Can the Best Managed Companies Beat the Market?

Many investors emphasize the importance of good management, believing it is crucial to adding value to businesses. However, assessing management is challenging, as investors and shareholders rarely interact directly with company leaders. Moreover, it’s difficult to determine how much of a company’s success stems from management prowess.

To explore this, we conducted a simple experiment using the Drucker Institute Company Ranking to form portfolios of well-managed companies. The scoring, based on management guru Peter Drucker’s core principles, evaluates five dimensions of corporate performance: customer satisfaction, employee engagement and development, innovation, social responsibility, and financial strength. Companies receive scores in each dimension, with combined scores determining overall rankings.

The ranking has been published annually since 2017, with the latest list released in December 2024. As the rankings change yearly, we formed a new portfolio of the top 20 companies, equally weighted, each year. To avoid look-ahead bias, we reviewed each portfolio's performance for the following year—for example, the 2023 portfolio’s performance was assessed using 2024 stock returns.

2017

The 2017 Portfolio underperformed the S&P 500 ETF (SPY), returning -4.92% versus SPY’s -4.56%.

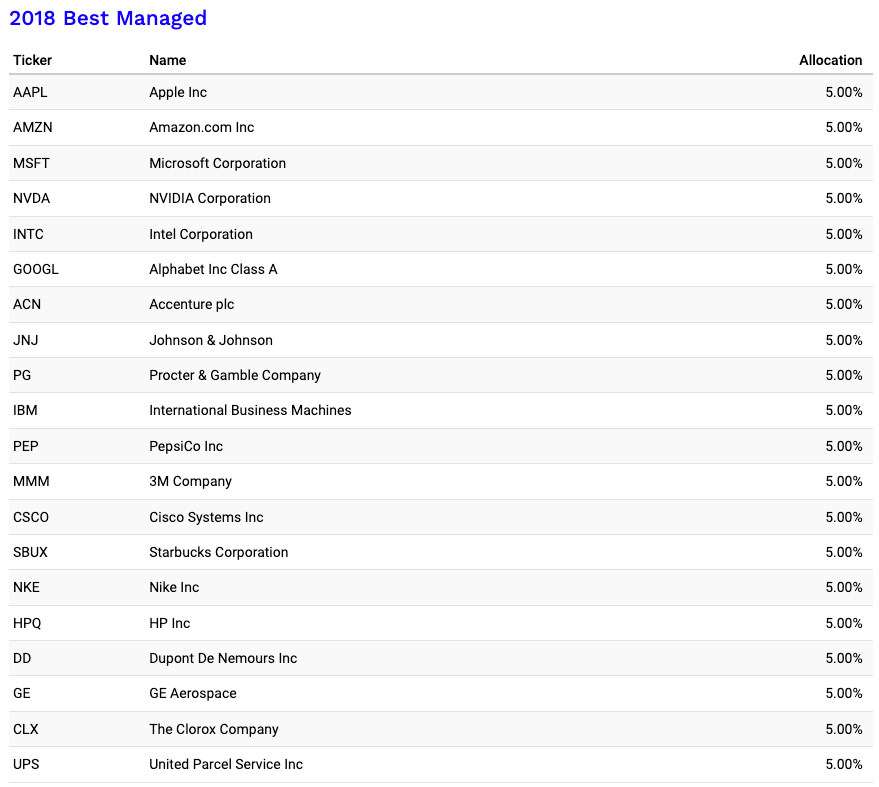

2018

The 2018 Portfolio also underperformed in 2019, returning 31.02% against SPY’s 31.22%, despite a strong market rally.

