As 2023 draws to a close, investors are likely focusing on their allocation strategies for 2024.

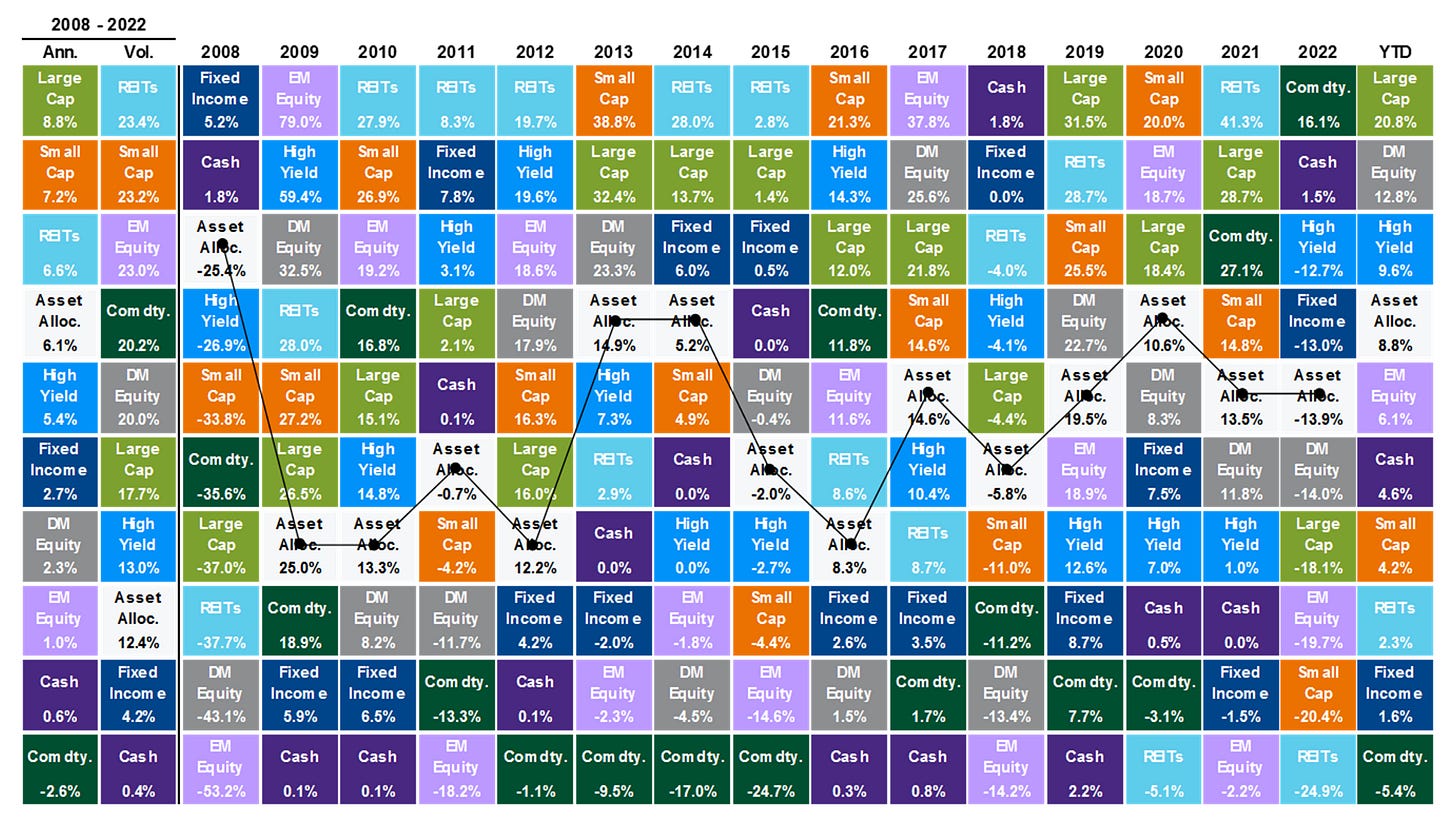

To facilitate this, I will use the 'asset performances quilt' to draw some insights into which assets might be the most promising for your portfolio. The analysis is based on the quilt featured in JPMorgan's Guide to the Markets - November 2023 edition.

#1 The top-performing asset this year is rarely the top-performing one next year

The exception was REITs, which consistently achieved first place for three years running from 2010 to 2012, and again for two consecutive years in 2014 and 2015. But the same cannot be said for the rest.

Therefore, if Large Caps (as exemplified by the 'Magnificent 7') dominate this year, it’s improbable they will be the top performers in 2024. This underscores the impracticality of 'rearview mirror investing', where one might chase the current best performers with the expectation of their continued dominance in the following year.

#2 Don't hold cash if you seek returns

The rationale is straightforward: typically, cash yields low returns. Many, however, gravitate towards cash holdings due to their perceived safety, especially in times of high interest rates like we've seen this year. Despite this, it's important to note that in most years, cash tends to be the worst performing asset.

Furthermore, should interest rates decrease in 2024, the appeal of holding cash will likely diminish. Therefore, if you find yourself with excess cash, it might be wise to consider putting it to work in other investments.

#3 Avoid commodities

Much like cash, commodities have frequently been among the worst performing assets. Notably, they lingered at the bottom of the rankings for four consecutive years. When combined with cash, these two asset classes have been the worst performers in 10 out of 14 years, significantly dragging down overall returns.

#4 Emerging Markets are too volatile for buy-and-hold

Emerging Markets (EM) exhibit a level of volatility that makes them unsuitable for a conventional buy-and-hold approach. Unlike REITs and Small Caps, which generally maintain positions in the upper half of performance rankings, EMs can oscillate dramatically. They may lead as top performers in one year only to plummet to the bottom in the next.

However, this volatility opens a door for a specific trading strategy: buy EMs after a decline of more than 10% in a year, and then sell after holding for a year. This approach has historically yielded substantial returns, exceeding 20% on the last five occasions. For instance:

2008: EM -53.2%, 2009: EM +79% (Gain 132.2%)

2011: EM -18.2%, 2012: EM +18.6% (Gain 36.8%)

2015: EM -14.6%, 2016: EM +11.6% (Gain 26.2%)

2018: EM -14.2%, 2019: EM +18.9% (Gain 33.1%)

2022: EM -19.7%, YTD: EM +6.1% (Gain 25.8%)

To trade on this trend, the iShares MSCI Emerging Markets ETF (EEM) is a close proxy for MSCI Emerging Markets Index which is used by JPMorgan to compile the returns for this quilt.

In summary, while EMs are too volatile for a straightforward buy-and-hold strategy, they offer lucrative opportunities for well-timed trades.