Founders generally possess charismatic qualities, maintaining a focused commitment to a vision while rallying individuals to realize that vision.

The emotional bond that founders form with their companies holds immeasurable value, and no amount of wealth can induce that sentiment into an employee.

Research has also indicated that companies led by their founders tend to outperform non-founder led ones.

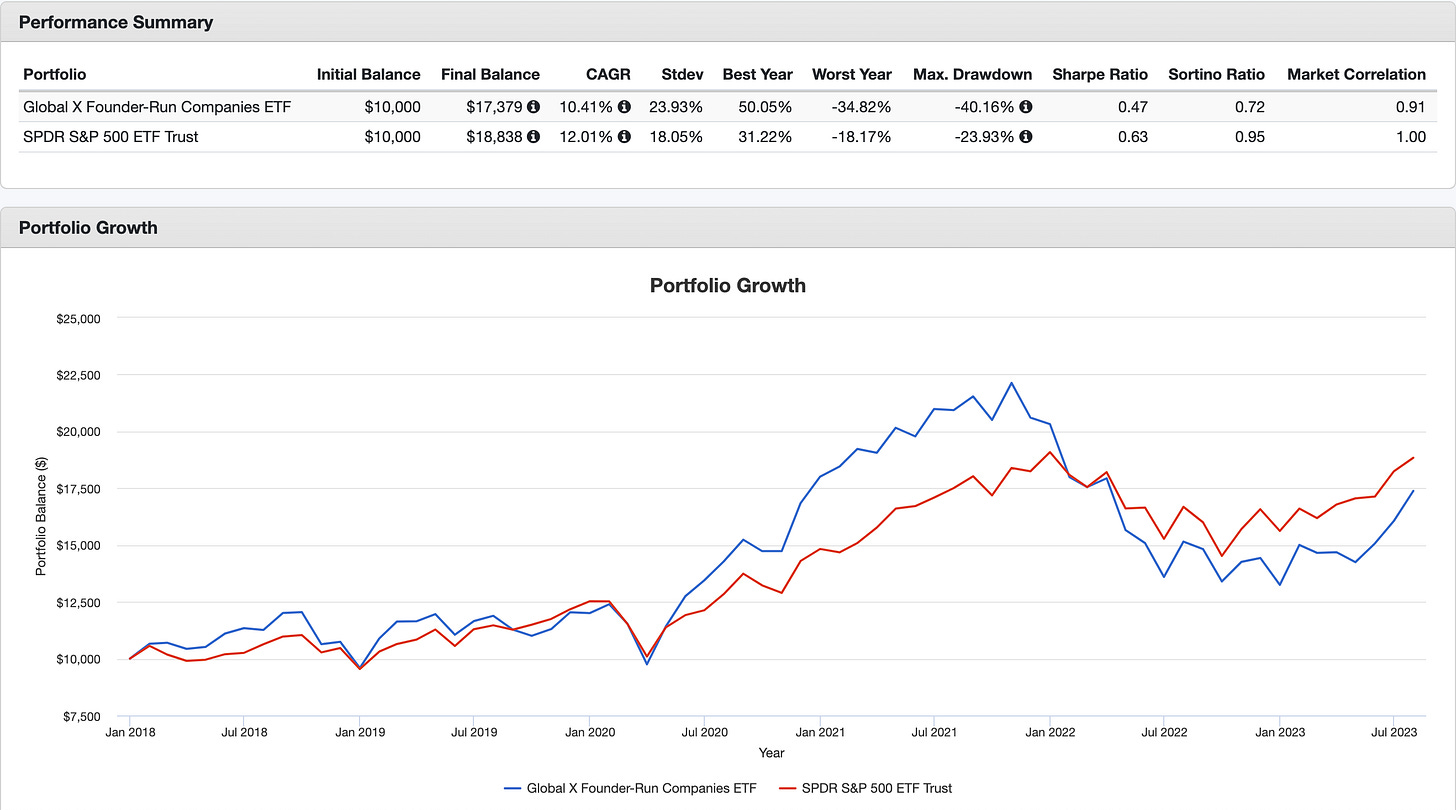

The Founder-Run Companies ETF (BOSS) is an example of an ETF aiming to capture the advantage associated with founder-led companies. Nevertheless, over the previous five years, this ETF did not surpass the performance of the S&P 500 ETF, exhibiting a 10.4% annual return compared to the S&P 500 ETF's 12% per annum. However, upon closer examination of the returns profile, BOSS did exhibit superior performance during the robust tech market conditions of 2020 and 2021. This is because the ETF holdings are skewed to tech, with approximately 40% of its holdings allocated to the technology sector.

This is not meant to dismiss the concept of founder-led companies. To simplify matters, I aimed to concentrate solely on the ten largest companies, determined by market capitalization, which are presently under founder leadership. In contrast, the BOSS ETF encompassed 99 holdings. Moreover, I opted for equal weighting, assigning a 10% allocation to each of these stocks.

Due to the absence of annual rankings, I am unable to perform a rebalancing. Thus, my approach involves solely utilizing the most recent list of top 10 companies and conducting replacements to evaluate the impact of removing specific well-performing entities.

By considering the present top ten founder-led companies, the portfolio would have achieved an impressive annual return of 40% over the past five years. In comparison, the S&P 500 ETF experienced a yearly gain of 16% during the same timeframe.

