The Nasdaq 100 has consistently delivered strong performance, driven by a tech-fueled rally that propelled the index to record highs. Nvidia has been a standout contributor to this surge. Tech stocks are known for their rapid growth, and in this post, we rank the top 10 fastest-growing Nasdaq 100 components based on their 10-year revenue CAGR, starting from #10:

#10 Palo Alto Networks (PANW)

Palo Alto Networks is a leading cybersecurity firm that helps businesses safeguard their digital infrastructure. Its offerings include next-gen firewalls, cloud security services, and advanced threat detection systems used by enterprises globally.

The company’s revenue has grown at an impressive 30% annually over the past decade, remaining resilient even during the Covid-19 pandemic and inflationary periods.

Its platform-based approach—integrating multiple cybersecurity products into a single ecosystem—has been a key driver of growth. Most importantly, it continues to ride the cybersecurity wave as digital security becomes a top priority for companies in today’s connected economy.

The stock has delivered a solid 38% year-to-date return. To address its surging share price, the company announced a 2-for-1 stock split effective December 16, 2024, making shares more accessible to a broader range of investors.

Morningstar values PANW at $375, with its current share price trading slightly higher at $398, suggesting a modest overvaluation.

#9 Broadcom (AVGO)

Broadcom is a global tech powerhouse specializing in semiconductors and infrastructure software. Its chips power essential technologies like data centers, networking, broadband, wireless, and industrial systems, making it a key enabler of today’s connected world. With a market cap of $856 billion, Broadcom is only 17% away from hitting the trillion-dollar mark, currently ranking as the 11th largest company globally.

10-Year Revenue CAGR: +30%

Broadcom’s growth has been fueled by custom chip development, particularly in AI-driven data centers. Its strategic collaborations with major tech giants for AI-specific chip solutions have expanded its market footprint significantly.

On December 11, 2024, Apple reportedly partnered with Broadcom to co-develop an AI server chip, codenamed "Baltra," expected to be ready for mass production by 2026. This move could reduce Apple’s dependence on current AI chip suppliers, highlighting Broadcom’s crucial role in the next wave of AI hardware innovation.

With a fair value estimate of $155 from Morningstar, AVGO appears overvalued, trading at a current share price of $183 — not surprising given its impressive 69% year-to-date rally!

#8 Nvidia (NVDA)

NVIDIA needs little introduction as it’s currently the hottest stock in the market, thanks to its dominance in AI hardware. At one point in 2024, it briefly overtook Apple as the world’s most valuable company. While it’s now back at number two, that’s still an impressive feat.

10-Year Revenue CAGR: 31%

On December 9, 2024, China’s State Administration for Market Regulation launched an antitrust investigation into NVIDIA, alleging potential violations of anti-monopoly laws. This is widely seen as a counter-move against U.S. restrictions on China’s chip industry. The probe targets NVIDIA’s AI chip market dominance and its compliance with conditions from its 2020 Mellanox Technologies acquisition.

According to Morningstar, NVIDIA's fair value estimate is $130, while its current share price is slightly above that at $139, reflecting some degree of overvaluation.

#7 Workday (WDAY)

Workday is a leading provider of cloud-based applications for finance and human resources, offering solutions that help organizations manage their financial and employee data efficiently.

10-Year Revenue CAGR: 32%

Workday's growth is driven by the increasing adoption of cloud-based enterprise solutions, as companies modernize their HR and financial systems for better efficiency and scalability. Its subscription-based business model ensures strong customer retention while enabling recurring revenue growth year after year.

Despite its solid fundamentals, Workday’s share price has underperformed this year, with just a 2% gain year-to-date. However, this presents an opportunity to buy the stock close to its fair value. According to Morningstar, Workday's fair value estimate is $270, while its current share price is $272.36, indicating it’s trading near its fair value.

Adding to the positive outlook, on December 7, 2024, S&P Dow Jones Indices announced that Workday would be included in the S&P 500 index, effective before the market opens on December 23, 2024. This inclusion could potentially increase institutional demand for the stock.

#6 Meta Platforms (META)

Meta Platforms, another Magnificent 7 stock on this list, has bounced back from negative sentiment surrounding its costly metaverse ambitions and Apple’s ad-tracking restrictions. Ad revenue has returned to growth, while metaverse investments have taken a backseat, making way for increased focus on AI development—a narrative well-received by the market.

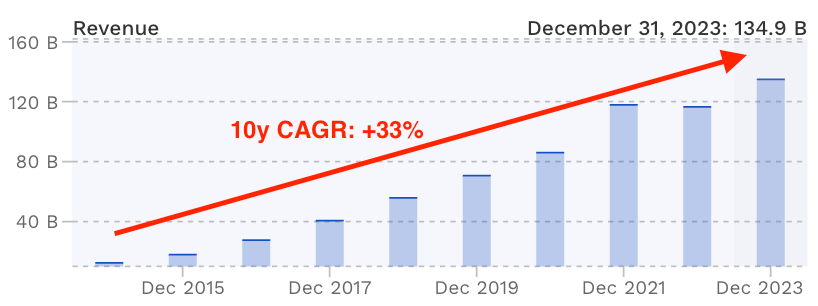

10-Year Revenue CAGR: 33%

Meta’s share price has surged 83% year-to-date, reflecting renewed investor confidence. However, the stock appears overvalued at its current share price of $633, compared to Morningstar’s fair value estimate of $560.