Go Woke Go Broke? Anti-Woke Investments For You

The term "woke" originally referred to being socially conscious and aware of issues like inequality and injustice, which was generally viewed positively. However, in recent years, the concept of 'wokeness' has become somewhat overbearing, with an excessive focus on social values that can sometimes backfire. This has given rise to the popular phrase, “go woke, go broke,” implying that an overemphasis on social causes may negatively impact businesses.

In the financial world, this trend has extended to investments, most notably with the rise of ESG-themed ETFs (Environmental, Social, and Governance). But now, we are also seeing the emergence of anti-woke ETFs, and here’s a list of them.

#1 God Bless America ETF (YALL)

The God Bless America ETF (YALL) certainly stands out with its name. This anti-woke investment fund targets U.S. companies that are seen as avoiding or opposing progressive social policies typically linked to "woke" ideologies. Its slogan, “put profits over politics,” encapsulates its mission by excluding companies that publicly advocate for progressive social causes.

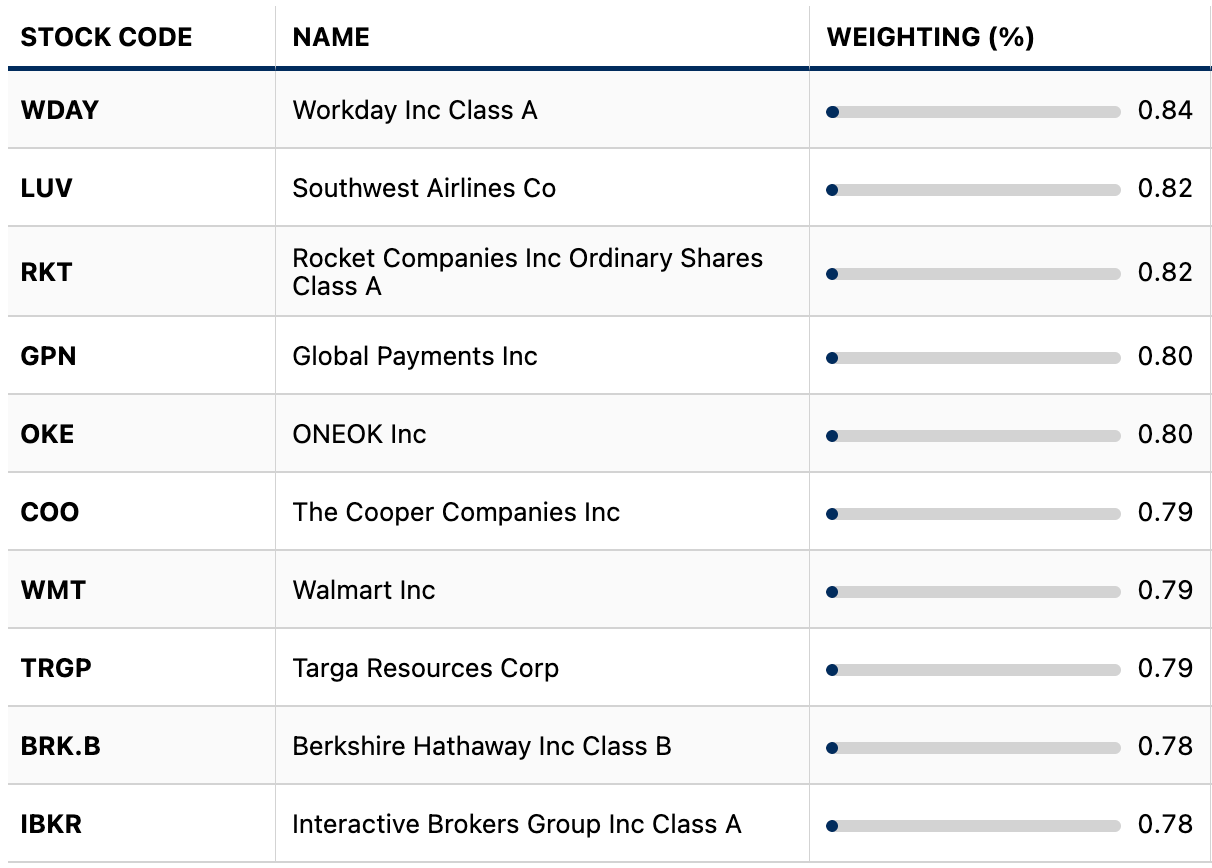

Launched in late 2022, YALL remains relatively small, with a fund size of $75.52 million and an expense ratio of 0.65%. Below are its top 10 holdings as of September 6, 2024.

