Nvidia Is Up 10% From $4T—Is $5T Next?

Nvidia reported earnings on Wednesday and the stock initially dropped 3% in after-hours trading, at one point down as much as 5%.

Some investors were probably just taking profits. The results weren’t bad, though some may complain that revenue growth has decelerated.

But growing at over 56% YoY is still very fast for the world’s largest company. None of the other Magnificent 7 are growing at this pace—not even half of it. Nvidia beat both revenue and earnings estimates. Even the guidance was a beat.

Another concern is Nvidia losing China revenue. H20 chip production has been halted as it’s no longer competitive against China’s homegrown alternatives.

However, Nvidia is now looking to sell a watered-down version of Blackwell to China. Trump has publicly said he is open to it. If approved, Nvidia should regain its China revenue.

Perhaps investors came to their senses—by Thursday’s trading, Nvidia was down less than 1%.

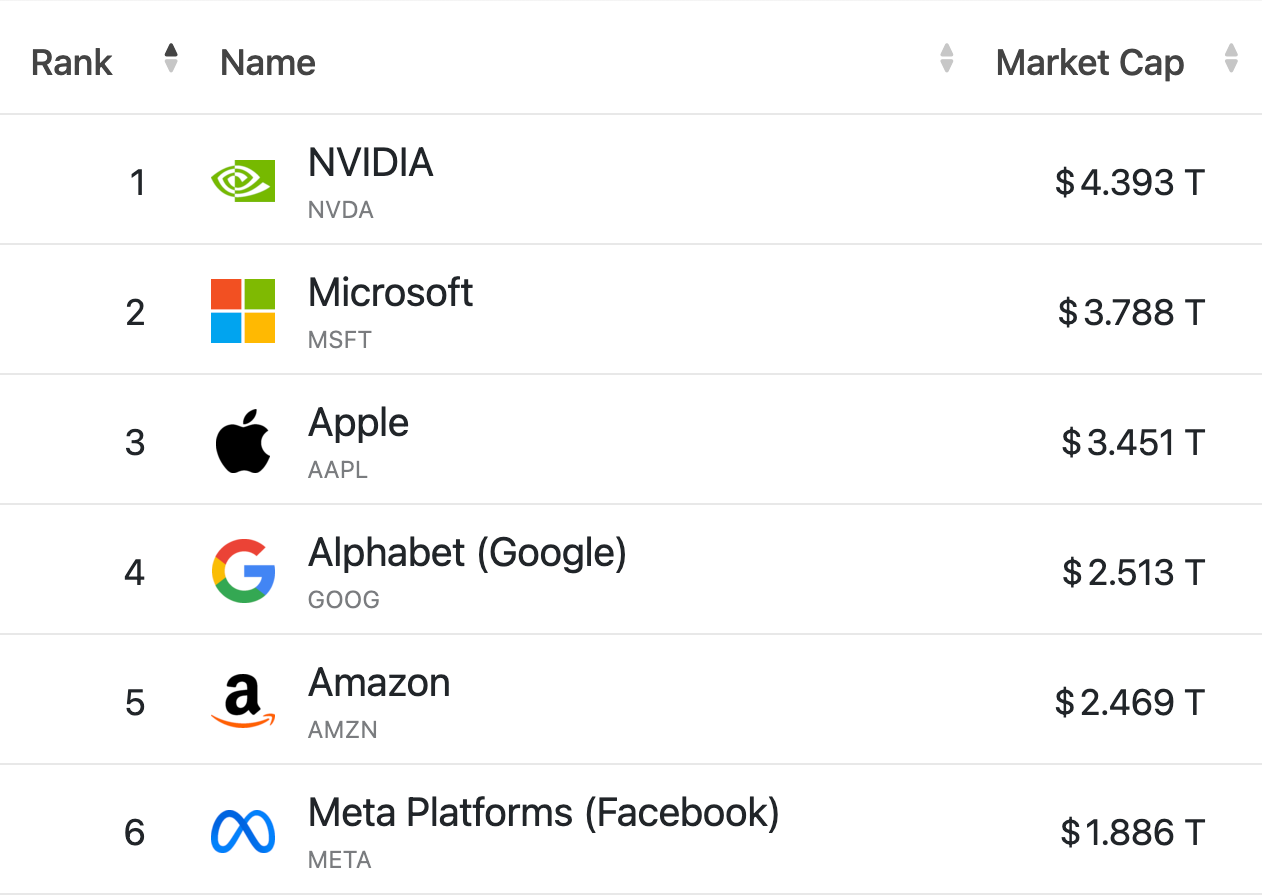

Nvidia crossed the $4 trillion mark on 9 July 2025, just under two months ago. Now it’s at $4.393 trillion, or about 10% higher. It’s also $605 billion ahead of Microsoft.

Nvidia isn’t far from the $5 trillion milestone. It needs just another 14% gain, which could happen within the year. The first trillion is the hardest, the next one gets easier.

The technological moat is very wide, even if it may not be permanent. There’s no doubt Nvidia will milk it big time in the near future. Its net profit margin is a staggering 52%.

Its H200 Blackwell chips are the best in the market. While the H100 was already ahead, Blackwell has pushed that lead even further.

What’s less talked about is CUDA—the OS for managing Nvidia’s chips. CUDA is dominant and no one comes close. Nvidia doesn’t just dominate hardware, it owns the software layer too. That makes it hard for any serious AI player to switch away.

Two customers accounted for 39% of Nvidia’s Q2 revenue. Some see this as a concentration risk, but they are likely major cloud players—the only ones with deep enough pockets to buy at scale. That’s actually a positive sign: AI spending and capex aren’t slowing.

The AI wave remains a structural trend. Any tech investor should bet on it—not against it.