Goldman Sachs (GS) has pinpointed 50 stocks poised to reap long-term rewards from artificial intelligence (AI) adoption. Unlike the current trendy AI stocks, iconic names like Nvidia are notably absent from this list. But GS identified other stocks that could have tangible benefits by adopting AI to either reduce headcount costs or to increase productivity.

Here's how Goldman Sachs accomplished this analysis. First, they examined nearly 1,000 different job roles in the US, sorting them based on their level of simplicity and significance. This enabled them to identify tasks that are more likely to be taken over by artificial intelligence (AI).

Second, the bank eliminated companies that aren't greatly affected by huge labor expenses. This is because adopting AI wouldn't lead to substantial cost savings for these companies.

Third, Goldman Sachs combined the potential cost savings from reducing the workforce and the increased earnings from AI-driven efficiency. Then, they ranked companies based on how much their profitability would change under this scenario.

Finally, Goldman Sachs ensured a balanced representation across various sectors. The number of companies selected from each sector was aligned with the proportions outlined in the Russell 1000 index. This approach prevented any concentration in a single sector.

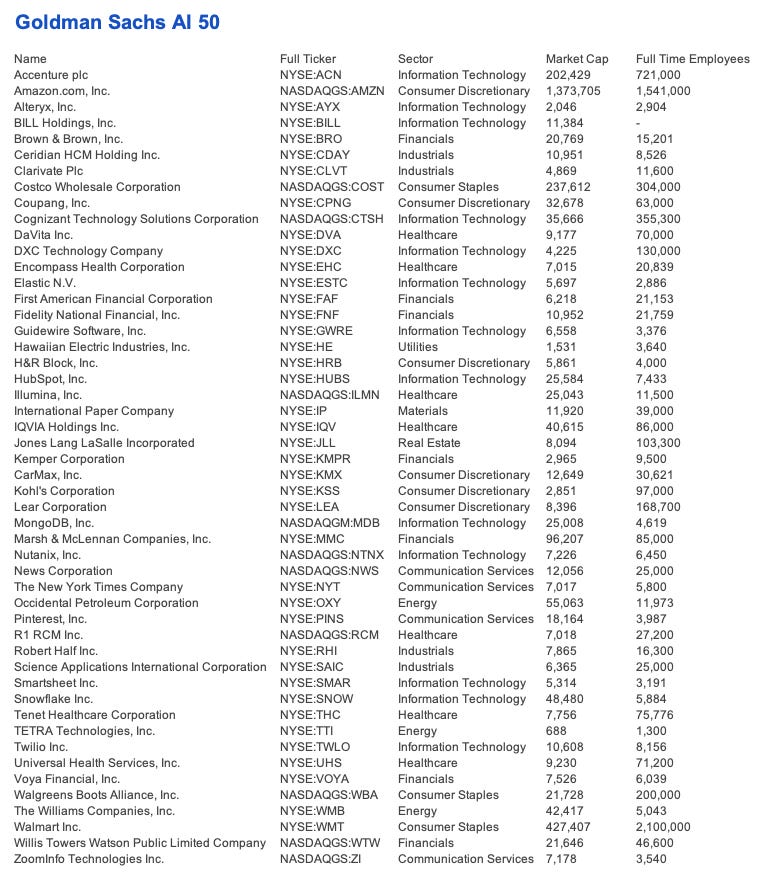

Following these steps, here is the list of the top 50 companies identified by Goldman Sachs:

Parsing through this list might still prove to be a daunting task. To address this, I considered an additional filter using Morningstar's moat ratings. While the merits of cost reduction and heightened productivity are undeniable, they might not independently lead to a significant increase in share performance. This is particularly true if a company loses its market share to competitors.

Consequently, the concept of a "moat" could serve as a means to ensure the identification of companies possessing a competitive edge. Moreover, these companies should already be performing well, placing them in a favorable position to fully capitalize on the advantages offered by AI.

Morningstar's moat ratings encompass two categories: 'wide' and 'narrow'. A 'wide' moat signifies a robust competitive advantage that facilitates significant economic gains, anticipated to persist over an extended duration. In contrast, a 'narrow' moat provides more moderate economic advantages and tends to have a shorter lifespan.

Among the 50 stocks on the list, there were only 5 companies boasting 'wide' moats. Here they are, listed in alphabetical order: