Circle's IPO Pops 247% in Two Days — What’s Going On?

There’s something hot in crypto last week.

No, it wasn’t Bitcoin — that barely moved, up just 0.2%.

Nor was it Coinbase, which rose a modest 1.5%.

The real heat came from Circle Internet Company (CRCL) — the issuer of USDC — which launched its IPO on Thursday at $31. By the end of its first trading day, the stock had soared to $82.84, a stunning 167% gain. And mind you, the IPO price had already been upgraded twice — from $26 to $28, and finally to $31.

Investor enthusiasm didn’t cool the next day either. Circle shares surged as high as $123.51 before closing at $107.70 on day two — a 247% gain for IPO buyers in just two days.

Even we expected Circle’s IPO to pop, but not this much. We suspect even the bankers were surprised — they likely left a lot of money on the table. Circle could have raised significantly more. Many investors are now scrambling to understand what the company actually does. Let’s break it down.

What is a Stablecoin?

One common complaint about crypto is volatility — prices swing wildly, making them impractical for daily use. Enter stablecoins — digital currencies pegged to real-world fiat currencies like the U.S. dollar.

USDC, the stablecoin issued by Circle, is pegged 1:1 to the USD. When someone buys 1 USDC, Circle either holds that dollar or invests it in short-term U.S. Treasury bills. In short, each USDC is backed by actual USD assets.

But unlike traditional money, USDC operates on blockchains, outside of government-run payment networks. It bypasses SWIFT and traditional banks for cross-border transfers — using blockchain infrastructure instead.

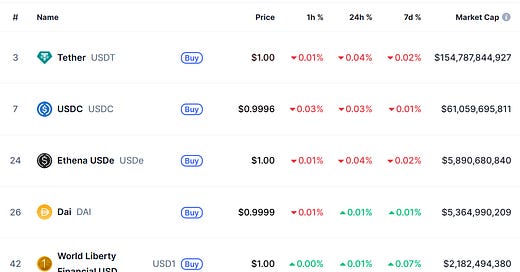

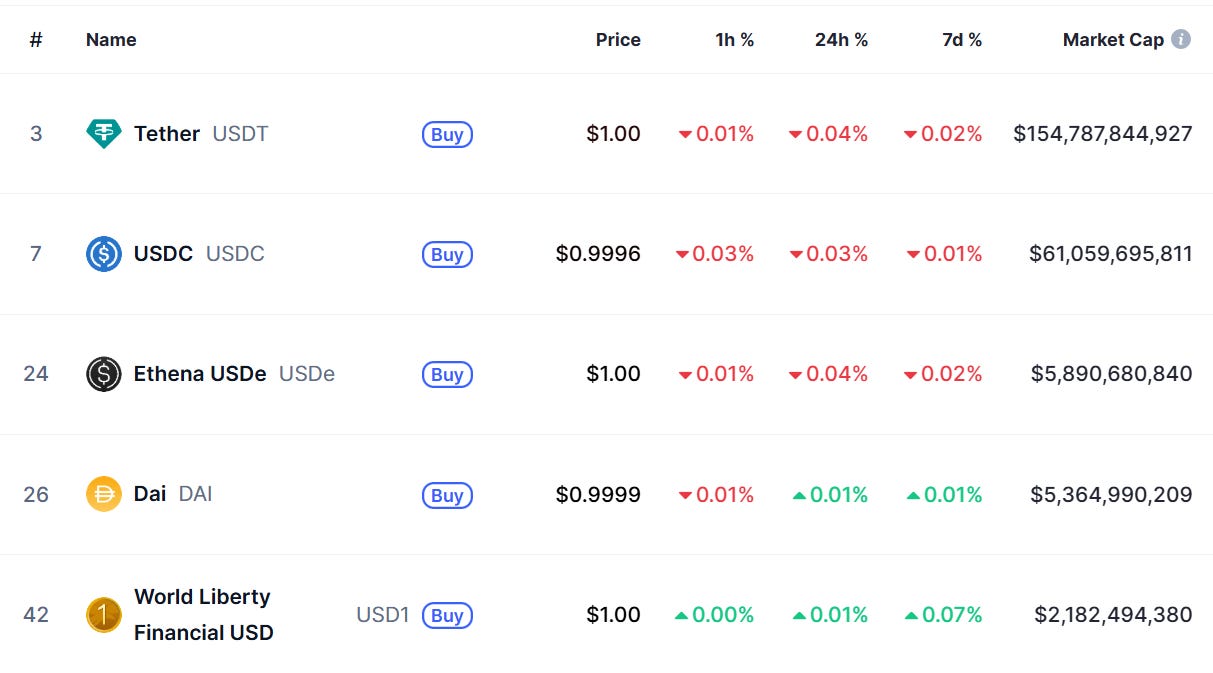

USDC is the second largest stablecoin behind Tether (USDT). Tether’s market cap is about $155 billion, more than double USDC’s $61 billion. All other stablecoins are small players in comparison, each with less than $6 billion in circulation. This is very much a duopoly.

How does Circle make money?

It’s simple: interest on your money.

When you buy USDC, Circle holds the equivalent in dollars or U.S. Treasuries. That reserve earns interest — and Circle keeps most of it.

In 2024, 95% of Circle’s $1.68 billion revenue came from this reserve interest income — similar to how banks earn on your deposits.

The remaining 5% came from:

Platform Services & APIs (e.g., sending/receiving stablecoins, blockchain tools for developers)

Cross-Border Payments & Treasury Services (e.g., FX conversions, settlement, custody services)

Circle has typical operating costs like staff, infrastructure, and tech. But one major cost is distribution — notably the revenue-sharing arrangement with Coinbase, which helped distribute USDC in its early days and continues to benefit from its growth.

Despite $1.68 billion in revenue, Circle’s 2024 net profit was $155 million, a 9% net margin. The key to future growth? Wider adoption of USDC. If usage increases, revenue and profits will rise in tandem.

Why did Circle’s share price skyrocket?

Circle is now worth $24 billion, implying a P/E ratio of 155x. But let’s put that in context:

It’s essentially a digital bank, but with limited services.

A small part of its business resembles a payment network like Visa or Mastercard.

Yet those larger, established players trade at far more conservative valuations.

So yes, the stock is priced for optimism.

What’s driving it? Likely the growing belief that blockchain and crypto will be adopted by traditional finance. Circle has partnered with Visa, Mastercard, Stripe, MoneyGram, Coinbase, BlackRock, Fidelity, and regional banks across the U.S., Singapore, and Europe. It supports 19 blockchains and integrates with major protocols like Uniswap, Aave, and OpenSea.

That said, while adoption is real, we believe the valuation has run ahead of fundamentals.

Just like Coinbase gave investors a way to bet on crypto trading, Circle offers the first pure-play exposure to the stablecoin boom. With no direct competitors listed, this is a scarce asset — and that lack of supply is fueling overwhelming demand.

So while the story is compelling, investors should tread with caution. Momentum is strong, but expectations are sky-high.

Interested to learn more about crypto? Join this live webinar here.