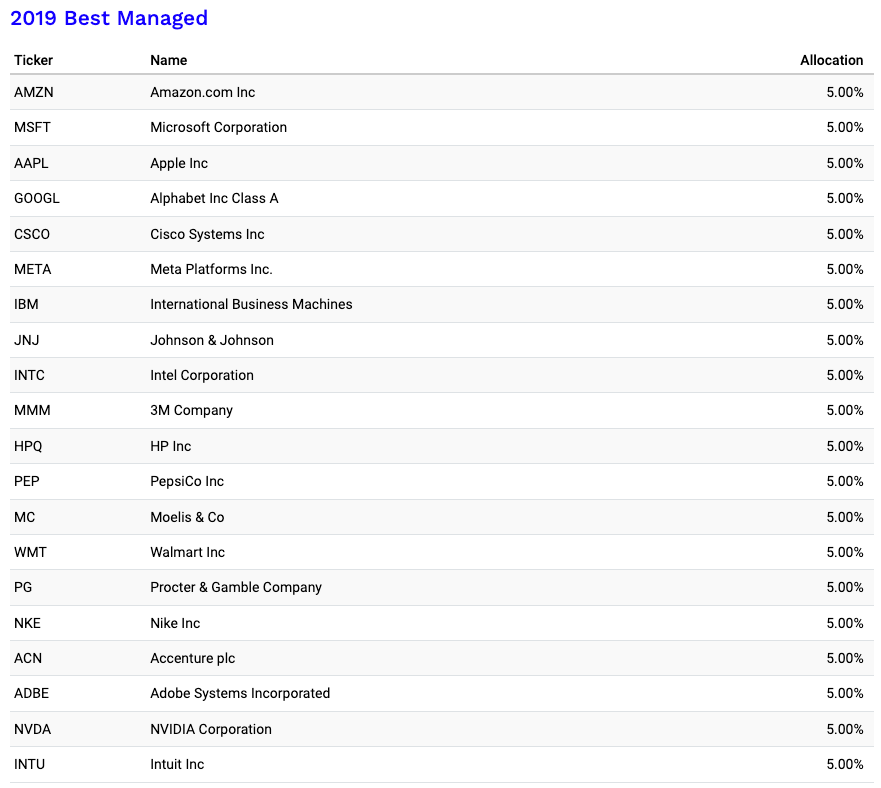

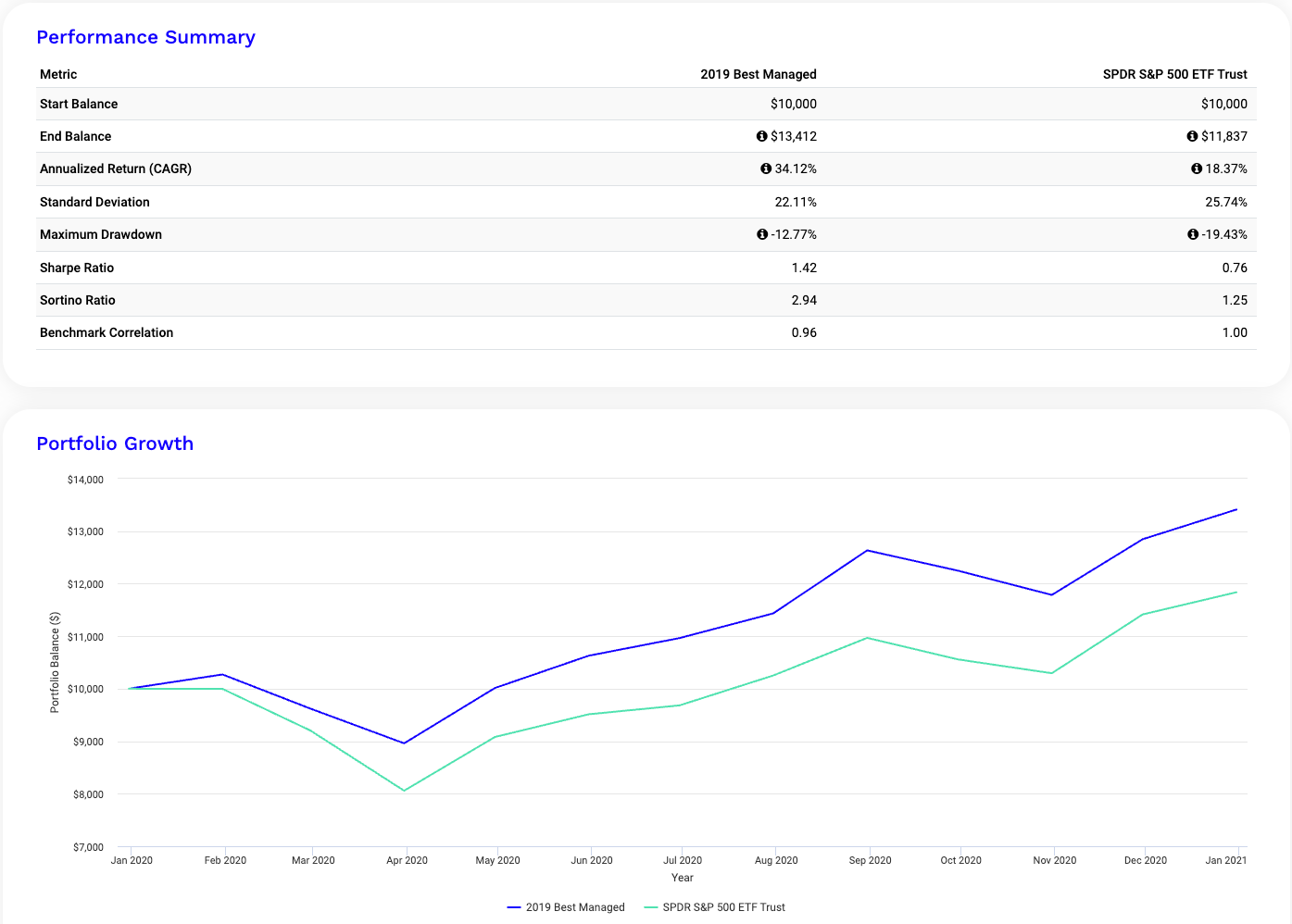

2019

In 2020, the 2019 Portfolio outperformed significantly, gaining 34.12% versus SPY’s 18.37%.

