US GDP Contracts 0.3% — The Stock Market Panicked For a While

The U.S. stock market had a fresh scare on 30 April 2025, when the S&P 500 gapped down and tumbled as much as 2.3% intraday. But in a dramatic reversal, it clawed back all its losses to close flat by the end of the day.

What spooked the market?

The U.S. reported a surprising GDP contraction of 0.3% in Q1 2025, triggering renewed recession fears. But on closer inspection, this drop appears to be a temporary quirk rather than the start of an economic downturn.

Here’s why: U.S. consumers went on a pre-tariff buying spree, front-loading imports before prices potentially rose. Imports surged, exports remained steady, and as a result, net exports subtracted nearly five percentage points from headline GDP. Strip that out, and the economy still looks intact.

In fact, the Atlanta Fed’s GDPNow model projected more than 2% growth for Q2 as of 30 April—hardly recession territory.

This explains the sharp market rebound. Once investors digested the details, they realized things weren’t as bad as they first seemed. The recovery reflects confidence that the economic slowdown is temporary and not the start of a broader crisis.

Microsoft Jumps 7% After Beating Expectations and Giving Strong Guidance

Software companies like Microsoft are largely insulated from tariffs, but Big Tech has its own hurdles. Earlier this year, Microsoft cancelled some data center expansion plans, stoking fears that AI demand might be fading.

That concern was quickly dispelled.

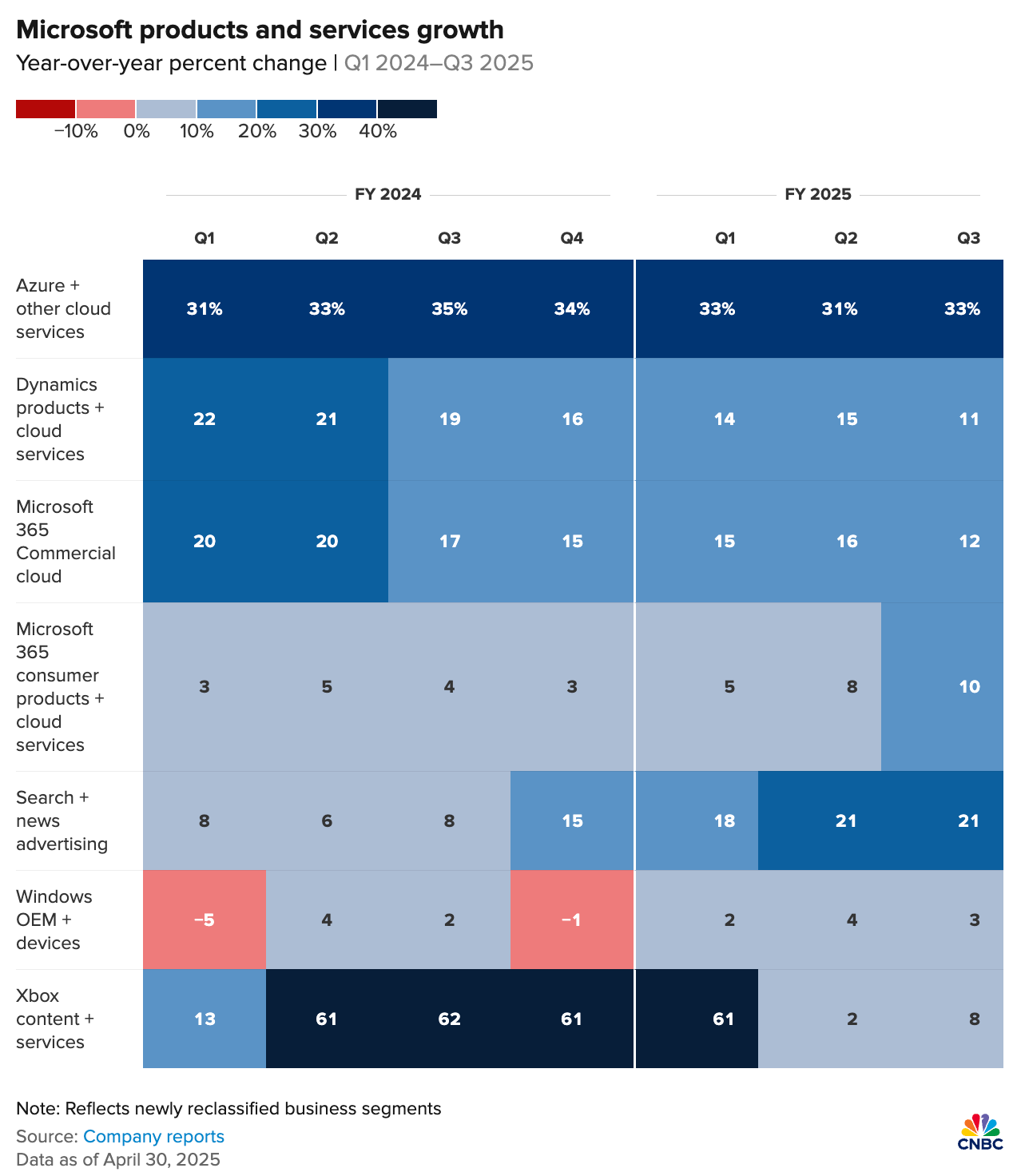

Microsoft's Azure cloud business grew over 30% in Q3 2025, and management expects 34–35% growth this quarter—an acceleration. The rest of the business held up well too, with both revenue and earnings beating expectations.

Most impressively, guidance came in strong: Microsoft expects Q4 revenue between $73.15 billion and $74.25 billion or a 18-20% growth, with the midpoint well above LSEG’s $72.26 billion consensus. Microsoft remains a steady ship in a chaotic sea.

Meta Climbs 5% as Revenue Rises 16% Despite Challenges

Meta also delivered, posting 16% revenue growth—slower than before, but still above estimates. Management remains confident, projecting Q2 growth between 8% and 16%.

Concerns that Chinese advertisers would cut spending due to tariffs were acknowledged, but the actual impact has been smaller than feared.

That said, Meta faces headwinds. It’s still embroiled in an antitrust trial, and recent rulings against Alphabet and Apple suggest the courts are turning increasingly hawkish on Big Tech.

On the product front, Meta has launched a standalone Meta AI app, in addition to embedding Meta AI across its platforms. But unlike Microsoft, Amazon, or Alphabet—which monetize AI through cloud services—Meta’s AI offerings are currently free, draining resources without a clear revenue plan. This could become a long-term liability unless monetization is figured out soon.

Big Tech Stays Strong—And More Results Are Coming

Despite macro jitters and regulatory pressure, Big Tech continues to post resilient results. I believe Amazon and Apple, which report next, will do well too.

Investors shouldn’t be overly bearish, as there are no clear signs of a recession—not even the recent GDP contraction, which appears to be a temporary reaction to trade tariffs. The market rebound remains intact.