Warren Buffett will step down as CEO of Berkshire Hathaway at the end of 2025. While he’ll still play an advisory role—likely as a sounding board to the new CEO—there’s no denying we are nearing the end of an era. Buffett’s eventual departure from this world is inevitable, and for investors, the question is no longer if, but how to carry on his legacy.

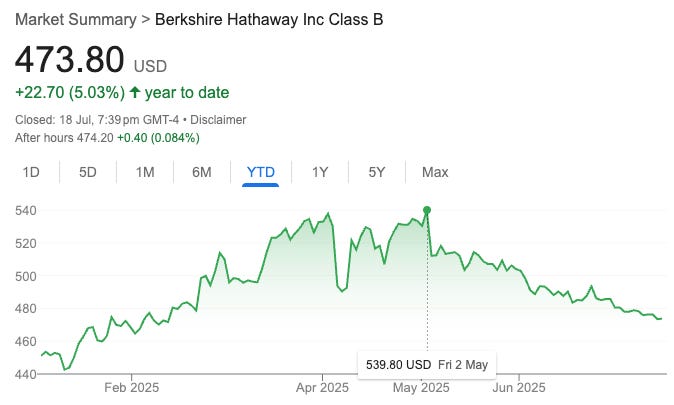

The retirement announcement on 3 May 2025 sparked concern. Since then, Berkshire’s share price has steadily fallen by 12%. It’s clear some shareholders are losing confidence, worried that the next generation of leadership won’t be able to replicate Buffett’s extraordinary success.

Although Buffett has reassured investors that Berkshire is in good hands, those words alone aren’t enough to silence the doubts. His shoes are too big to fill.

So what exactly is Buffett’s secret—and can we replicate it using ETFs without picking stocks ourselves?

Herein, we’ve reviewed a wide range of ETFs inspired by different facets of Buffett’s investment philosophy. The truth is, there isn’t a single ETF that can replace him. Buffett is unique. But by breaking down his approach into its core components, we can reconstruct a strategy that closely mimics what made him so successful.

Buffett’s Alpha, Deconstructed

In their now-famous paper “Buffett’s Alpha”, researchers Frazzini, Kabiller, and Pedersen (AQR) revealed that Buffett’s outperformance boils down to four key factors:

Value – Buying undervalued companies; never overpaying.

Quality – Focusing on businesses with solid profit margins, predictable earnings, and strong operating metrics.

Low Beta – Preferring steady, less volatile stocks.

Leverage – Using low-cost insurance float to invest with about 1.6x effective leverage.

These four factors explained nearly all of Buffett’s alpha. While no ETF captures all of them perfectly, we can combine multiple ETFs to build a composite Buffett Replication Portfolio.