“Black Swan,” “Antifragile,” and “Barbell” are terms and concepts introduced by Nassim Taleb that have intrigued many investors. However, these concepts often come across as abstract and challenging to apply in a practical manner. There’s another term, though less well-known, that I find much more practical: the Lindy Effect.

The Lindy Effect simply states that the longer a non-perishable entity (like a company or technology) has survived, the longer its remaining life expectancy. In other words, the more time something has endured, the more likely it is to continue to thrive.

When applied to investing, this concept suggests that companies or brands that have survived for decades are likely to persist for many more years. Therefore, Lindy stocks are ideal for long-term investing as they can benefit from the compounding effect over time.

This might sound counterintuitive in an era where investors chase innovative companies and emerging trends. Yes, these new ventures can deliver rapid gains, but they are often fragile and can disappear just as quickly. Their returns are driven largely by volatility, not by compounding.

Warren Buffett is perhaps the most famous Lindy investor, even though he has never explicitly used the term. His actions, however, align perfectly with the concept. I reviewed Berkshire Hathaway’s portfolio using CNBC’s data, adding the founding years and ages of the companies as of 2024.

The average age of Buffett’s portfolio companies is an impressive 80 years. Not only that, but many of his top holdings are over a century old, with a clear concentration of centennial companies among his largest investments. Even his recent foray into Japanese stocks includes companies that are more than 100 years old.

While I don’t believe Buffett strictly looks at a company’s age or consciously applies the Lindy Effect, his focus on businesses with highly predictable future cash flows naturally leads him to invest in Lindy stocks. These companies have matured, outcompeted their peers, and secured strong positions in their industries.

Building a Lindy Portfolio

There’s a great Reddit post discussing a Lindy portfolio of 73 stocks that are at least 100 years old, which outperformed the S&P 500. Inspired by this study, I took the same set of 73 stocks and applied some quantitative factors to refine the selection.

Portfolio 1: High Gross Profitability

First, I ranked the stocks based on Gross Profitability and formed a portfolio of the top 15 stocks. High Gross Profitability indicates quality, and since this metric tends to be stable year over year, we don’t need to replace the stocks frequently, allowing it to truly be a long-term portfolio.

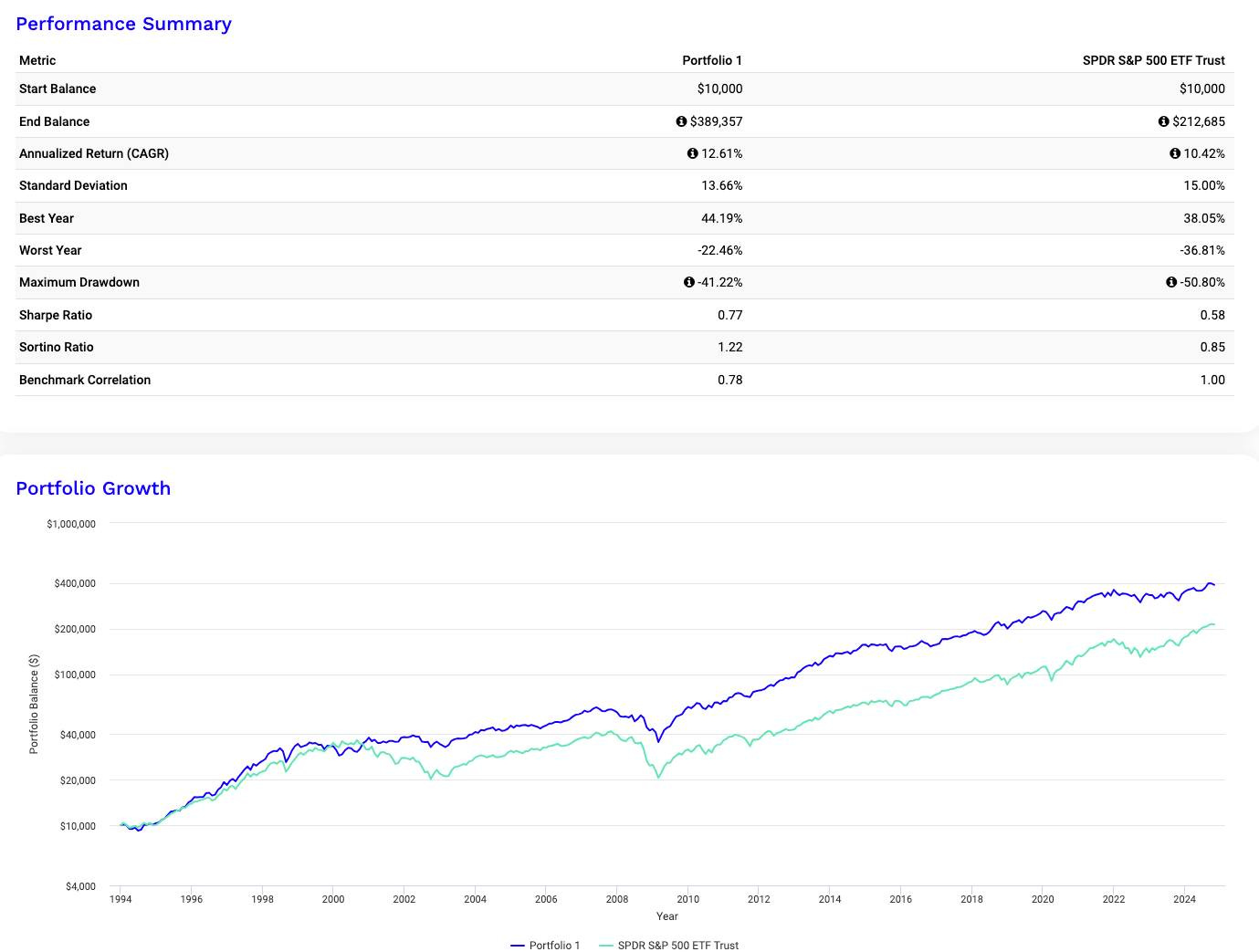

The backtested returns for this portfolio were 12.61% per year since 1994, outperforming the S&P 500’s 10.42% annual return while achieving lower volatility and drawdowns.

Portfolio 2: Long Dividend Growth Streak

Next, I ranked the stocks by their dividend growth streaks, selecting companies that consistently increase dividends year after year. This is a strong indicator of robustness, as these companies maintain stability even through economic cycles.