to maintain the business. The result is the amount of cash that is available to the owners of the business.

Some businesses, such as airlines, require significant investments in capital equipment to keep the business running. For example, airlines need to maintain and replace planes on a regular basis, which can be very expensive.

Buffett focuses on the maintenance CAPEX, which refers to the amount of money a company needs to spend just to keep its current operations going. This helps him determine whether a company is generating enough cash to sustain its current level of operations.

In addition to maintenance CAPEX, there is also growth CAPEX, which refers to the money a company spends on expanding its operations.

Owners earnings is a guesstimate as Buffett doesn't really do very detailed mathematical calculation when valuing a company. If a spreadsheet is needed, it means it is too complicated and the business is something that he doesn't understand.

Hence, one would not find this owners earnings calculation easily. But we can use a proxy called free cash flow (FCF). The key difference is that free cash flow does not take into account the difference between maintenance and growth capital expenditures, while owner earnings does.

The Pacer US Cash Cows 100 ETF (COWZ) is an ETF that selects stocks based on high free cash flow yield.

This free cash flow yield is calculated by dividing free cash flow with enterprise value. The latter is used instead of purely market cap because it consider the amount of debt and cash in the company, which makes this single metric more robust. Companies with higher debt will cause the yield to go down.

Some may not believe that one single metric can pick good performing stock. But we have to know that the S&P 500 index is also based on one metric - traded market cap.

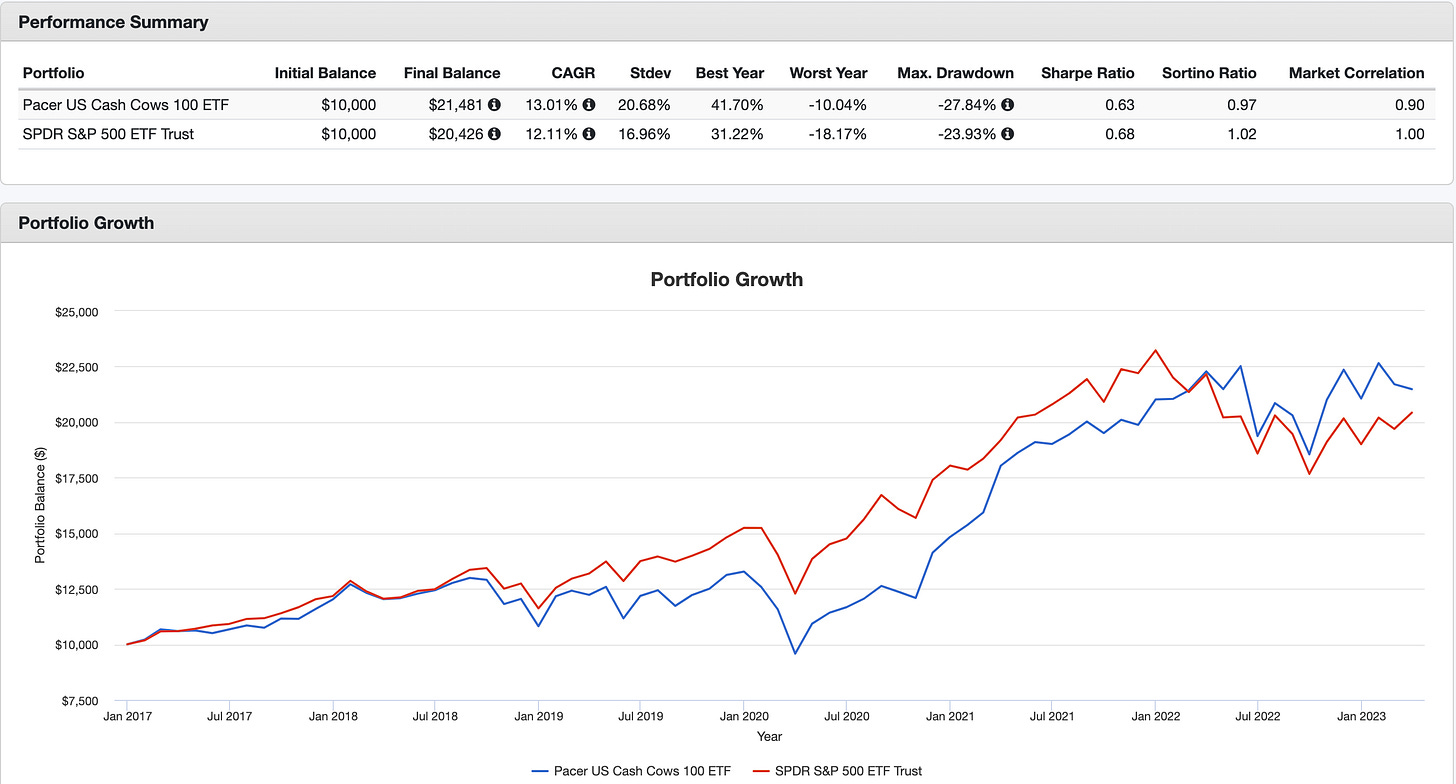

In fact, COWZ has outperformed the S&P 500 ETF (SPY) since it was incepted 7 years ago - COWZ returned 13% per year while SPY did 12%. But COWZ is more volatile as shown by its higher standard deviations and there were some years it underperformed SPY. Nonetheless, it is still impressive for an ETF to deliver above 10% annual returns. (This ETF also made my list of the Best ETFs for 2024.)