Why is Buffett buying more Japanese stocks

In 2020, Berkshire Hathaway made its inaugural foray into Japanese trading houses by investing in five prominent companies: Mitsubishi (TSE:8058), Mitsui (TSE:8031), Itochu (TSE:8001), Marubeni (TSE:8002), and Sumitomo (TSE:8053).

It's not hard to see why Buffett is drawn to these companies. They bear a striking resemblance to Berkshire Hathaway, but with a Japanese twist.

These companies function as conglomerates, with diverse operations that span a wide range of industries such as energy, metals, chemicals, food, textiles, and more. In short, they have their fingers in many pies.

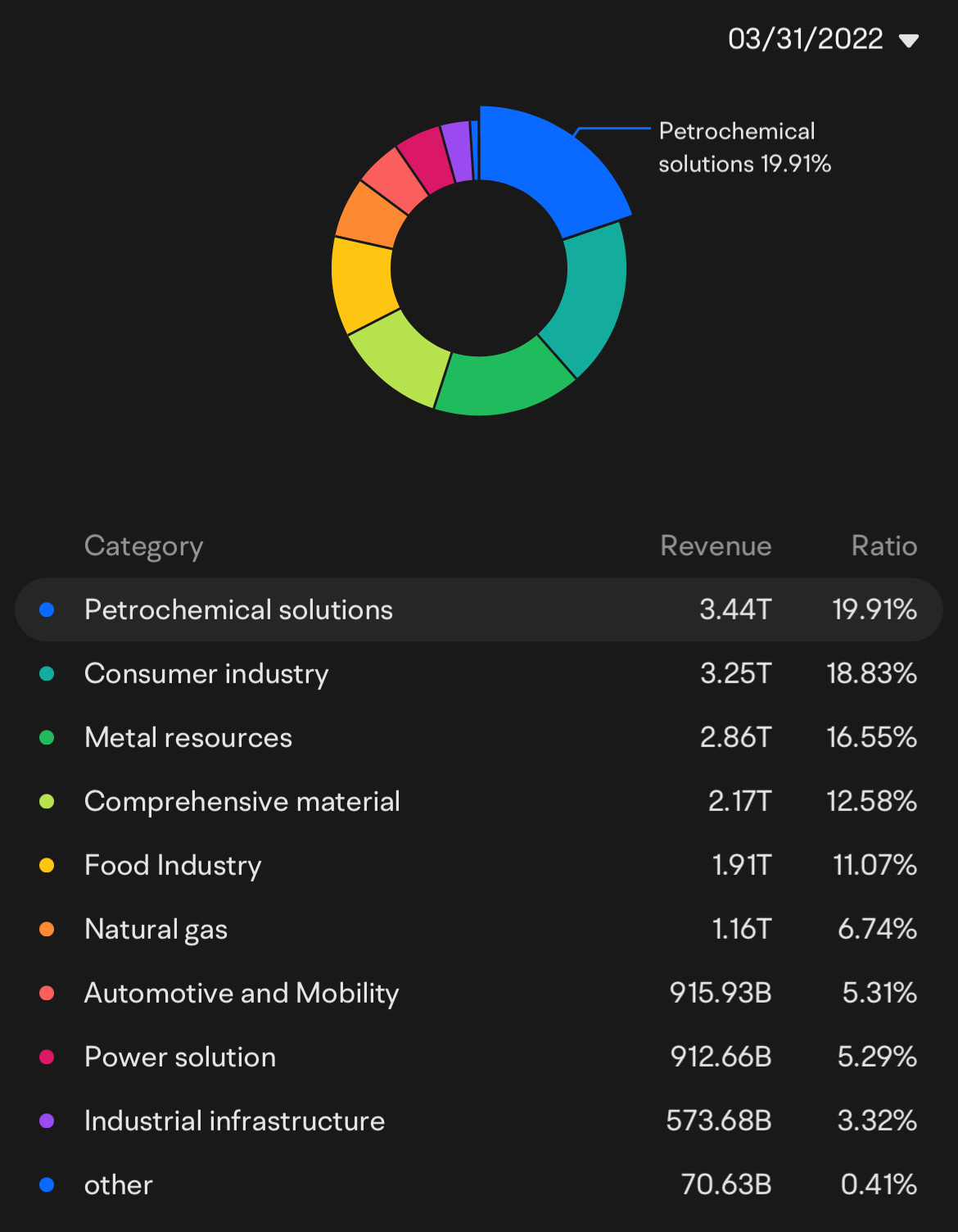

Mitsubishi boasts an impressive portfolio of 10 distinct business segments, with the petrochemical, consumer, and metal resources segments ranking as their three highest revenue streams.