Despite its size, the fund's performance has been notable, delivering an impressive 35.29% return over the past year—likely boosted by its exposure to Nvidia.

#2 American Conservative Values ETF (ACVF)

Conservative values typically emphasize tradition, individual responsibility, limited government, and free-market principles, which contrast with progressive ideals like advancing LGBTQ+ rights, climate change policies, and income redistribution. As expected, this ETF aligns with anti-woke sentiments, avoiding companies like Facebook, Alphabet, and Netflix, instead focusing on firms that remain neutral or support conservative principles.

With a fund size of $99.37 million and an expense ratio of 0.75%, ACVF is still relatively small. Its top 10 holdings largely mirror major S&P 500 components, minus those deemed "woke."

Over the past year, ACVF returned 22.16%, slightly underperforming the S&P 500 ETF, which gained 24.82% during the same period.

#3 Point Bridge GOP Stock Tracker ETF (MAGA)

While most businesses tend to avoid politics, the Point Bridge GOP Stock Tracker ETF (MAGA) dives straight in, unapologetically. MAGA screens companies in the S&P 500 based on their political contributions, specifically focusing on those that are highly supportive of Republicans. Republicans are generally seen as more conservative, while Democrats lean toward progressive or "woke" values, although not every party member fits neatly into these categories.

MAGA holds over 100 stocks and is less concentrated than the previous two ETFs, as the top 10 holdings collectively account for less than 10% of the fund’s allocation.

Despite this unique angle, MAGA has struggled to attract Republican investors, with the fund size remaining small at just $22.3 million—putting it at risk of closure. However, its performance has been respectable, delivering a 20.82% gain over the past year.

#4 Strive U.S. Energy ETF (DRLL)

As the world intensifies efforts to combat climate change, the transition to clean energy has gained momentum. However, many anti-woke advocates remain committed to fossil fuels, and it’s not without reason. Fossil fuels continue to be the most reliable energy source, with extensive infrastructure already in place to generate cost-effective power. As a result, the reliance on fossil fuels isn’t disappearing anytime soon. The Strive U.S. Energy ETF (DRLL) taps into this by focusing on the U.S. energy sector, covering everything from crude oil, natural gas, and coal to hydroelectric, nuclear, solar, wind, and other alternative energy sources along the entire U.S. energy supply chain.

With over $300 million in net assets, DRLL is the largest ETF on this list. As a sector-specific ETF, it has plenty of competitors in the alternative energy space. It boasts an expense ratio of 0.41%. Notably, the fund is heavily concentrated in Exxon Mobil and Chevron, which together make up more than 40% of the portfolio.

Unfortunately, DRLL has been the worst performer among these ETFs, delivering a negative return of 5.45% over the past year. This is largely due to the underperformance of oil and gas stocks, as inflation has eased and recession fears have dampened demand and lowered prices for oil and gas products.

#5 Berkshire Hathaway (BRK.B)

Though not an ETF, Berkshire Hathaway is a well-known stock that deserves mention here. You might wonder why it's on this list. Warren Buffett, as a profit-driven, business-first investor, doesn’t necessarily align with either "woke" or "anti-woke" labels, as social values are not a primary consideration in his investment decisions. However, looking at Berkshire’s portfolio, which includes significant stakes in energy companies and other industries like railroads that have environmental impacts, it leans more towards being "anti-woke."

Last week, Berkshire Hathaway hit a $1 trillion market cap, just two days before Buffett's 94th birthday. Some believe investors may have pushed the share price higher as a special tribute. Over the past year, Berkshire's share price has risen by 28.79%.

Overall, anti-woke ETFs have performed well, with the exception of the energy-focused DRLL, which struggled due to its narrow sector focus. In the future, it will be interesting to pit these anti-woke ETFs against their woke counterparts to see which group delivers better returns. Stay tuned for that showdown!