Palantir Crashes 14% in a Week — Is the AI Trade Over?

It has been a tough week for AI stocks. Prices have fallen sharply even though the broader indices stayed relatively flat.

Two of the hardest-hit names were Applied Materials and Palantir, both down more than 14% in the past week.

Applied Materials’ decline was triggered by its earnings release. The company guided for $6.7 billion in revenue this quarter, well below the $7.34 billion expected. CEO Gary Dickerson highlighted that the macroeconomic and policy environment is “creating increased uncertainty and lower visibility,” remarks that unsettled investors.

The selloff didn’t stop there — peers like Lam Research and KLA Corp dropped more than 7% over the week, showing how fragile sentiment is across the semiconductor equipment space.

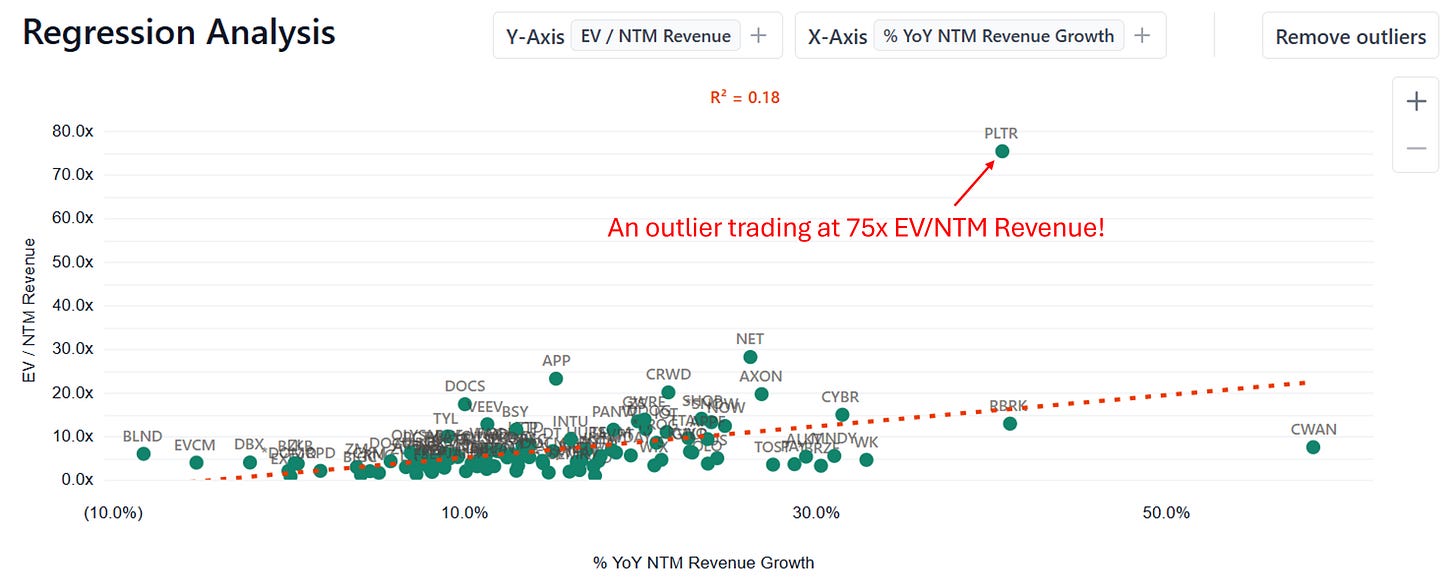

Palantir, on the other hand, suffered a six-day losing streak with no clear catalyst. To me, it looks like mean reversion at work. Palantir remains one of the most richly valued names in the AI universe — trading at a forward EV/revenue multiple far above its peers. When momentum cools, these stretched valuations get punished first.

The cloud providers weren’t spared either. CoreWeave, an Nvidia-backed AI cloud service provider, lost 21% in a week. Big tech names also slipped: Oracle -5%, Microsoft -4%, Amazon -2%, Alphabet -1%, and even Nvidia -3%.

