Consider a scenario where a single company influences the allocation of $1.3 trillion in investment funds. This company is none other than MSCI, which stands as one of the world's three major index providers, alongside S&P Global and FTSE. In the fiscal year 2022, MSCI's index revenue closely matches that of SPGI, both reaching $1.3 billion. However, as FTSE's revenue is combined with Refinitiv, it is not possible to make a direct comparison in this case.

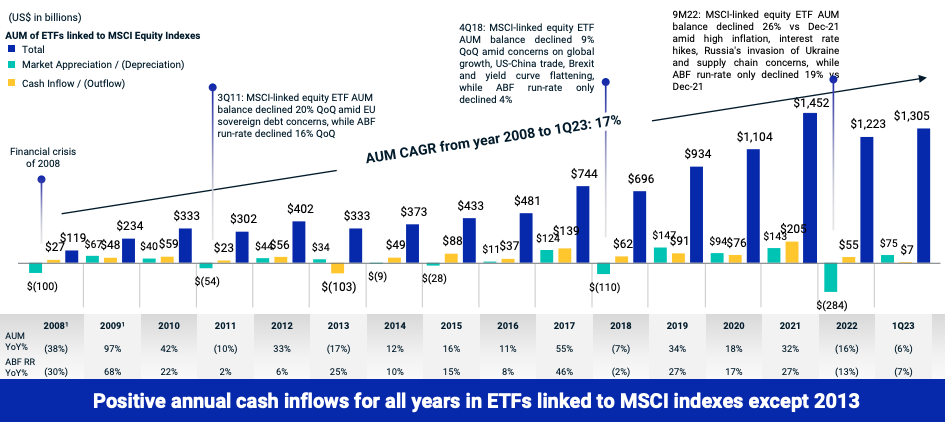

At the end of May 2023, around $1.3 trillion in assets under management (AUM) across various ETFs are linked to MSCI indices. These ETFs are managed passively, meaning that investment decisions are not made by the managers themselves. Instead, they rely entirely on the calculations provided by the MSCI indices to determine capital allocation. Consequently, when MSCI adds or removes a stock from its index, the corresponding ETFs will buy or sell that stock accordingly. This demonstrates the significant influence of MSCI as an indexer, capable of impacting markets through its index adjustments.

Back in 2008, the assets under management (AUM) of ETFs following MSCI indices amounted to a mere $119 million. Since then, it has expanded significantly, surpassing a growth rate of 17% annually and increasing by more than 10 times. MSCI has undoubtedly capitalized on the flourishing ETF industry, which has consistently attracted more funds over the years. This trend is expected to persist, indicating a promising future for MSCI and the indexing business as a whole. Presently, there is no better time to be involved in the indexing industry.

MSCI generates revenue through licensing fees. When an ETF chooses to track an MSCI index or a fund uses an MSCI index as a benchmark, they are required to pay licensing fees to MSCI. These fees are typically calculated based on a percentage of the AUM that the ETF or fund manages or through a recurring subscription model. As the AUM of these funds increase, the licensing fees also grow proportionately.

This is what makes MSCI a highly advantageous business model. The creation of an index is not a complex task; it involves a one-time effort that can be repeatedly use to generate increasing revenue. It essentially comprises a set of rules and mathematical calculations to rank and determine the weightage of components. The absence of material costs, factories, or machinery makes it an incredibly asset-light business, with staff expenses being the primary cost. As a result, MSCI enjoys an impressive net profit margin of 39%.

Considering the ease of creating an index, one may question whether MSCI possesses a competitive advantage. It is true that anyone can create an index, but the real challenge lies in persuading asset managers to track or benchmark against a newly introduced index. This task is no easy feat since asset managers and investors are unlikely to embrace an index without an established reputation or track record. Here, MSCI's branding acts as its competitive moat, making it one of the top choices when customers seek an index solution.

Keep reading with a 7-day free trial

Subscribe to Finbite Insights to keep reading this post and get 7 days of free access to the full post archives.