Micron Ban, Who's Next? Why You Should Decouple Your Portfolio

China recently block operators of key infrastructure from buying chips from Micron.

It didn't outright ban Micron as other private and less sensitive state-owned enterprises can continue to do business with Micron.

Micron share price did not drop much, just over 2%. This means that the market does not expect the rest of the companies to follow suit with the self-imposed ban.

The deteriorating relationship between the United States and China is evident, and it would be naive to expect any significant improvement in the near future. In fact, successfully averting a war would be considered a positive outcome.

This ongoing retaliatory exchange is expected to escalate further. The US has imposed restrictions on high-end semiconductor manufacturing equipment exports to China and threatened to ban TikTok, prompting China to respond by prohibiting infrastructure companies from purchasing Micron chips. This cycle of actions and counteractions is likely to continue, with both countries potentially implementing further measures in the future.

Indeed, Robert Axelrod's tournaments have demonstrated the effectiveness of the Tit-for-Tat strategy where it won in most of the scenarios. This strategy involves initially cooperating and then mirroring the opponent's previous move. It has shown that reciprocating actions can be the most advantageous approach in certain competitive scenarios. Playing nice unilaterally, without receiving reciprocal actions, can often lead to exploitation and unfavorable outcomes.

Given this understanding, it is highly probable that both the United States and China will continue to retaliate with equal force in their ongoing dispute. Each side will likely respond consistently to avoid the perception of weakness or vulnerability. This pattern of exchanging blows is driven by the mutual desire not to lose ground and to maintain a position of strength.

Consequently, investing in US companies that heavily rely on business dealings in China is becoming increasingly risky. The possibility of a ban being imposed and subsequently causing a significant decline in share prices adds to the apprehension surrounding such investments.

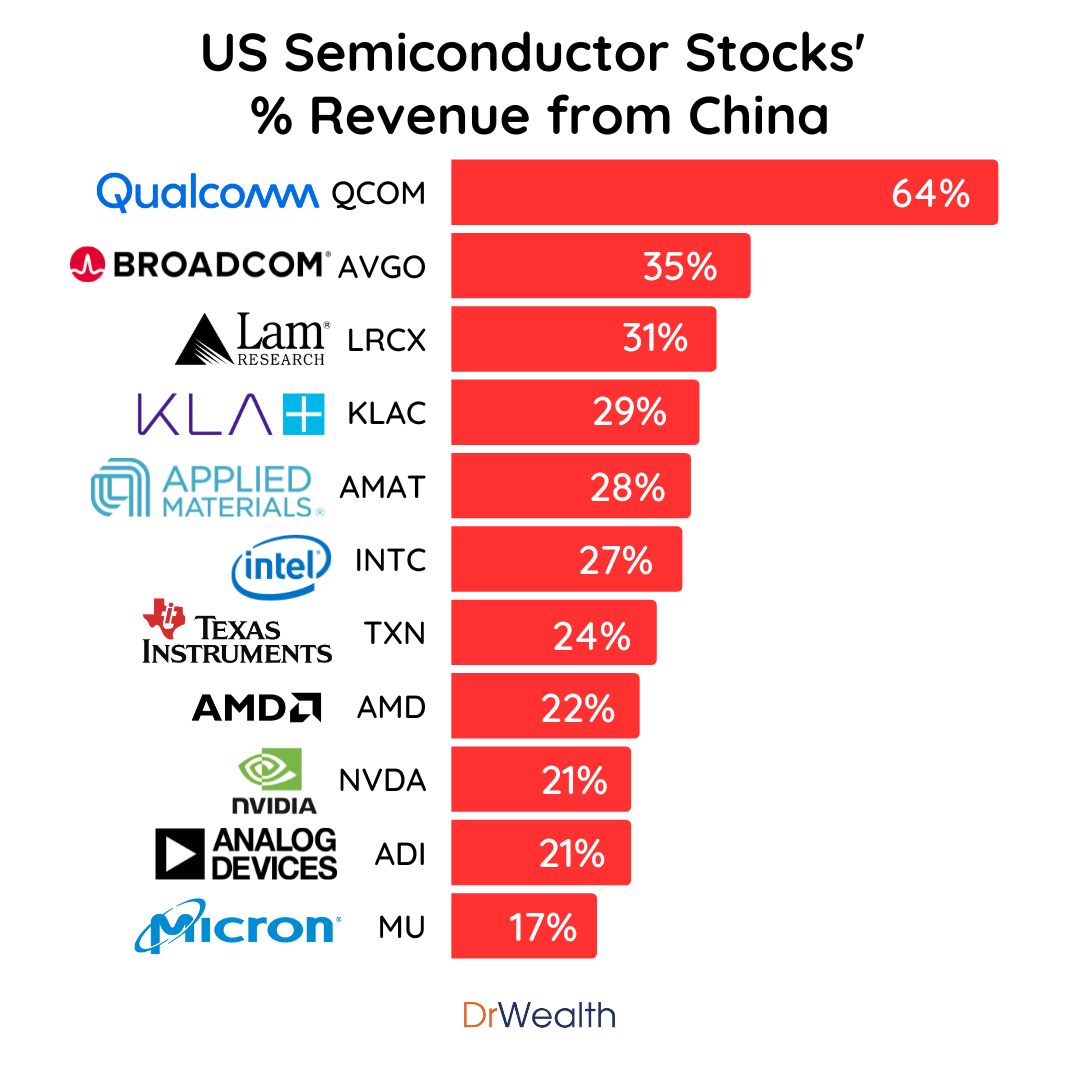

In addition to Micron, several other chip companies based in the US also have significant exposure to the Chinese market:

As the chip war intensifies, there is indeed a risk that any of these companies with substantial exposure to China may become targeted or face increased scrutiny.

So far, the policy responses in the chip war have been calculated and measured. The United States has not imposed a complete ban on semiconductor access to China, but rather restricted the export of advanced chips. This approach likely stems from the desire to allow American companies to continue profiting from the largest chip market, China, while limiting China's access to high-end chips in order to impede its progress.

Likewise, China has not banned all sales of Micron products within its borders, but has limited it to infrastructure companies. It is probable that China still relies on foreign technology and understands that banning more US companies would be detrimental to its own interests. Additionally, there may be readily available alternatives to Micron, such as Samsung Electronics and SK Hynix, making the impact of the ban less severe.

Another factor to consider is that China may not have reached the scale or technological capability necessary to replace the supply provided by US companies. Therefore, China will likely continue relying on these companies while it scales up its own production and improves its technology. However, as China progresses and expands its capabilities, the likelihood of it seeking to remove US companies from its supply chain in the future increases.

Taking a prudent approach, it is advisable to initiate a process of portfolio decoupling. This entails investing in US companies that do not engage in business operations in China, as well as Chinese companies that predominantly focus on serving domestic markets without generating revenue from the United States. By adopting this strategy, investors can mitigate the potential risks associated with the escalating tensions between the two countries and reduce exposure to potential disruptions in cross-border trade and regulations.