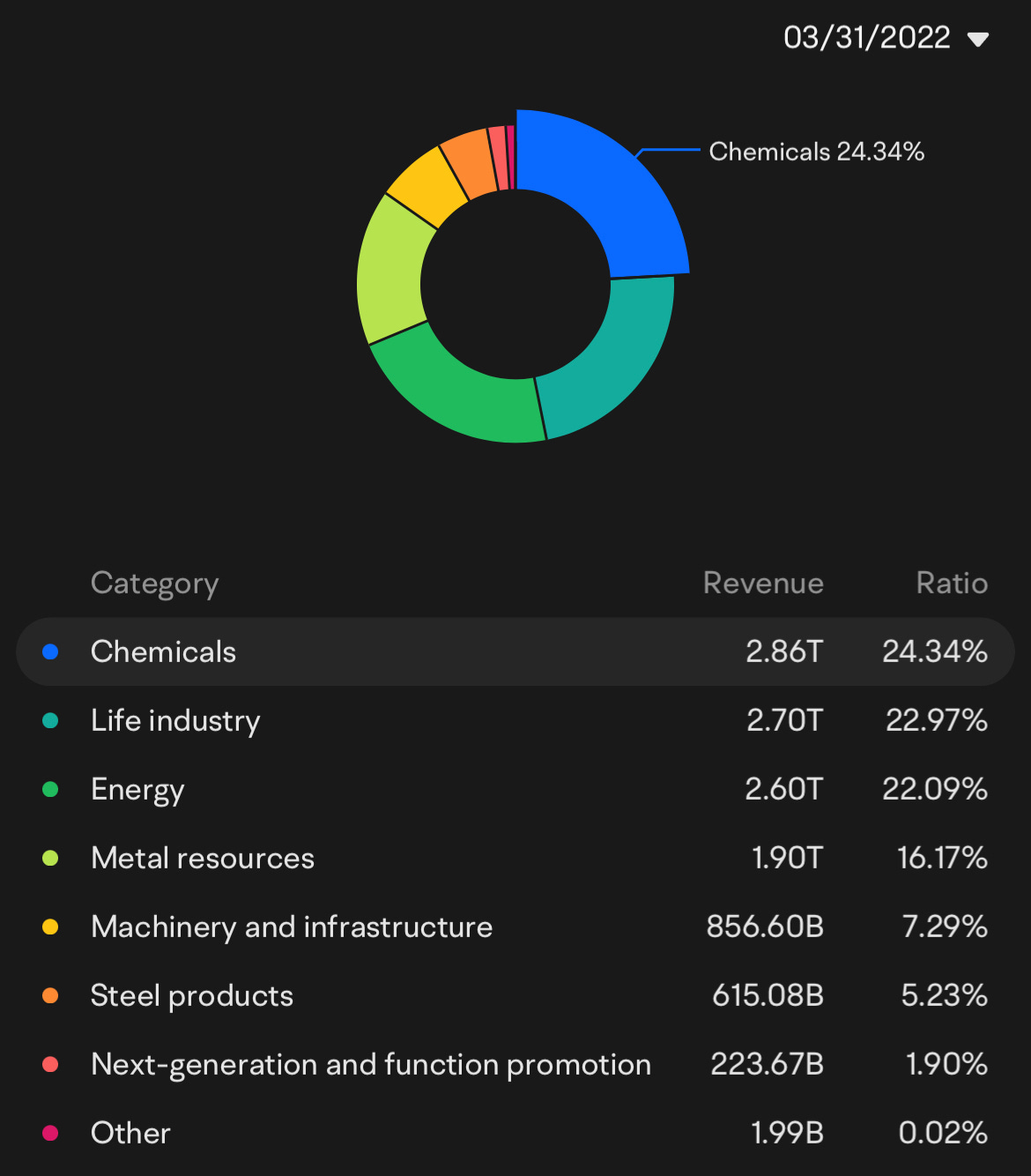

In contrast, Mitsui operates with fewer business segments than Mitsubishi. However, their major revenue streams come from the chemicals, lifestyle (which encompasses food and retail), and energy sectors.

