I've covered numerous ETFs in Finbite Insights, and it's time to revisit them in a single post.

Before diving in, I want to outline my biases in ETF selection.

Firstly, my preference leans towards equities over other asset classes. This bias stems from equities' proven track record as the highest long-term return asset class, despite their inherent higher volatility. Consequently, you'll notice that all five ETFs I'm discussing are equity-based.

Secondly, my preference is for strategy-based ETFs over those concentrated in specific countries, sectors, or themes. The reasoning is clear: choosing a country, sector, or theme necessitates accurate and timely selection, which may not be ideal for long-term holding. In contrast, a strategy-based ETF dynamically adjusts its exposure according to its investing criteria, offering a more resilient approach for investors.

It's also worth noting that besides these five, there are high-performing passive index ETFs like the S&P 500 ETF (SPY) and Vanguard Total World Index ETF (VT) to consider, especially for broader exposure and minimizing the luck factor.

Now, without any particular order of preference, let's explore the five top ETFs.

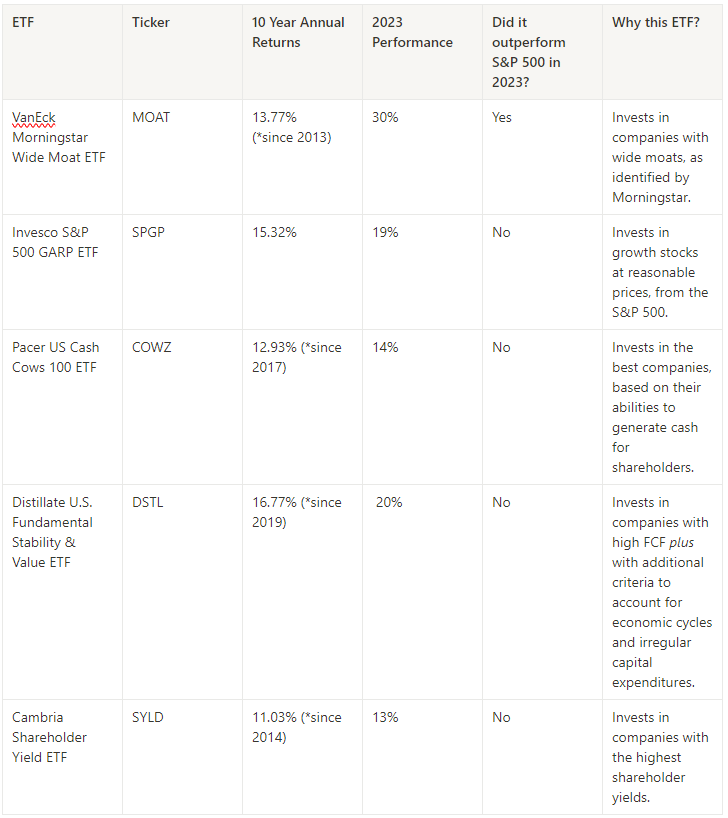

5 Best ETFs For 2024

1. VanEck Morningstar Wide Moat ETF (MOAT)

VanEck's MOAT ETF invests in companies with sustainable competitive advantages, or 'wide moats', identified by Morningstar's equity research. These 'moats' are essentially strong competitive barriers that help companies dominate markets and generate excess profits.

Since 2013, MOAT has seen an annual return of 13.77%, slightly edging out SPY's 13.29%. In 2023, its performance was even more impressive, gaining 30% against SPY's 23%.