Mettler Toledo (MTD) may not be a household name, but it is highly regarded in laboratory work, industrial applications, and the F&B sector, where precision weighing scales are indispensable.

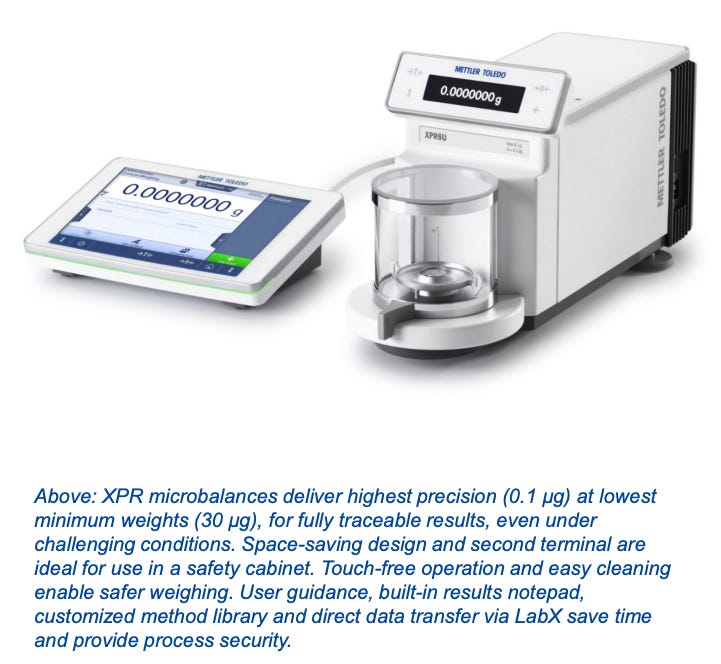

One of its standout products is a scale capable of measuring up to six decimal places (micrograms), reflecting its focus on high-precision instruments:

That said, Mettler Toledo also provides large-scale solutions, including massive scales designed to weigh vehicles.

Mettler Toledo's product portfolio extends beyond scales to include lab equipment such as pipettes, titrators, pH meters, thermal analysis systems, and more. Its diverse customer base ranges from pharmaceutical and biotech companies to refining and logistics firms. Notably, no single customer accounts for more than 1% of its sales, demonstrating strong customer diversification.

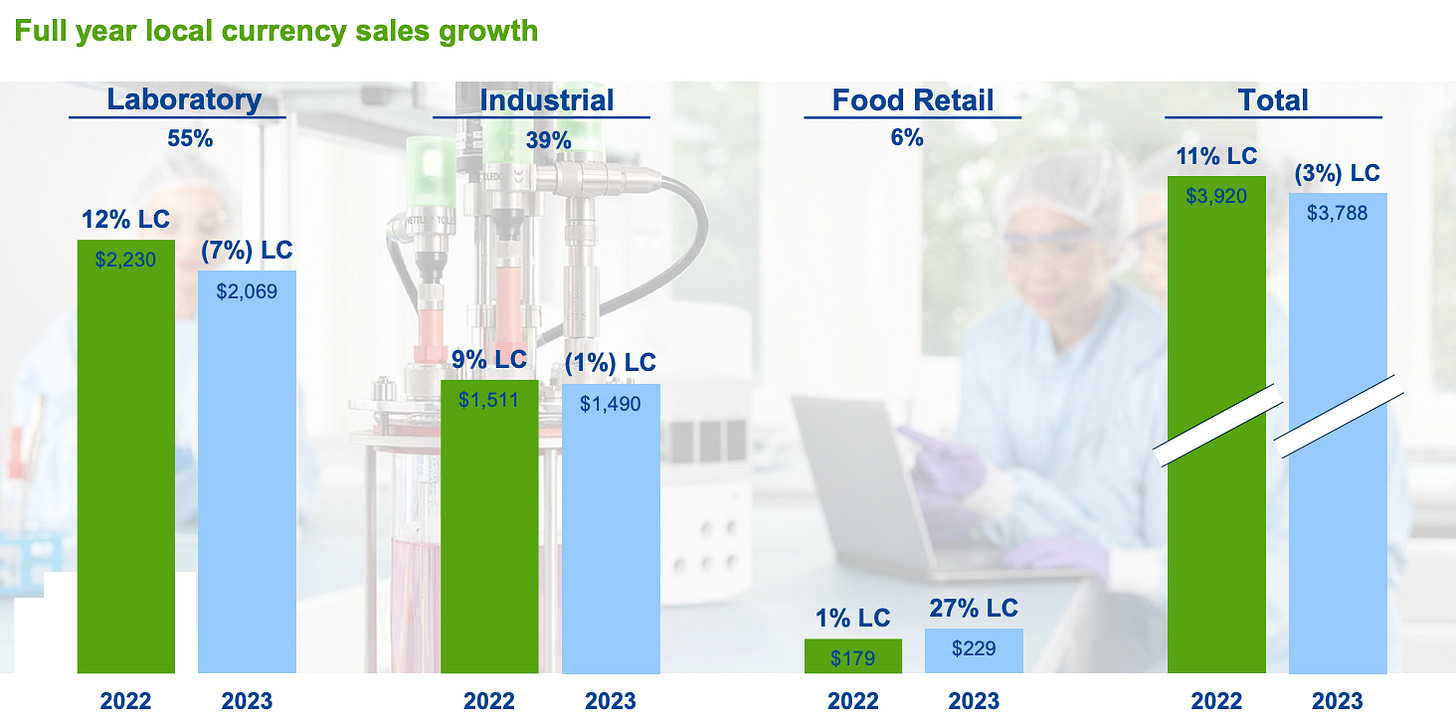

In terms of revenue composition, laboratory instruments make up the largest share at 55%, followed by industrial applications at 39%, and Food Retail contributing 6%. Interestingly, Food Retail was the only segment to show growth in 2023.

