Apple and Amazon Beat Expectations —But Investors Stay Tariffied

Two days ago, Microsoft and Meta smashed expectations, sending their share prices soaring.

Today, the other Big Tech names starting with A—Apple and Amazon—went the other way. To be fair, Alphabet (the third “A”) did post solid results, with its share price rising.

Earlier this week, I noted that Alphabet’s strong earnings gave me confidence the rest of the Magnificent 7 might also surprise on the upside. Among them, Amazon looked like the undervalued bet.

So, what happened? Were Apple and Amazon’s results really that bad?

Not quite—but there were reasons behind the market reactions.

Amazon

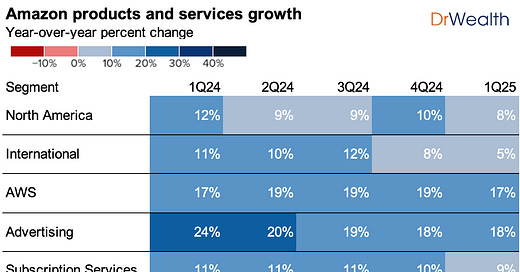

Here’s a quick snapshot of Amazon’s Q1 performance:

Overall, revenue and earnings beat expectations. So why did the stock drop?

It’s all about the guidance.

Amazon expects Q2 revenue between $151B and $155.5B, which falls short of Wall Street’s forecast of $158.5B. That’s just 5%–9% YoY growth—a slowdown that signals caution, especially in the face of tariff risks.

CEO Andy Jassy acknowledged the uncertainty which didn’t assuage investors’ fears:

“Obviously, none of us know exactly where tariffs will settle, or when.”

There were reports that Amazon might display tariffs at checkout, but the management has since dialed that down—likely due to political pressure from Trump. Meanwhile, sellers don’t seem to be passing higher costs to customers yet, meaning they’re absorbing the impact—for now.

Amazon’s edge has always been low prices, and it’s clear they intend to fight to maintain that. They may push lesser-known, lower-cost brands or tap into existing stockpiles to manage short-term pricing pressure.

My take? The conservative guidance sets the stage for potential upside surprises in the next quarter.

The stock dropped around 3% after hours, which isn’t dramatic—especially considering it rose 3% during the regular session.

Apple

Apple also beat on both revenue and earnings:

Revenue: $95.4B (vs $94.66B expected)

EPS: $1.65 (vs $1.63 expected)

Below is a table showing the revenue growth or decline across Apple’s various segments. Mac sales continue to soften, while iPad revenue is up—but I wouldn’t read too much into that, as both categories have long replacement cycles and their trends can reverse. The bigger concern lies with wearables. As the newest hardware segment, it was expected to drive growth, but so far, it hasn’t delivered. On the bright side, Services remains a strong performer with 12% year-on-year growth. Overall, a 5% increase in total revenue is still respectable for a company of Apple’s scale—you simply can’t expect it to grow at the same pace as when it was smaller.

But like Amazon, the market is focused on the future, not the past.

Tim Cook said a majority of U.S. iPhone sales this quarter would come from India, and nearly all other Apple devices would come from Vietnam.

That’s Apple’s workaround to avoid China-origin tariffs—but Trump’s sweeping tariffs now hit India and Vietnam too, at 26% and 46% respectively. They’re still lower than China’s 200%+, but they’re significant. Plus, the 90-day grace period is already ticking.

Among the Magnificent 7, Apple is the most exposed to tariffs because of its globally distributed supply chain. As long as Apple manufactures abroad, this threat lingers.

Apple’s stock dropped 4% and is now likely to lose its top spot in market cap to Microsoft.

Investors hate uncertainty—and right now, U.S. trade policy is anything but clear. No firm deals, lots of volatility, and a wildcard in Trump.

Still, panicking rarely pays off.

Stick to investing in good businesses at reasonable prices. That mindset has outlasted wars, inflation, pandemics, and yes—tariff tantrums.