Review of Goldman Sachs' 25 Conviction Buys

Goldman Sachs periodically publishes its conviction list of stocks, attracting considerable attention from investors eager to gain insight into the thinking of one of the most renowned names in investment banking.

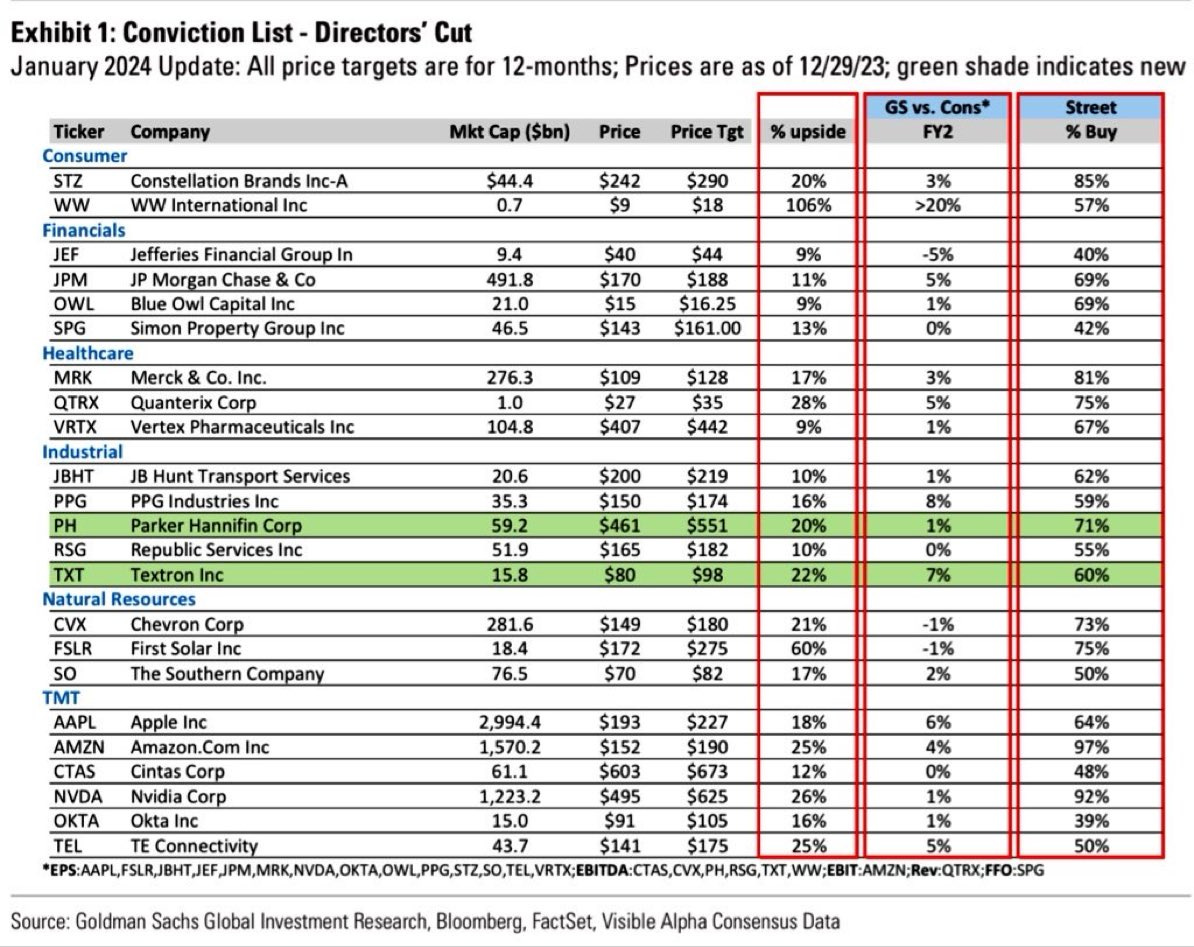

Below is the latest list, updated in January 2024:

Firstly, I never trust price targets from sell-side analysts because these are merely opinions and highly dependent on the assumptions in their models. One should always conduct their own valuations.

Secondly, it doesn't make sense to take stock recommendations at face value. If you haven't taken the time to analyze the stock, or if you don't understand the business, you won't have the confidence, let alone the conviction, to hold on when things turn sour.

And trust me, stocks can turn bad quickly. In such cases, what do you do? Likely, you'll feel lost and indecisive, holding onto a significant loss and hoping for a price recovery. That's not a nice position to be in.

Therefore, it is crucial for every investor to be discerning and use the list to generate ideas, but ultimately, to do their own research.

I will share my thought process as an example.

Constellation Brands (STZ) owns a portfolio of alcoholic brands, notably including Modelo, which recently made headlines by surpassing Bud Light as the top-selling beer in the U.S. Generally, I am not in favor of beer stocks due to the high level of competition and the minimal differentiation among them. I wager that most consumers would be unable to discern the differences in a blind taste test. Consumers tend to become more price-sensitive and gravitate towards cheaper beers. This behavior forces companies to lower their prices, which in turn compresses their margins.