What a week!

The S&P 500 has been on a roller coaster ride, and it's been a while since we've experienced this level of volatility.

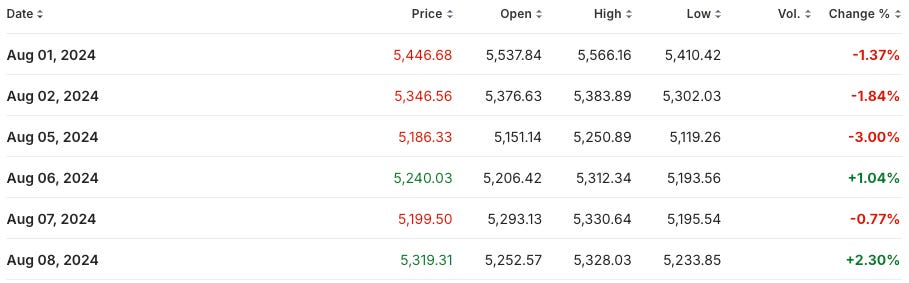

S&P 500 still down 4% for the month. The S&P 500 is still down 4% for the month. After consecutive declines in the first three trading days of August, the index staged a rebound on the fourth day and saw one of its strongest comebacks on August 8, 2024, with a 2.3% gain. However, the S&P 500 remains down 3.6% month-to-date. I don’t think we can celebrate yet, as relief rebounds are common after a sharp fall. Nonetheless, some respite from a falling index is definitely welcome.

Unemployment claims drop. One of the key factors that helped boost the markets was the drop in unemployment claims. They declined by 17,000 to 233,000, coming in below expectations. This alleviated concerns of an economic slowdown and reduced the risk of a recession.

Magnificent 7 fell, bonds gain. Other major U.S. stock indices also faced declines. The Dow Jones Industrial Average (tracked by the DIA ETF) was down 3.6%, while the Nasdaq 100 (tracked by the QQQ ETF) dropped 4.6%. The Magnificent 7 (tracked by the MAGS ETF) stocks were the worst performers, down 5.8% month-to-date. This risk-off mentality was evident as long-term bonds (measured by the TLT ETF) rose 0.6% for the month.

Meta shines among Mag 7. Meta was the only bright spot among the Magnificent 7, reporting solid advertising results with a 22% rise in revenue year-over-year for its second quarter. This was double Alphabet’s revenue growth of 11%. Meta's stock gained 7.7% month-to-date, while the rest of the Magnificent 7 were down, with Amazon and Tesla being the worst performers, each losing more than 10% month-to-date.

74% of S&P 500 stocks were losers. Only 130 of the S&P 500 component stocks gained in the past week, leaving the majority as losers. The average return was -3.2%. Fortinet was one of the biggest winners, with an 18% gain, as the cybersecurity firm reported better-than-expected results. Kellanova, the parent company of Pringles, was the best performer with a 24% jump in share price, spurred by news that Mars is seeking to take over the company. Other consumer staples like Kenvue and Clorox also performed well, likely benefiting from a recessionary outlook that prompted investors to seek defensive stocks.

Intel was the worst performer in the S&P 500, reporting disastrous earnings. Its revenue declined by 1%, and it swung to a net loss. The company halted dividend payments and announced a 15% workforce reduction. Intel is struggling as it falls further behind in the AI race after missing the mobile computing era. The stock is down 33% over the past week. Even AI-related stocks like Super Micro and Micron saw more than 10% declines, likely due to a moderation in their overvalued share prices.

Travel stocks also had a tough week. Disney’s theme parks reported a slowdown with just a 2% revenue growth, and Airbnb issued a warning about slowing U.S. demand, causing its stock to drop 18% in the past week. Norwegian Cruise Line also fell 18%. This paints a picture of a pullback in travel and discretionary spending.

Investors turn defensive with consumer staples. It's clear that investors went defensive in the last 5 days, as consumer staples were the only sector to gain while the remaining sectors saw losses. The consumer discretionary sector was the hardest hit, as investors believe a recession would hurt this sector the most.

Overall, the markets seem to be pricing in a possible recession. Even if a recession doesn’t materialize, investors are bracing for an economic slowdown. In my view, this recent rebound feels more like a relief rally rather than the beginning of a strong recovery. Typically, after a steep fall and a spike in volatility, prices need time to stabilize before they can move upward—much like a wound needs time to heal. It’s unlikely that the market can stage a sustainable rebound in just one week. That said, I still believe this isn’t a crash but rather a correction, which could result in a 10-20% drop from the peak. The recent decline was less than 10%, suggesting there might be a bit more downside before the market finds its footing.

The AI narrative is facing some doubts as AI-related stocks have taken a beating. It’s a healthy sign for prices to come back to earth, removing some of the overvaluation. However, it’s crucial for the AI story to remain stronger than the recession narrative, as the market needs something positive to look forward to. Other than AI, it’s hard to see another story as significant at the moment to power the markets higher.

The stock market is pretty much the definition of neglect at this point 😂 everyone is telling you there is something wrong and you just keep ignoring it!

Great write up on the market activity!