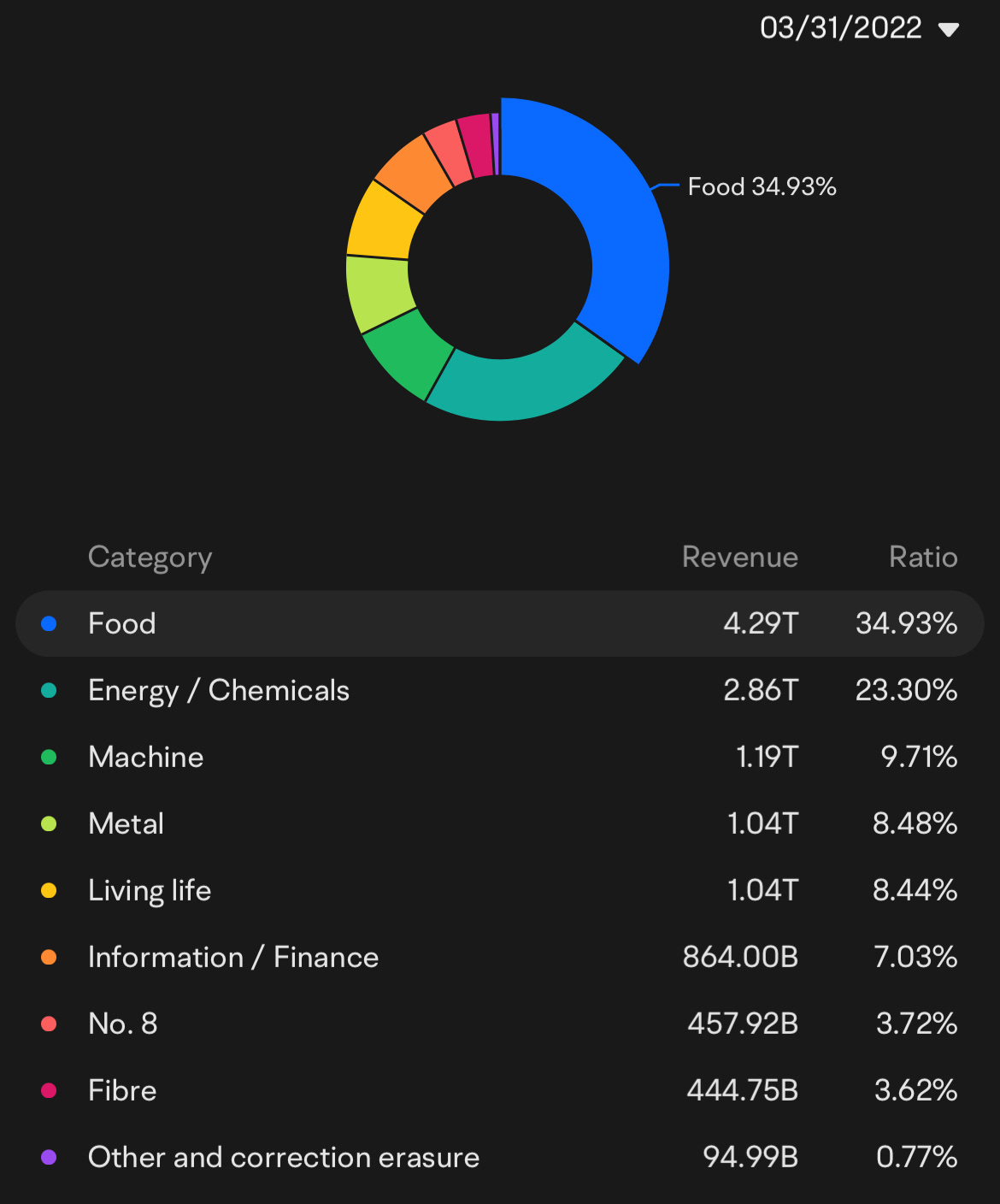

As for Itochu, the food and energy/chemicals segments together accounted for over half of the company's total revenue.