Further down the value chain, the companies providing infrastructure and power to the AI boom saw red ink too:

Constellation Energy -4%

NRG Energy -4%

Talen Energy -6%

Vertiv -6%

Dell -7%

Supermicro computer -7%

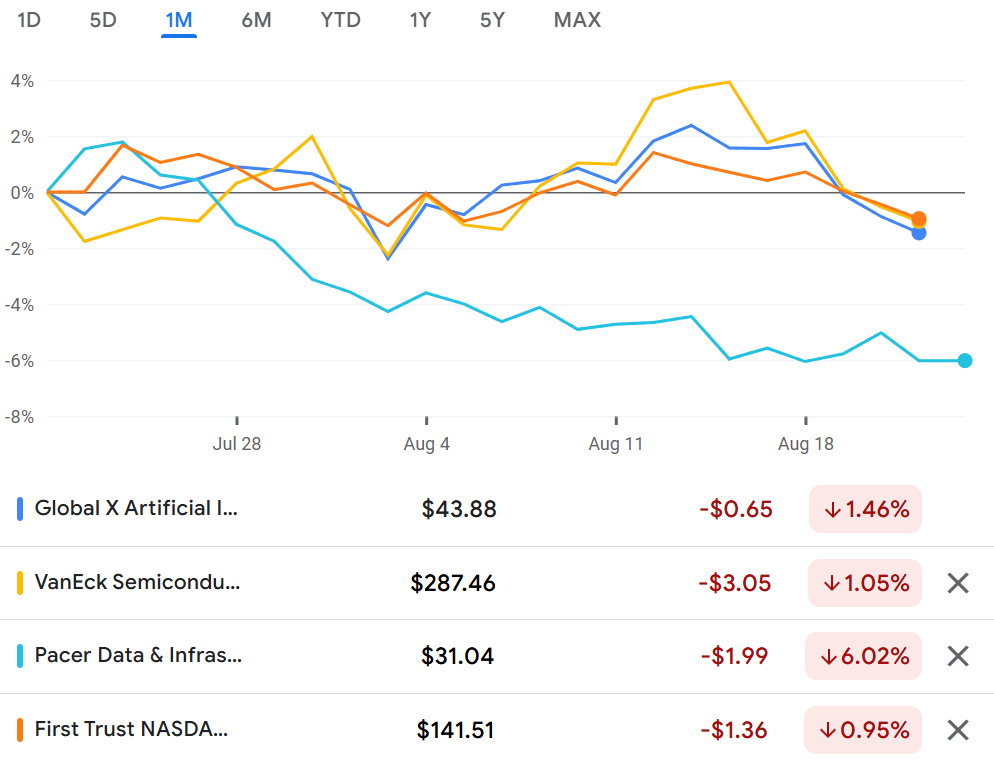

Even the AI Value Chain portfolio I’ve previously outlined — a basket of four ETFs across chips, cloud, software, and infrastructure — was down 2% for the week.

So is this the beginning of the end of the AI story?

I don’t think so. AI remains a structural wave that will likely last for many years. But waves don’t go in a straight line. After such strong rallies, it’s natural — and even healthy — for valuations to cool off.

For investors, here are a few ways to think about this pullback:

Reassess conviction levels. Drawdowns are a stress test: are you in AI because of hype, or because you truly believe it will reshape industries long term? If you find your conviction wavering, it may be a sign your allocation to AI stocks is too high — trimming might be the prudent move.

Differentiate the value chain. Chipmakers, cloud platforms, and infrastructure players don’t move in sync. For instance, energy providers could face regulatory caps even as demand soars. Not every company in the value chain will benefit equally. Personally, I lean toward market leaders with few competitors and above-average margins.

Watch for entry (and exit) points. If you missed the earlier runs, corrections like these can be opportunities to scale in gradually. For those already in early, this may also be the time to take some profits off the table and rebalance.

This isn’t the end of the AI story. But it could mark a shift to a more mature phase where earnings delivery, not just narrative, will matter more. If you believe in AI’s long-term trajectory, these pullbacks may be when you get paid for having patience.