Buffett's Investment in Japan Pays Off: 13 Nikkei 225 Stocks Reach All-Time Highs

The period known as Japan's Lost Decade, which commenced in 1991, was later referred to as the Lost 20 Years and subsequently the Lost 30 Years. During this time, Japan struggled to break free from the deflationary cycle and experienced a prolonged period of weak economic growth.

As a result, foreign investors showed little interest in Japanese stocks for an extended period. However, this year has brought a notable change. On June 13, 2023, the Nikkei 225, Japan's stock index, closed above 33,000 for the first time since 1990. Some investors see this as a potential resurgence of the Japanese stock market after three decades.

The exact reasons behind the renewed interest in Japan stocks are uncertain, and it is unclear whether Warren Buffett played a role in this development. In a surprising move in 2020, Berkshire Hathaway invested in a selection of Japanese trading firms, which raised questions about why Buffett chose Japan and why he made these investments at that particular time.

The outcomes of Buffett's choices were validated as all five of his Japanese investments reached new record highs. However, without access to the precise purchase prices, it is difficult to determine the exact gains he achieved. Therefore, we can only make approximate estimations regarding the size of his profits.

Marubeni (8002) +386%

Despite the challenging "lost decades" that Japan experienced, Marubeni emerged as one of the rare Japanese stocks to reach a new all-time high in 2018. Remarkably, it also turned out to be the most profitable investment among Buffett's selections in Japan with over 300% gains.

Mitsui & Co (8031) +250%

When Warren Buffett purchased Mitsui, the share price was lingering below the previous all-time high reached in 2007. However, after Buffett's investment, the stock experienced a significant surge and continued to reach new highs in subsequent periods.

Mitsubishi (8058) +238%

Buffett's timing was indeed remarkable as he entered Mitsubishi near the lows caused by the Covid pandemic. Consequently, he was able to capture a significant portion of the returns when the stock began its upward rally over the past three years.

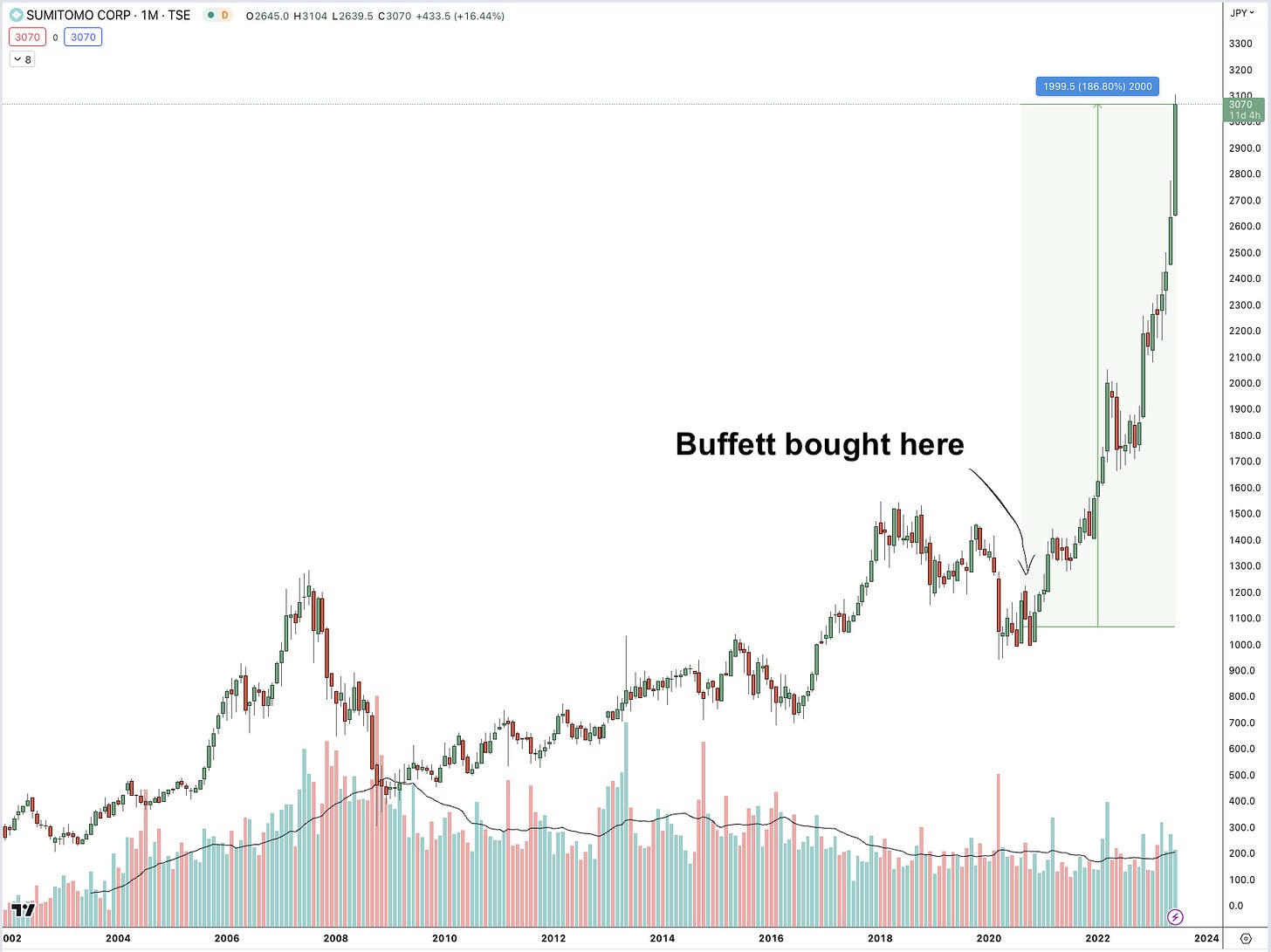

Sumitomo (8053) +187%

Sumitomo is the second stock on the list that reached an all-time high in 2018. However, the stock subsequently experienced a decline. Buffett took advantage of the dip in 2020 and made a purchase, which proved to be a wise decision. Since then, Sumitomo's stock has enjoyed a significant increase of 187%.

Itochu (8001) +137%

Despite the challenging period of the Lost Decades, Itochu's share price has demonstrated consistent growth over time, as if the economic difficulties had little impact. Nevertheless, Buffett managed to enter the market in 2020 and has since achieved a return of 137% on his investment in Itochu.

In addition to the five Japanese stocks mentioned earlier, there were eight other component stocks of the Nikkei 225 index that reached all-time highs (see the list below.) One notable stock on that list is Fast Retailing (9983), widely recognized as Uniqlo. Interestingly, some of these stocks have relatively modest valuations, indicating that their current prices are not considered expensive.