Utilities: The Hidden Play for AI and Data Center Growth

In our increasingly cloud-centric world, data centers have become the beating heart of digital infrastructure. Whether you’re streaming Netflix or running a multinational enterprise on AWS, those servers in vast warehouse-like facilities underpin the digital experiences we rely on every day. Yet, behind all that computing muscle lies a core resource: electricity—and a lot of it.

Hyperscalers require at least 50 megawatts (MW) or more per site. Going beyond 100 megawatts is increasingly likely too. While constructing a modern data center typically takes around 18 months, building (or expanding) the power plants, substations, and transmission lines to feed it can take 2 to 3 years (sometimes longer). This discrepancy can create a potential bottleneck.

Grid Upgrades: Large new loads mean utilities may need to build or upgrade substations and transmission lines, typically a multi-year process involving permits, local approvals, and sometimes lengthy environmental reviews.

Site Selection: Hyperscalers (AWS, Microsoft, Google, Meta) often choose locations with both cheap and readily available power. But in fast-growing regions, the sudden arrival of multiple data centers can strain existing infrastructure, leading to delays.

Because of these factors, the timeline mismatch—rapid data center build-outs versus slower power infrastructure development—can become a real constraint.

Expanding power generation and building more power plants will be needed to support the growth of data centers. There will be two major groups that will benefit:

Equipment Suppliers: Companies that make turbines, generators, or transmission gear (e.g., GE Vernova, Siemens, Caterpillar, or ABB)

Utilities: These are companies that supply electricity continuously to data centers and bill usage accordingly.

1. Power Suppliers with Power Purchase Agreements (PPAs)

Certain independent power producers (IPPs) can secure 10–20 year power purchase agreements (PPAs) with data center operators. These agreements lock in steady revenue streams over a decade or more, typically with modest annual escalators.

One example is Dominion Energy (D) in Northern Virginia has seen major demand from AWS and other hyperscalers. In their investor calls, they frequently highlight the need to expand capacity to meet data center loads.

NextEra Energy (NEE) is another example, which often signs large renewable PPAs with tech giants for solar or wind power, yielding stable, predictable earnings for many years.

While equipment makers might enjoy a sales boost, the long-term beneficiaries are often the utilities and IPPs that supply electricity to these data centers under lasting contracts.

2. Non-Regulated Utilities

To further refine our understanding, it’s crucial to distinguish between regulated and unregulated (or merchant) power players:

Regulated Utilities

Operate under state-approved rate structures.

Build capacity and recover costs (plus a set return) through regulated rates.

Revenue growth is stable but often capped by regulatory constraints. Examples: Dominion (D), Duke Energy (DUK), Southern Company (SO), Pinnacle West (PNW).

Unregulated (Merchant) Generators / IPPs

Sell power in competitive markets or directly to corporate customers via PPAs.

Greater upside if demand spikes or if they can negotiate favorable terms.

More volatility, however, since they’re exposed to commodity prices. Examples: NRG Energy (NRG), Vistra (VST), Constellation (CEG), AES (AES).

In terms of enjoying higher upside, unregulated players in fast-growing markets (like Texas) can benefit if rising demand from data centers pushes wholesale power prices higher. By contrast, a regulated utility might simply build new infrastructure and earn its regulated return. That’s good for stable dividends and cash flow—but not necessarily explosive growth.

3. Focus on Data Center Growth Areas

Existing data centers already have power capacity secured. So, we have to look at where new data centers are likely to sprout. Key regions in the U.S. include:

Northern Virginia (“Data Center Alley”)

Primary Utility: Dominion Energy (regulated).

Loudoun County remains the world’s largest concentration of data centers. Demand for expansions is still high.

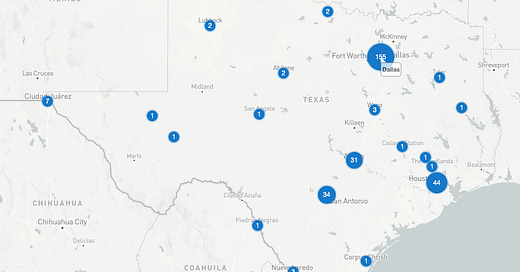

Texas (Dallas-Fort Worth, Austin, San Antonio)

Deregulated Market (ERCOT), so no single utility “monopoly.”

Merchant Generators / IPPs with big footprints here: NRG, Vistra.

Phoenix, Arizona

Primary Utility: Pinnacle West (Arizona Public Service) (regulated).

Another rising data center hub due to climate considerations and business-friendly policies.

Atlanta, Georgia

Primary Utility: Southern Company via Georgia Power (regulated).

North Carolina

Primary Utility: Duke Energy (regulated).

Large data centers for Apple, Google, and Meta exist already, with potential for further growth.

Portland / Hillsboro, Oregon

Primary Utility: Portland General Electric (POR) (regulated).

Increasingly popular for its cooler climate and robust fiber infrastructure.

Wherever new data center clusters are forecast, that’s where you’re likely to see additional capital expenditure on the grid and potential growth in power sales.

4. The Clean Energy Angle

As hyperscalers ramp up their low-carbon and net-zero commitments, non-fossil-fuel-based PPAs are in high demand. While many data center operators focus on wind, solar, or battery storage, nuclear has also entered the conversation as a 24/7 carbon-free resource. This trend benefits:

NextEra Energy (NEE)

The largest developer of wind and solar in the U.S.; frequently signs high-profile PPAs with tech giants for large-scale renewable projects.

AES (AES)

Pivoted heavily to renewables and has announced deals with Google and Microsoft, focusing on solar, wind, and battery storage solutions.

Constellation (CEG)

The nation’s largest carbon-free energy producer through its nuclear fleet, it has partnered with Microsoft and others to provide 24/7 emissions-free power. While nuclear isn’t classified as “renewable,” it helps data center operators meet round-the-clock sustainability targets.

By securing clean power—whether fully renewable or carbon-free nuclear—hyperscalers can address both energy and environmental mandates, making these providers key beneficiaries of the data center boom.

Putting It All Together

These are the key utility stocks that meet most of the above criteria: