Top 10 Stocks Bought by Billionaire Investors in Q4 2024

The 13F filings for large funds, which disclose their transactions from the last quarter, have been published. These reports often reveal surprising moves by some of the world's top investors. Analyzing their decisions can help us refine our investment thinking or uncover new trading ideas we may have overlooked.

This time, we've decided to focus on four billionaire investors—Warren Buffett, David Tepper, Bill Ackman, and Daniel Loeb—and highlight the top 10 stocks they bought, ranked by investment value.

Let’s start in reverse order:

#10 Brookfield (BN) - $119M

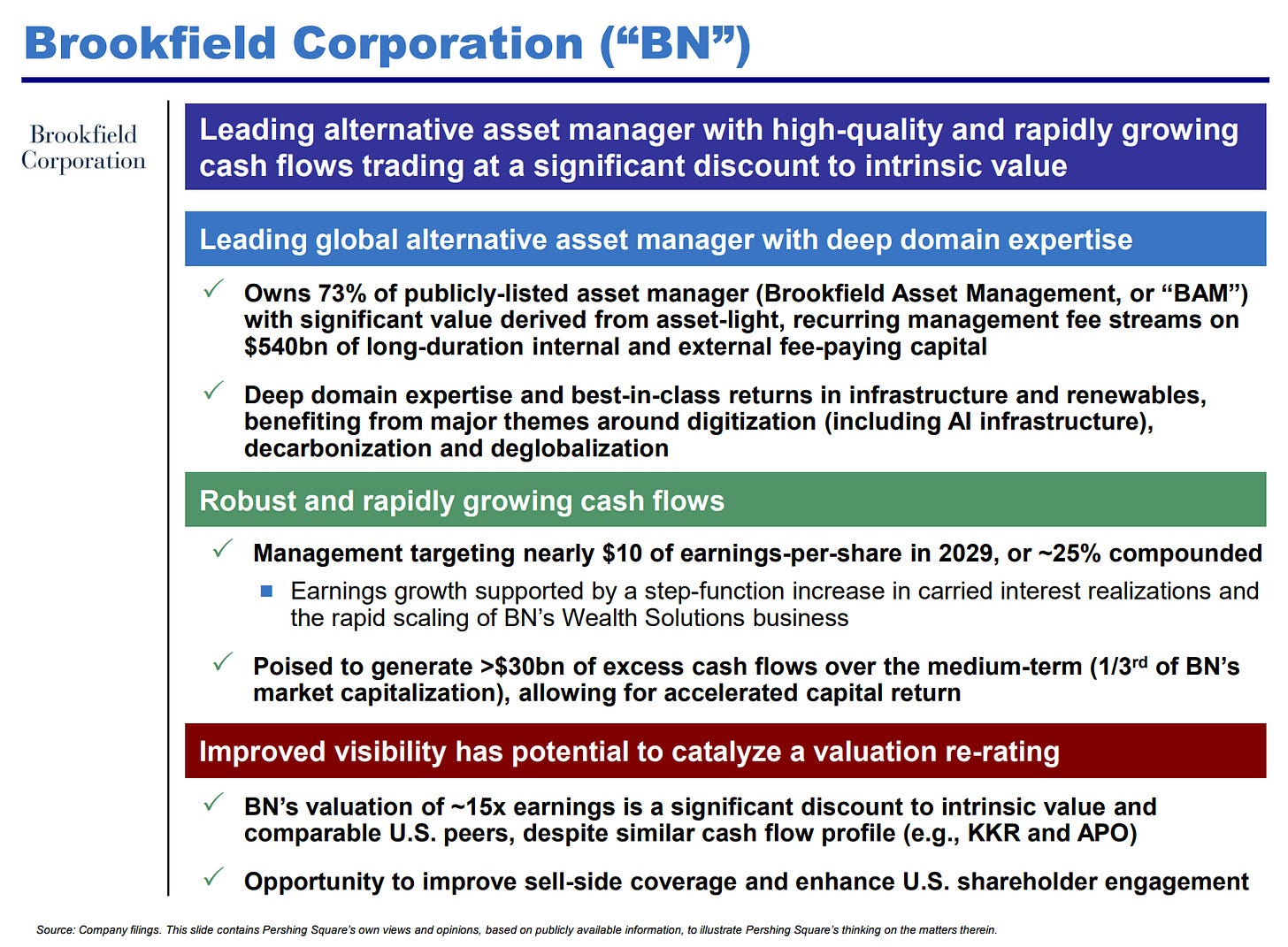

Bill Ackman of Pershing Square added to his existing position in Brookfield, bringing its total value in his portfolio to $2 billion.