2020

The outperformance continued in 2021, with the 2020 Portfolio rising 39.46%, surpassing SPY’s 28.75%.

2021

In the bear market of 2022, the 2021 Portfolio dropped 22.66%, underperforming SPY’s -18.17%.

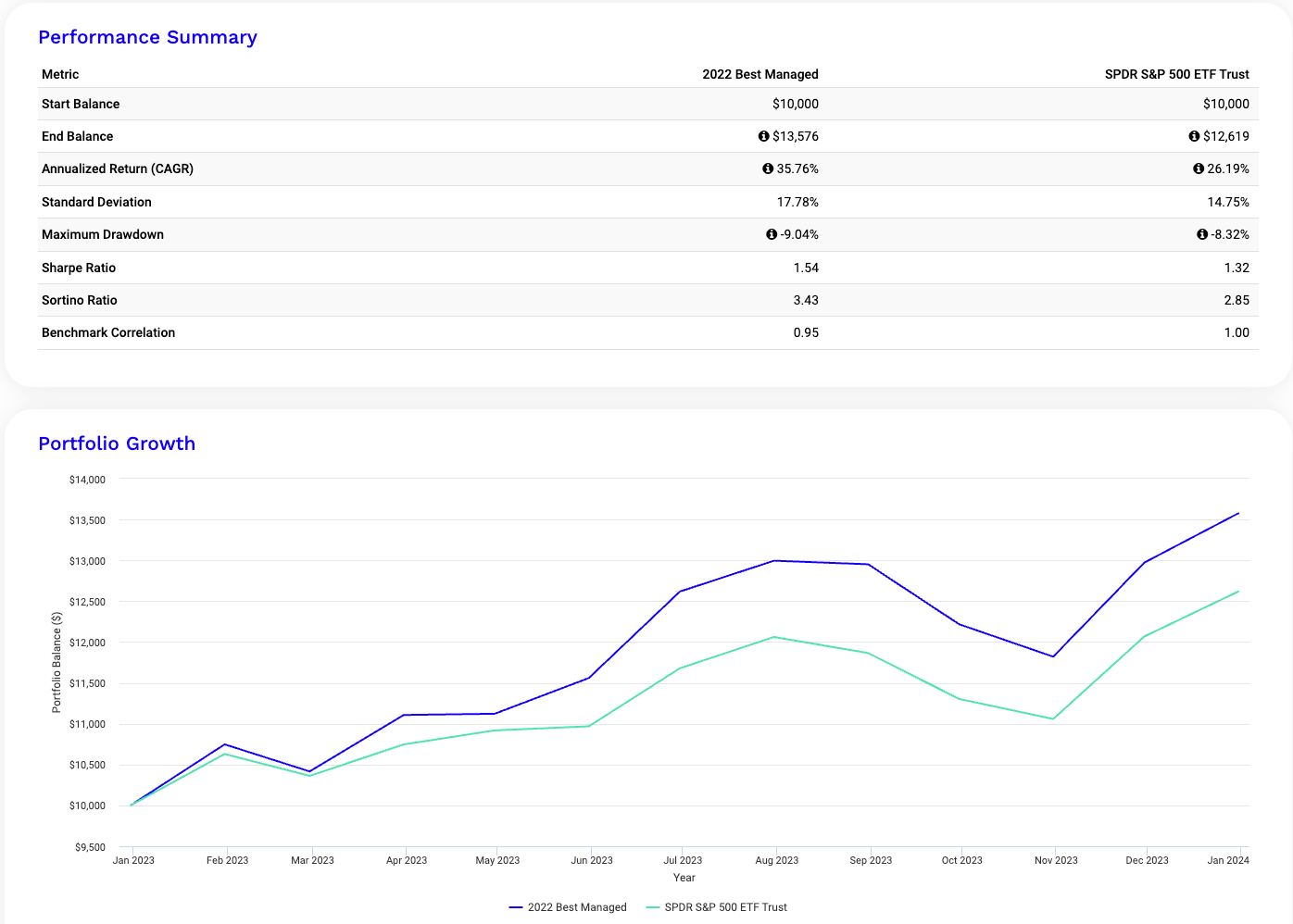

2022

The 2022 Portfolio rebounded strongly in 2023, delivering a 35.76% return versus SPY’s 26.19%.

2023

Though 2024 was another strong year, the 2023 Portfolio gained 23.87%, still lagging SPY’s 27.97%.