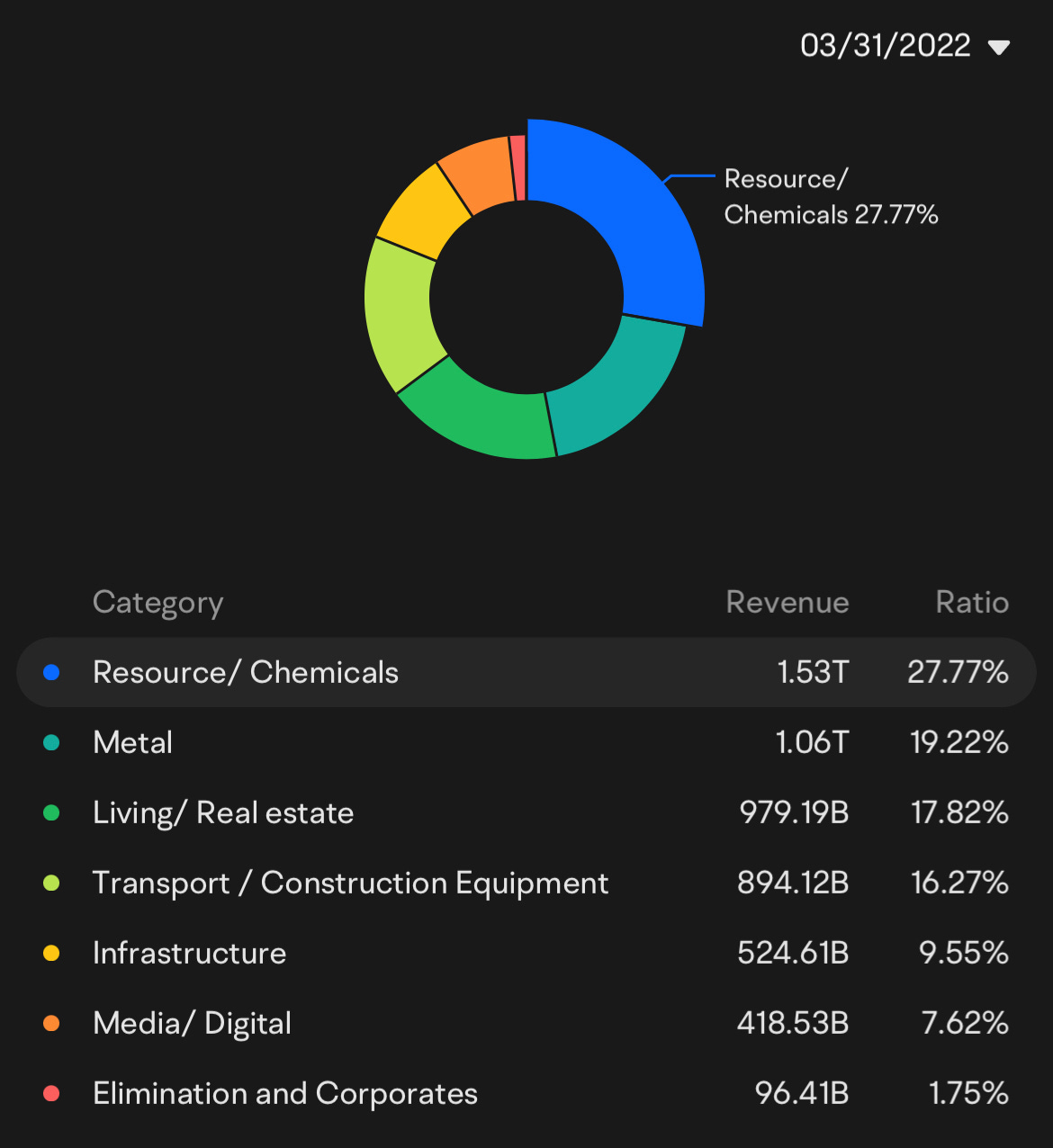

Marubeni places a strong emphasis on the food industry. In fact, their agriculture and food segments make up over half of their total revenue.

Last but not least, Sumitomo's top three segments were chemicals, metals and real estate.

These companies have truly evolved into massive conglomerates, whose operations extend far beyond trading to encompass the production of goods (such as automobiles) and the provision of services (like retail). In other words, they are much more than just trading houses.

Here is a table to compare the financial performances of these 5 Japanese companies: