Investing is often a blend of art and science, even when employing quantitative methods. The art involves crafting an investment strategy, while the science entails using mathematics to articulate that approach. Relying solely on a scientific method without the artistic aspect may result in curve fitting past data, which might not recur in the future. Conversely, a purely artistic approach without scientific backing may be idealistic and lack practical application in the real world.

Therefore, I always prefer to assess the soundness of a strategy before examining the results; both aspects must impress. With advancements in the ETF market, there are now more high-quality ETFs that offer robust investment strategies and returns, even if they are largely quantitative. I have identified a few of these on Finbite Insights, and today, I am excited to share another one with you.

This ETF aims to blend two types of growth stocks. The first type includes stocks that are growing significantly faster than others, albeit with higher volatility in their stock prices and greater valuations. The second type encompasses stable growth companies, which, although they do not grow as quickly as the first type, compensate with higher quality and more reasonable valuations.

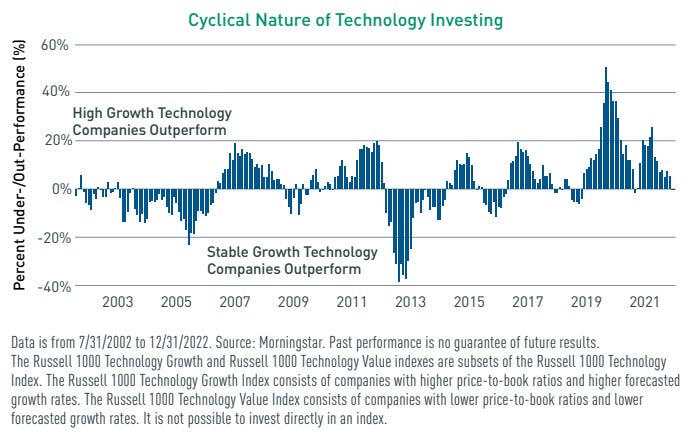

Even among growth stocks, there exists a cycle where high-growth stocks perform well during certain periods, while stable growth stocks excel in others. By blending both types in a portfolio and adjusting the weightings based on the market cycle, the ETF seeks to achieve more consistent returns.

The ETF manager employs three categories of scoring to manage the fund.

First, there is a quality scoring system used to filter out lower-quality stocks. This system utilizes well-known metrics such as Return on Assets (ROA), Return on Equity (ROE), and profit margins.

Second, the stocks are evaluated based on their value attributes, which include ratios such as book-to-price, earnings yield, and free cash flow yield.