Geographically, Mettler Toledo's revenue is well-distributed, with the Americas contributing 41%, Europe 27%, and Asia/Rest of the World 32%, showcasing its global reach and diversification.

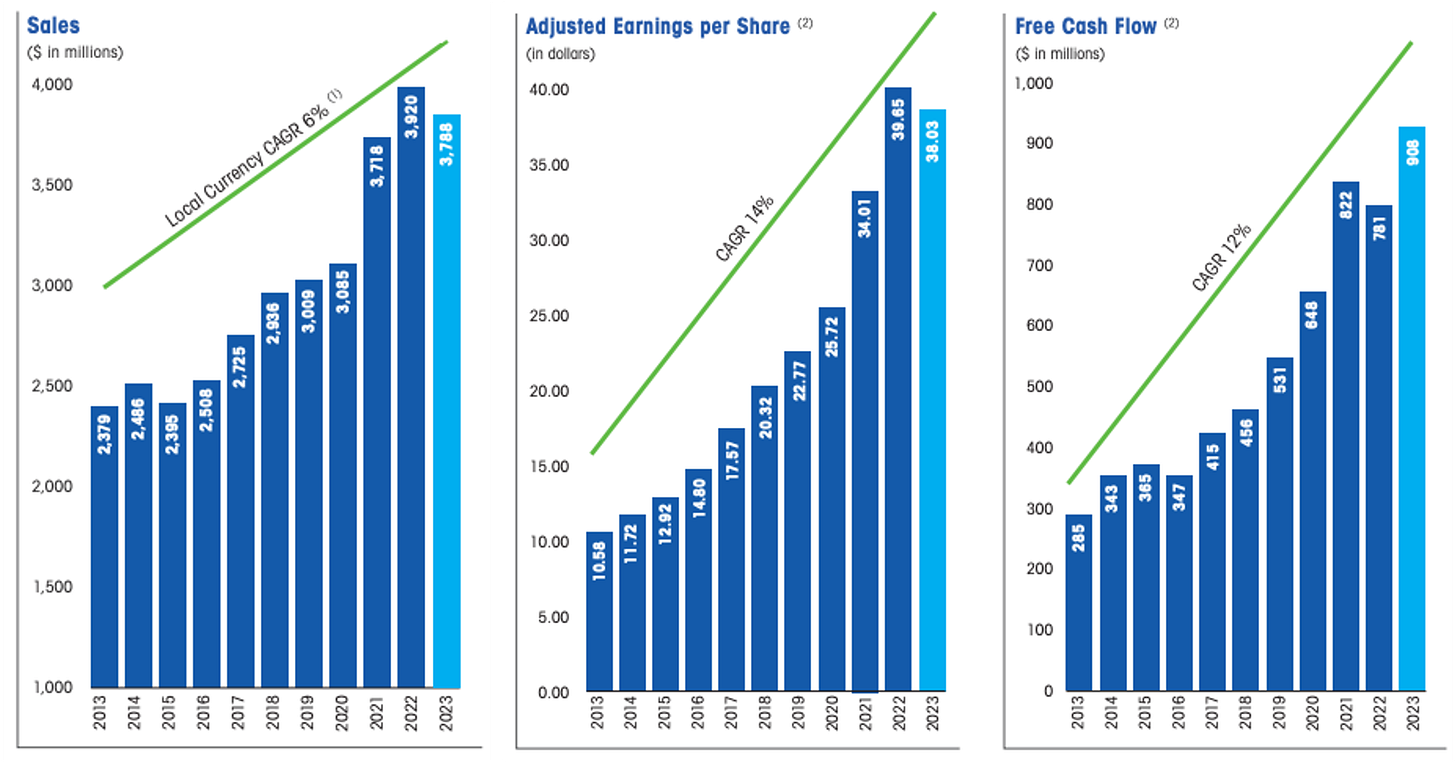

Despite its broad diversification, Mettler Toledo has faced challenges recently. Growth slowed in 2023 and remained flat through the first nine months of 2024. This sluggishness likely explains why its share price has underperformed, rising just 3% this year compared to the S&P 500 ETF's 27% surge.

The slowdown is largely attributable to weak demand from China, where economic headwinds have taken a toll, particularly on industrial scales, which are more cyclical. Additionally, lab revenue from pharmaceutical and biotech sectors softened as the effects of COVID-19 subsided. While the latter reflects a normalization trend, the former appears to be a temporary issue.

Over the longer term, Mettler Toledo has demonstrated consistent growth. Over the past 10 years, revenue, earnings per share (EPS), and free cash flow (FCF) have grown at annual rates of 6%, 14%, and 12%, respectively. Revenue declined year-over-year only in 2015 and 2023, while EPS has seen just one annual decline in the past decade (2023). While MTD may not be a rapid growth stock, it exhibits the traits of a steady and resilient performer.