The Inevitable Correction for AI and Semiconductor Stocks is Here

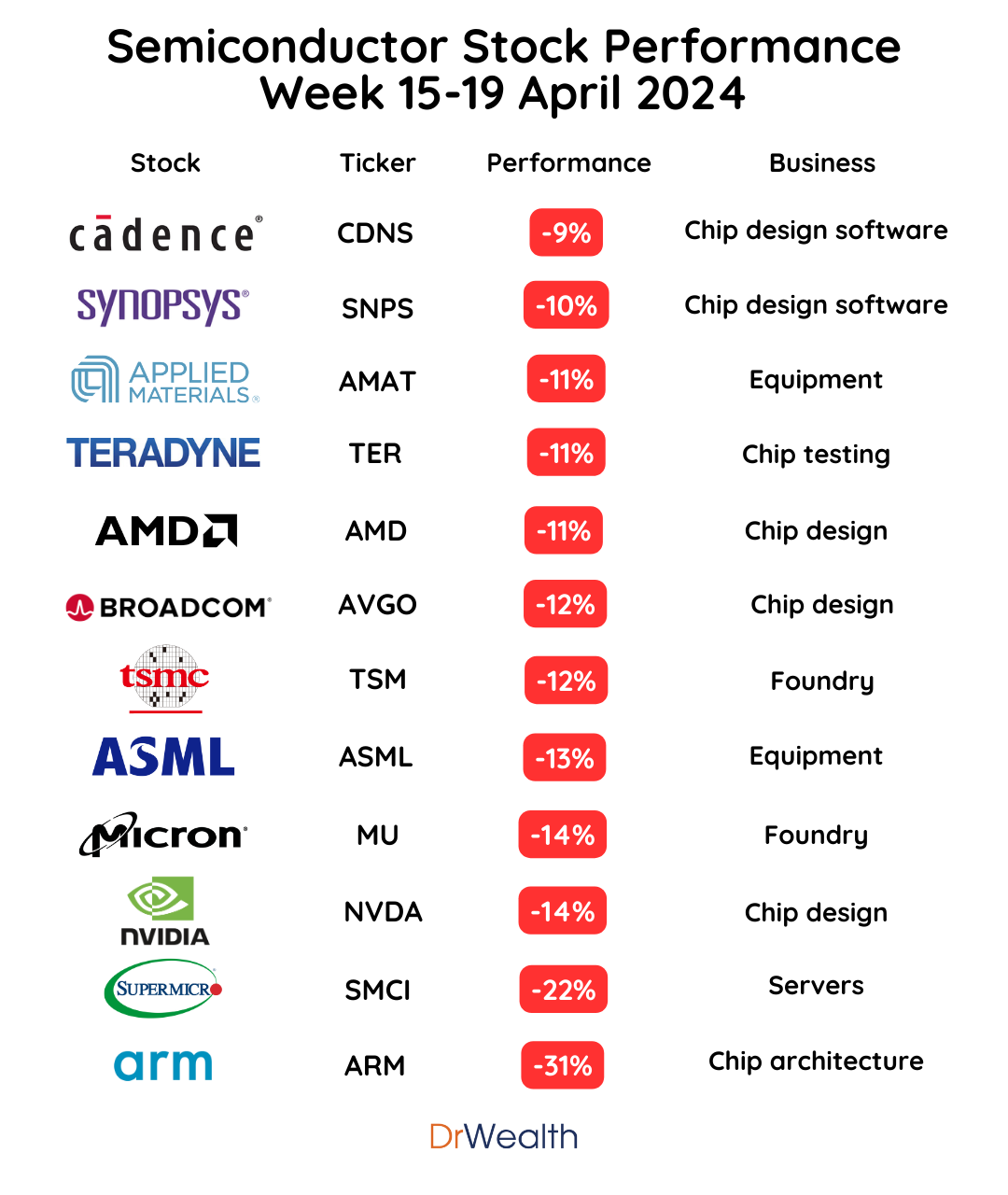

The AI narrative has been propelling the stock market, and many investors are astonished that related stocks have surged for such an extended period. To date, the hardware underpinning AI has benefited more than the software, with semiconductor stock investors reaping substantial rewards. However, this trend took a turn last week when semiconductor stocks experienced a significant decline, with several dropping by more than 10%.

There is always concern when a leading market story begins to falter, and top-performing stocks start to plummet. Currently, the market lacks strong alternatives for leadership. Thus, the downturn in Nvidia, a key figure in the AI story, has triggered a ripple effect, pulling down other semiconductor stocks. From chip design to foundries to testing, the entire value chain felt the impact.

Nvidia (NVDA) saw its shares fall by 10% last Friday, culminating in a 14% decline for the week. Super Micro Computers (SMCI), which has benefited from increased spending on AI servers, experienced a significant 22% drop in its share price. Arm, the ubiquitous chip architecture used by most designers, faced an even steeper fall of 31%.

The world's largest foundry, TSMC (TSM), and the most advanced lithography machine maker, ASML (ASML), also saw their share prices decline by 12% and 13% respectively. The impact extended across the supply chain, from upstream chip design software companies like Synopsys (SNPS) and Cadence (CDNS), to downstream chip testing firm Teradyne (TER), each of which saw its stock fall by 9% or more in the past week.

It is long overdue for AI-related semiconductor stocks to undergo a correction, given their excessive run-up. I have developed fair price estimates for most of these stocks (shown below), and despite the recent declines in share prices, many still appear overvalued. Therefore, I believe further drops are warranted.