Thermo Fisher is not a stock that is known to most investor even though it is a big cap company with $191 billion market cap and ranked as 51st largest globally.

This lack of recognition likely results from its B2B nature, as it primarily serves industry insiders rather than being a household consumer brand.

Perhaps one of the few points of consumer familiarity could be their association with PCR tests for COVID-19, particularly during the height of the pandemic, where Thermo Fisher played a significant role as a major supplier of the PCR machines essential for conducting these tests.

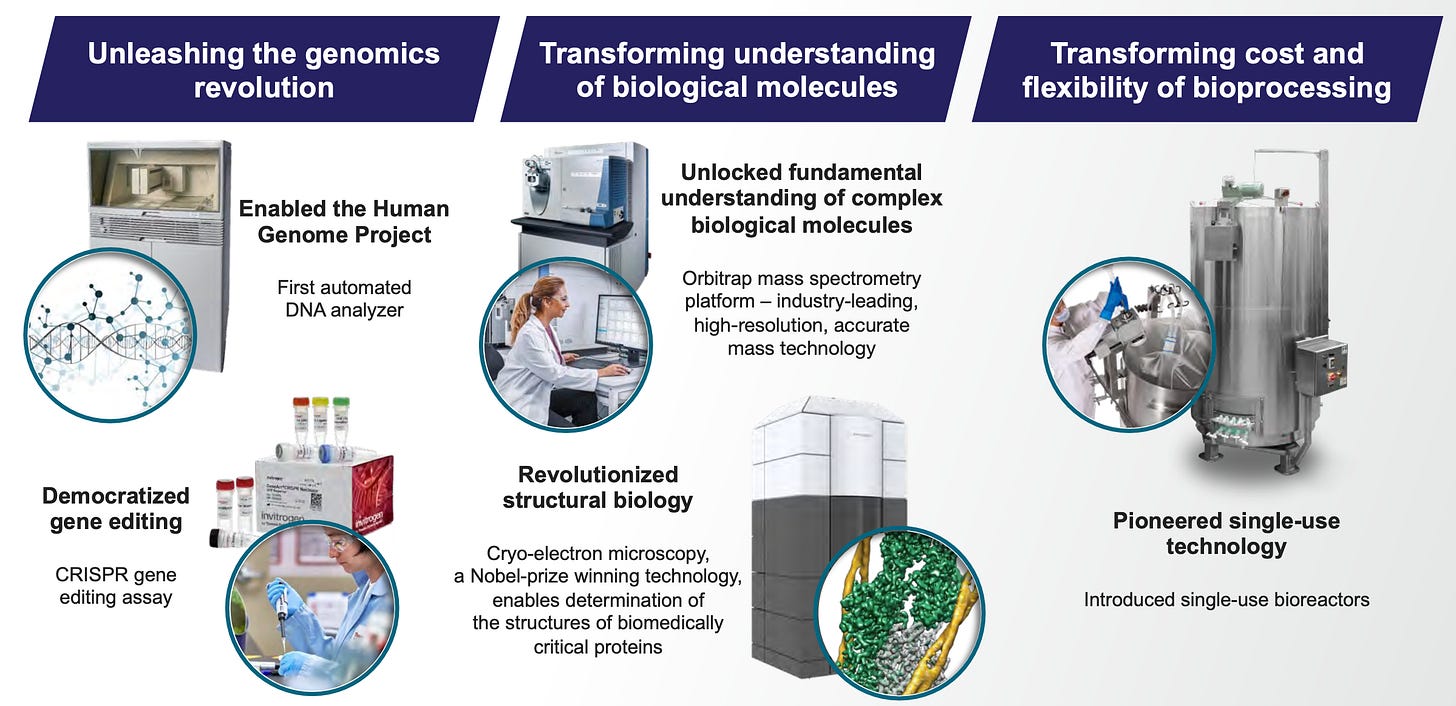

Thermo Fisher serves as a vital backbone to the life science and pharmaceutical sectors by delivering scientific tools and lab gear, diagnostic materials, and life science reagents to industry professionals.

To grasp the significance of its contribution, consider its pivotal role in groundbreaking endeavors like powering the Human Genome Project with its analyzers and supporting gene editing advancements.

The company's revenue has progressively transitioned from equipment to consumables, a more favorable shift due to their largely recurring nature, currently representing 82% of the total sales.

Over the last decade, sales have shown a Compound Annual Growth Rate (CAGR) of 14%. However, this growth is not solely organic, as Thermo Fisher has been actively acquiring other companies, averaging $4.7 billion in annual acquisition spending since 2010.