Brookfield is a Canadian alternative asset manager specializing in real estate, infrastructure, renewable power, private equity, and credit.

Ackman’s investment thesis highlights global infrastructure trends supporting AI development and renewable energy production as key drivers of growth. He also compared Brookfield’s valuation to other listed private equity firms like KKR and Apollo, concluding that BN is significantly cheaper than its peers.

Below is a one-pager from Ackman outlining his thesis on Brookfield:

#9 Workday (WDAY) - $126M

Dan Loeb of Third Point initiated a new position in Workday last quarter.

Workday is an enterprise cloud software provider specializing in human capital management (HCM), financial management, and analytics solutions for businesses. Finbite Insights previously covered Workday [link], and since then, the stock has declined by about 10%.

Currently, Workday remains fairly priced, trading slightly below the regression line, as shown in the chart below.

However, concerns persist about the deceleration in subscription revenue and a sales leadership transition. Additionally, the potential dismantling of DEI initiatives under a Trump administration could negatively impact the HR software industry, including Workday, over the next four years.

On a more positive note, Workday’s AI rollout has shown promising early results. Its recruiter agent helped boost the average selling price of its recruiting solutions by 150%, while total new annual contract value surged 4x. This could reignite growth and position Workday to capitalize on the AI boom.

#8 Fortive (FTV) - $146M

Dan Loeb of Third Point also initiated a new position in Fortive last quarter. While the company is less well-known, it has a market cap of $28 billion and is an S&P 500 component, making it far from an obscure small-cap stock.

Fortive manufactures high-tech tools, software, and equipment for industries like healthcare, manufacturing, and electronics, helping businesses improve efficiency and performance. It was spun off from Danaher and owns a diverse portfolio of brands, shown below.

Morningstar rates Fortive as a narrow-moat stock, attributing its competitive edge to customer switching costs and intangible assets.

Customer Switching Costs: Fortive has a large and loyal customer base, with its products recognized for reliability and high quality in mission-critical applications, making them difficult to replace.

Intangible Assets: Fortive invests 6.5% of revenue into R&D, driving innovation in Tektronix oscilloscopes and Fluke’s noncontact voltage technology, solidifying its leadership in these areas.

#7 Capital One Financial (COF) - $152M

This is the third Dan Loeb investment to make the list. While Capital One Financial isn’t as well-known as JPMorgan or Goldman Sachs, it is far from a small player—it is the 28th largest bank in the world by market cap. The company specializes in credit cards, auto loans, and operates a national bank under the Capital One brand.

While Loeb initiated a position in COF last quarter, Warren Buffett was busy selling bank stocks, including COF. Berkshire Hathaway sold $271 million worth of COF stock, along with reductions in Bank of America, Citigroup, and Nu Holdings. Despite these sales, Bank of America remains Berkshire’s third-largest holding.

Bank stocks have been in the spotlight amid the high-interest rate environment, benefiting from higher profitability. COF’s stock is up 47% over the past year, making its valuation less attractive at current levels. Morningstar estimates its fair value at $184, while the stock is currently trading at $201.70, indicating it may be somewhat overvalued but not excessively so.

#6 Alibaba (BABA) - $176M

The first and only China stock on this list, Alibaba remains a go-to investment for those seeking China exposure.

David Tepper has been bullish on China stocks since 2024, famously telling the media to “buy everything China.” He backed up his words by adding another $176 million to his Alibaba stake, bringing his total investment to $1 billion—now the largest holding in his portfolio, representing 15.54%.

Tepper’s average purchase price was $83.45, and with the stock now trading at $124.73, he’s sitting on nearly a 50% gain.

Alibaba’s recent rally has been fueled by several key developments:

DeepSeek’s breakthrough AI model has sparked renewed investor interest in China tech stocks.

Apple’s partnership with Alibaba to integrate AI features in iPhones for the Chinese market.

Xi Jinping’s meeting with China’s top tech executives, including Jack Ma, signaling a potential thaw in regulatory pressure after years of crackdowns.