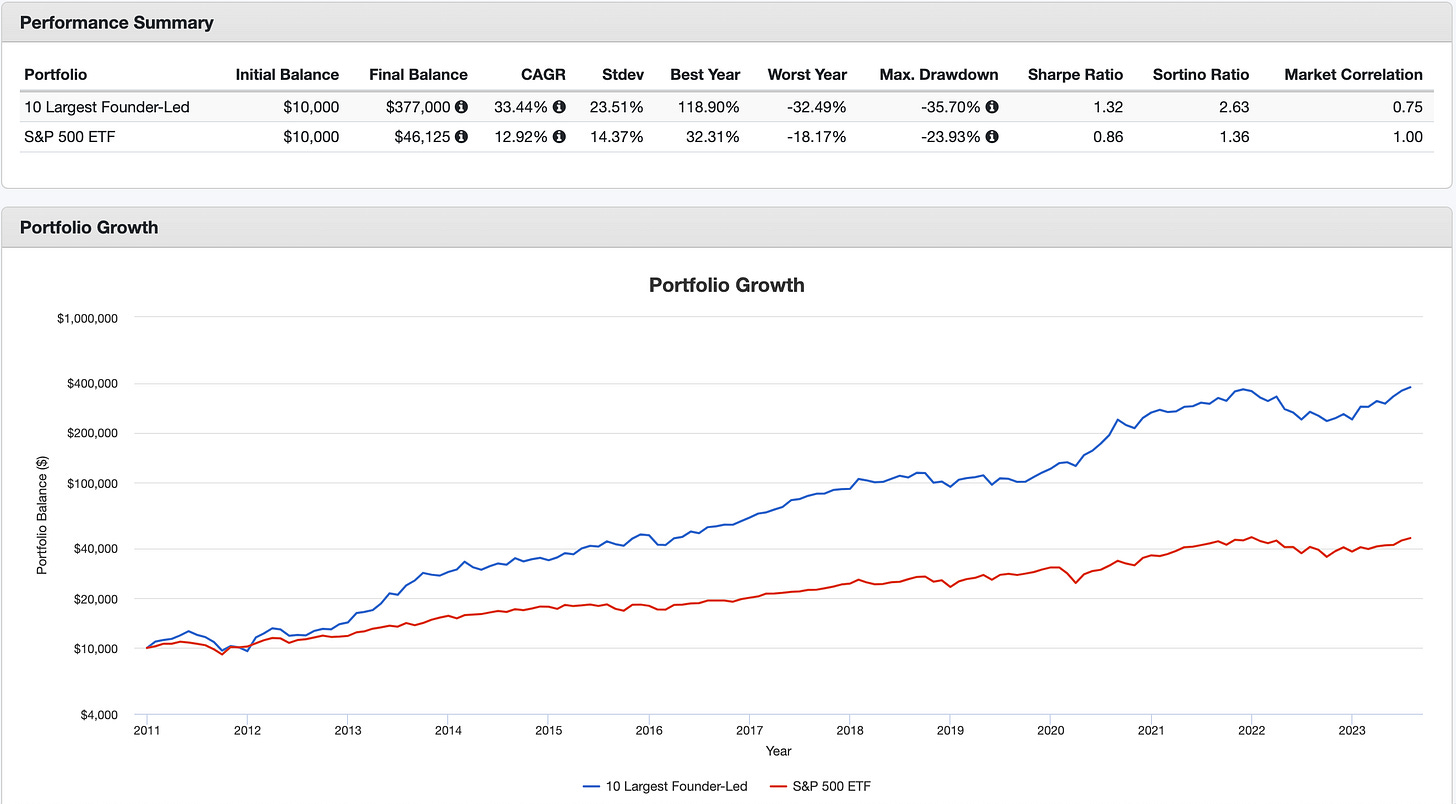

I made a substitution by replacing PDD Holdings (PDD) with Regeneron Pharmaceuticals (REGN) due to the former's limited trading history. This adjustment has allowed me to access a 12-year span of data. The Founder-Led portfolio achieved an impressive annual return of 33% over the past 12 years, while the S&P 500 ETF managed a 13% annual return over the same period.

Lastly, I intentionally substituted Nvidia (NVDA) with Blackstone (BX), as Nvidia has been the top-performing stock in 2023 due to the excitement around AI. My goal was to assess the extent of the performance decrease when Nvidia has been excluded.

As a result of this change, the returns declined to approximately 30% per year, which is still an impressive return. This underscores that the other founder-led companies substantially contributed to the portfolio's impressive gains and not based on any particular company.

By focusing on larger market capitalization companies, it becomes apparent that founder-led enterprises tend to exhibit better performance.

Here's the list of the current top 10 largest companies led by founders, arranged from smallest to largest:

#10 BlackRock (BLK) - $100.5B Market Cap

Larry Fink was one of the co-founders of BlackRock and he remains as the CEO today. He has been running the company for 35 years and has established BlackRock as the largest ETF manager in the world, helping investors adopt a passive and low-cost approach to investing.

#9 PDD Holdings (PDD) - $104B Market Cap

Better known as Pinduoduo, it changed its name to PDD Holdings last year so that it can be a holding company for the US ecommerce arm, Temu. Pinduoduo was founded in 2015 by Colin Huang. It found success in promoting group buys in China's lower tier cities. Temu has also rose to be a popular e-commerce site in the US where it peddles cheap China goods to the Americans.

#8 Prologis (PLD) - $104B Market Cap

Prologis, a REIT, maintains a portfolio of logistics properties and holds the distinction of being the world's largest logistics real estate company. Hamid Moghadam played a pivotal role in this success story as he co-founded Abbey, Moghadam & Company in 1983. This entity later merged with ProLogis in 2011, subsequently adopting the Prologis name. Presently, Hamid Moghadam continues to serve as the Chairman and CEO of Prologis.