FactSet is a financial data company that is less well-known compared to its competitors. Most people consider Bloomberg the gold standard in financial data, followed by Refinitiv (formerly Thomson Reuters).

This perception is reflected in their market shares. According to the Burton-Taylor International Consulting 2020 Report, Bloomberg commands 33.4% of the market, while Refinitiv secures the second spot with 19.6%. S&P Capital IQ ranks third, and FactSet comes in fourth with a 4.5% market share.

So, why focus on the fourth-largest player? There are two reasons.

First, as Bloomberg is a private company, it isn’t an investment option. Capital IQ is part of S&P Global, which is listed but includes other businesses like indexing and credit ratings. Similarly, Refinitiv is now part of the London Stock Exchange Group (LSEG), meaning an investment in LSEG includes exposure to its stock exchange operations. While S&P Global and LSEG are excellent companies—we’ve covered them previously here and here—investors looking for pure-play exposure to financial data companies are left with FactSet.

Second, FactSet’s financial performance and valuation make it an attractive investment opportunity.

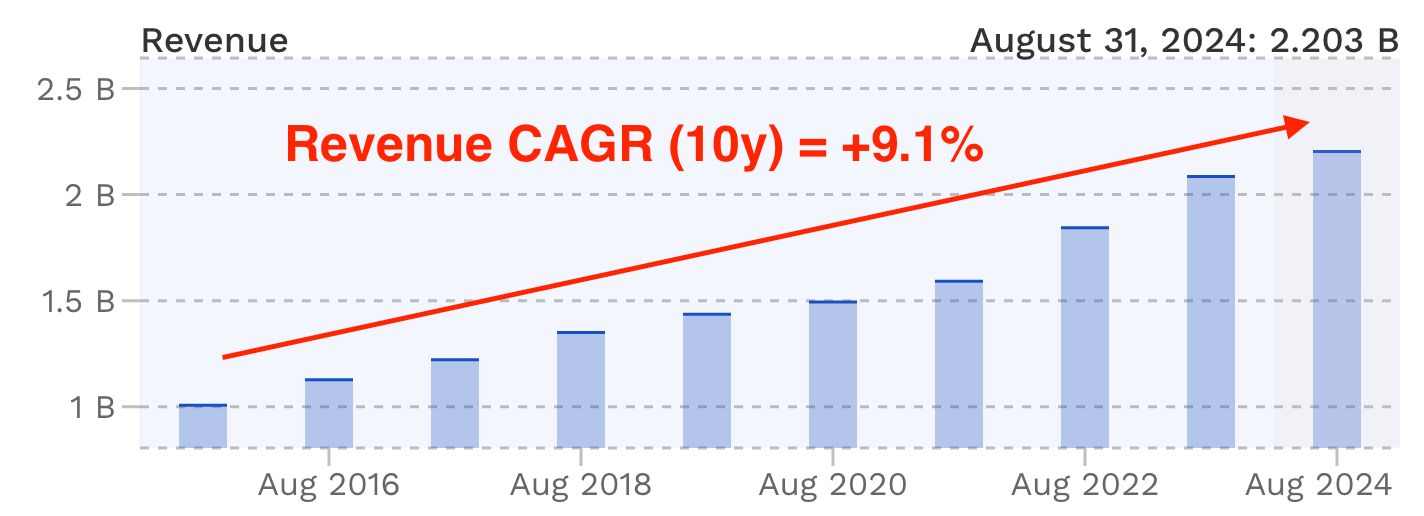

Though not a high-growth stock, FactSet is a steady performer, akin to the proverbial tortoise winning the race through consistency. Over the past decade, its revenue has grown every year, even during challenging periods like the COVID-19 pandemic and the bear market of 2022. This resilience reflects the subscription-based, recurring nature of its business.

This consistent revenue growth has translated into impressive shareholder returns, delivering a 15.1% total return from 2014 to 2024.