Amazon Cloud Margins Shrinking but Fledgling Ad Business Gaining Ground

The after-market trading of Amazon's shares showed an unexpected pattern. Following the release of the company's results, the stock price surged by 10%. However, the price erased the gains and dropped by another 2% after the analyst briefing.

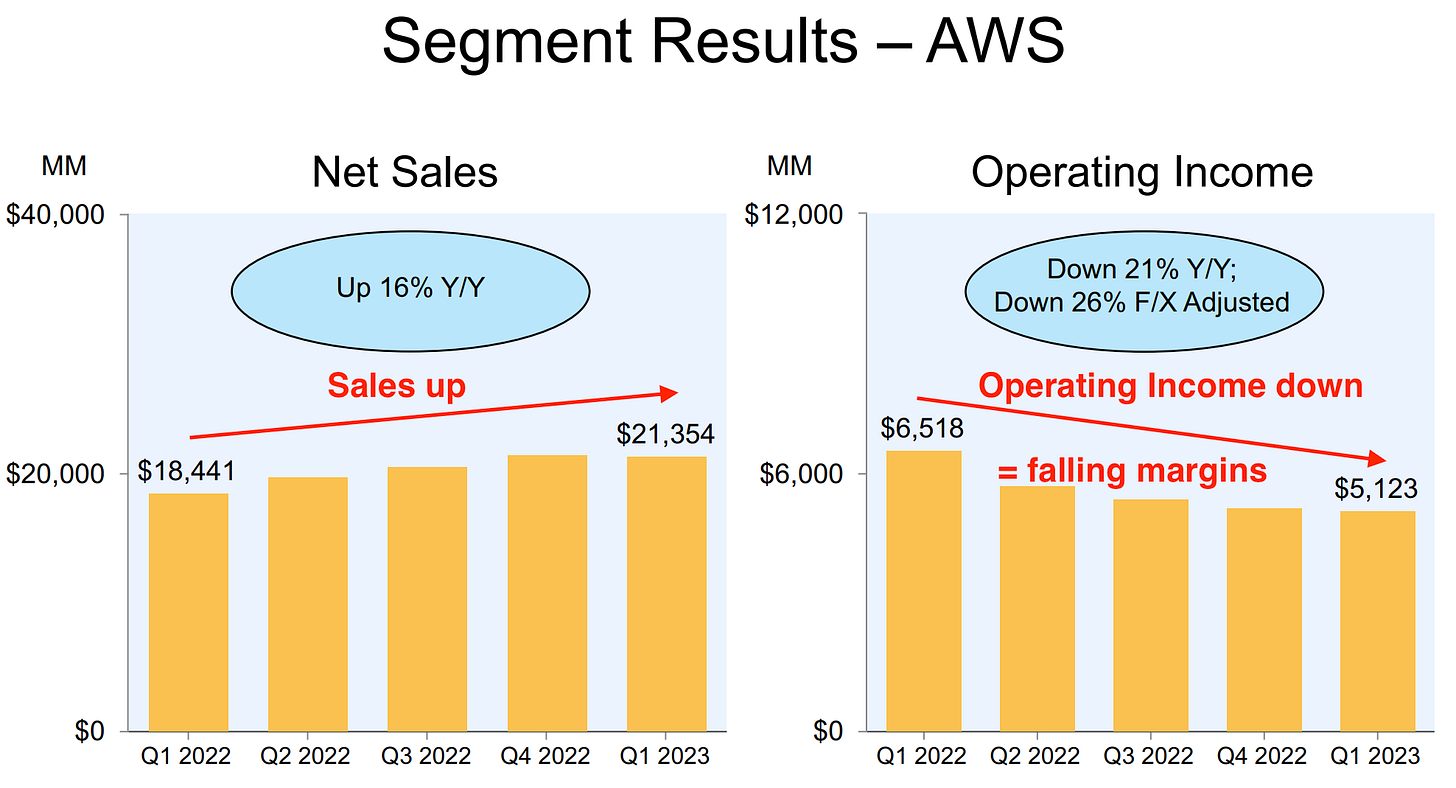

Some blamed the AWS cloud business showing a slowing growth. But heh, it is still at a 16% YoY growth rate that beat analysts' expectation. So what's the matter?

The primary concern with AWS's performance was not its growth rate, but rather its operating income, which fell short of expectations. Despite generating $5.12 billion, it failed to meet the consensus of $5.18 billion.

Additionally, the operating margin has steadily decreased to 24%, the narrowest it has been since 2017. This trend of declining margins has persisted across multiple quarters without showing any signs of rebound.

AWS is super important to Amazon because without which, Amazon will sink into deep losses.

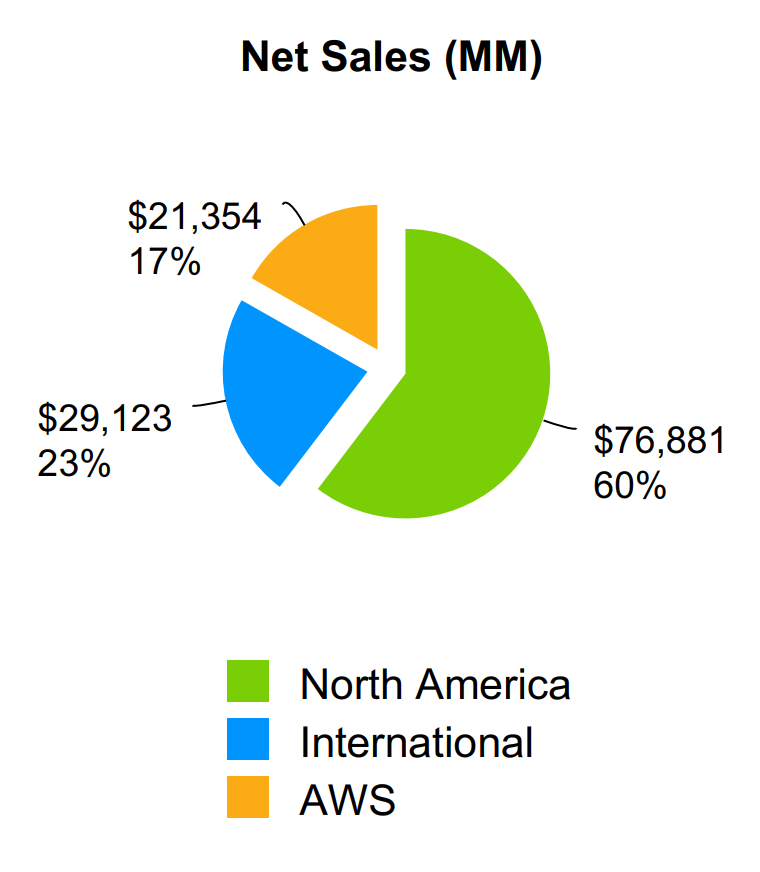

In the first quarter of 2023, Amazon reported a total operating income of $4.77 billion. However, if we exclude AWS's contribution of $5.12 billion, Amazon would have faced an operating loss of $350 million. In other words, AWS accounted for 17% of Amazon's total revenue, yet it contributed all of the company's operating income.

For the same period, Amazon's international business segment incurred an operating loss of $1.25 billion, while the North America segment generated an operating income of $898 million, and it still fell short of AWS's $5.12 billion contribution. These figures indicate that AWS's success is necessary to offset the poorer margins from the ecommerce business.