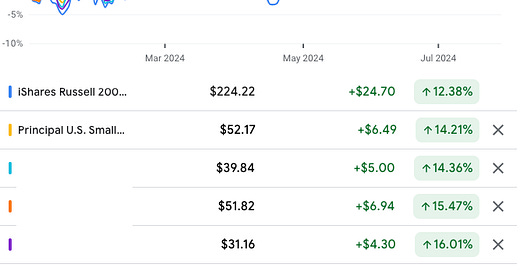

For the past two weeks, small caps have been outperforming big caps. This might be an opportune moment for those looking to ride the market rotation trend. Here are five ETFs that allow you to do so effortlessly, without the need to analyze small caps individually. They are arranged from the lowest to the highest year-to-date return.

#1 iShares Russell 2000 ETF (IWM) +12.38% YTD

The iShares Russell 2000 ETF (IWM) is one of the most recognized indexes and ETFs for gaining exposure to small caps. Most discussions about small caps outperforming big caps use the Russell 2000 as a benchmark against the S&P 500. While the S&P 500 serves as the benchmark for large caps, the Russell 2000 is the equivalent for U.S. small caps.

Year-to-date, IWM is still underperforming SPY, but the gap has narrowed due to IWM's strong performance over the past month, gaining 11.45% while SPY declined by 0.17%.

The Russell 2000 is a subset of the Russell 3000, which tracks the largest 3,000 stocks in the U.S. The Russell 2000, however, tracks the smallest 2,000 stocks within the Russell 3000, thus representing the small caps in the U.S. stock market. The index is managed by FTSE Russell, one of the three largest indexing companies globally and is owned by the London Stock Exchange Group. Unlike the market-weighted S&P 500, where larger caps receive more allocation, the Russell 2000 is equally weighted and completely reconstituted annually.

IWM has low fees at 0.19% and remains one of the most popular avenues for gaining exposure to small caps.

#2 Principal U.S. Small-Cap ETF (PSC) +14.21% YTD

The second ETF on this list is the Principal U.S. Small-Cap ETF (PSC), an actively managed ETF. It is managed by two portfolio managers with over 19 years of experience.

They utilize a rule-based framework to select stocks, starting with the Russell 2000 as the investment universe. Stocks must pass three factors: quality, value, and momentum. A ranking system is used for their combined multi-factor score, and only 500 out of the 2,000 stocks are chosen. The allocation is not equal; stocks with higher liquidity and lower volatility have higher weightings.

As of July 25, 2024, the ETF has a fund size of $619.9 million and charges an expense ratio of 0.38%. This is higher than IWM, mainly due to the smaller fund size and active management. Despite the higher fees, PSC has managed to outperform IWM over the past seven years, with PSC delivering an annual return of 9.07% versus IWM’s 6.97%. Thus, the additional fees are justifiable.