Mag 7 sat on the throne,

Mag 7 had a great fall.

All of Trump’s horses,

And all the Fed’s men,

Could they put Mag 7 on the throne again?

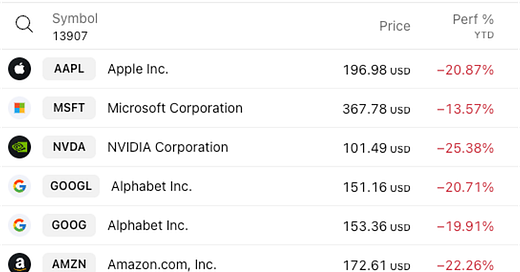

The once-unassailable U.S. tech titans – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – collectively dubbed the Magnificent 7, have hit a rough patch.

They have declined 22% year-to-date as a group, underperforming the S&P 500 and Nasdaq 100, which are down less than 14%.

Diving deeper, Tesla was the worst performer with a 38% decline, while Apple, Nvidia, Alphabet, and Amazon each suffered losses of more than 20%.

These are some of the most well-followed stocks in the world.

Many are now wondering: is this sell-off a buy-the-dip opportunity — or a warning sign of deeper trouble, with the ongoing trade war, economic slowdown, and antitrust lawsuits hanging over the market?

Let’s break down each company’s outlook and see how they stack up against my 2025 valuation benchmarks.

Apple: Still Premium-Priced Amid Trade War Risks

Even market darlings stumble, and Apple is no exception.

After flirting with a $3+ trillion market cap (and briefly nearing $4T in late 2024), the stock has cooled off.

Yet by most metrics, Apple remains expensive. My fair value is $160 — well below its recent $196 share price.

Apple faces a perfect storm of headwinds:

Maturing smartphone demand (and lack of a new blockbuster product)

Trade tariffs

Fierce competition, especially in China.

China, long Apple's growth engine, has become a problem. Local champion Huawei has staged a comeback: iPhone sales plunged 18% in Q4 2024, dropping Apple to third place behind Huawei. Beyond China, a global economic slowdown could further hurt high-end gadget sales.

Worst of all: tariffs. Apple’s masterful global supply chain has become a liability.

The U.S. has slapped over 200% tariffs on Chinese-made goods, and Apple remains highly dependent on China for manufacturing. Diversification to India and Vietnam helps little, because tariffs now hit nearly all foreign-made goods.

On the bright side, Apple’s sticky ecosystem, brand loyalty, and massive cash hoard are enviable.

But given the valuation and tariff risks, Apple looks more like a hold than a buy. It’s a phenomenal company — but it's still priced for perfection.

Microsoft: Resilient Giant, Minimal Trade War Risk

Among the Magnificent 7, Microsoft is arguably the most resilient.

Unlike companies heavily reliant on manufacturing or Chinese consumers, Microsoft’s strength lies in software — and software crosses borders far easier than goods.

Windows and Office remain deeply embedded worldwide. Switching away is difficult and costly for enterprises. However, China is the one exception. Beijing’s push for self-sufficiency has led to Kingsoft’s WPS Office replacing Microsoft Office across many Chinese government agencies and state-owned enterprises. Still, China represents a small portion of Microsoft's global revenue. Outside of China, Microsoft's grip is ironclad.

Meanwhile, Microsoft is also growing aggressively:

Azure is the second-largest cloud platform globally, just behind AWS, and still expanding fast.

Microsoft was an early AI mover, with OpenAI integration powering its Co-Pilot features in Office and Bing Search.

In gaming, Microsoft is now the second-largest gaming company globally (after Tencent), thanks to the Activision Blizzard acquisition.

In short: Microsoft is diversified, battle-hardened, and ahead of the curve. Minimal trade war risk, strong AI and cloud momentum, and fortress-like customer stickiness.

At $368 today vs my fair value of $356, Microsoft is a reasonable buy — not a steal, but a solid name to own.