The increase in the US Debt Ceiling has been approved, and the upcoming process involves the issuance of additional treasury securities by the US government to borrow more funds and replenish its financial resources.

Analysts predict that the market will be flooded with treasury securities valued at over $1 trillion this year. This development will have significant ramifications across various areas.

Firstly, there will be a temporary reduction in liquidity. This is because as more investors purchase treasuries, additional dollars are transferred to government accounts. Eventually, this money will be spent and re-enter circulation in the economy. However, in the interim, there will be less available money in circulation until the government spends it.

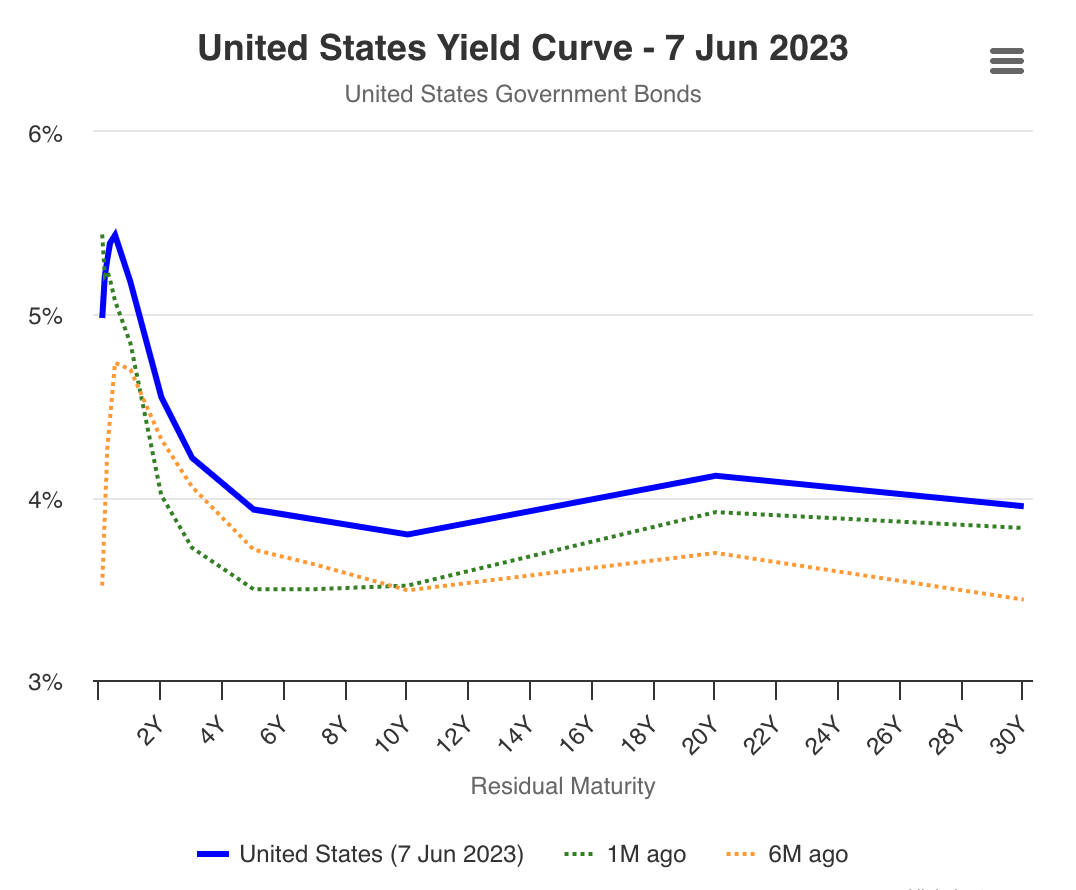

Secondly, there will be an increase in short-term interest rates. With the issuance of more treasuries (resulting in increased supply), treasury prices will decline to entice more investors to purchase them. As prices fall, interest rates rise. The higher interest rates also serve to attract additional investors to buy treasuries. Therefore, even if the Federal Reserve does not raise rates, short-term interest rates will still increase due to the issuance of treasuries. In fact, the markets have already reacted, and interest rates have risen compared to a month ago.

Thirdly, as interest rates rise, it will pose additional challenges for the already vulnerable commercial real estate sector. The sector may experience a higher number of defaults and lower occupancy rates as the economy slows down. The increasing interest rates also raise the likelihood of a recession.