The S&P 500 Index is widely observed globally, as it gauges the stock performance of the top 500 companies in the United States, which boasts the world's largest economy. Despite being US-based, these companies often have extensive global influence across various sectors. Consequently, the index is regarded as a well-diversified ETF to many investors.

The S&P 500 Index's popularity is evident by the fact that the three largest ETFs in the world track the index. SPDR S&P 500 ETF (SPY) has $377 billion in assets under management, iShares Core S&P 500 ETF (IVV) has $308 billion, and Vanguard 500 Index Fund (VOO) has $290 billion. This totals almost $1 trillion in assets under management for these three ETFs.

Over the course of approximately three decades, from 1993 to the present, the SPY has exhibited impressive returns, averaging an annual growth rate of 9.7%.

Is there a way to improve the returns? Yes, and it is not by taking leverage because that would introduce the risk of ruin - the entire portfolio can go to zero. Instead, we can simply adjust the allocation of the Index.

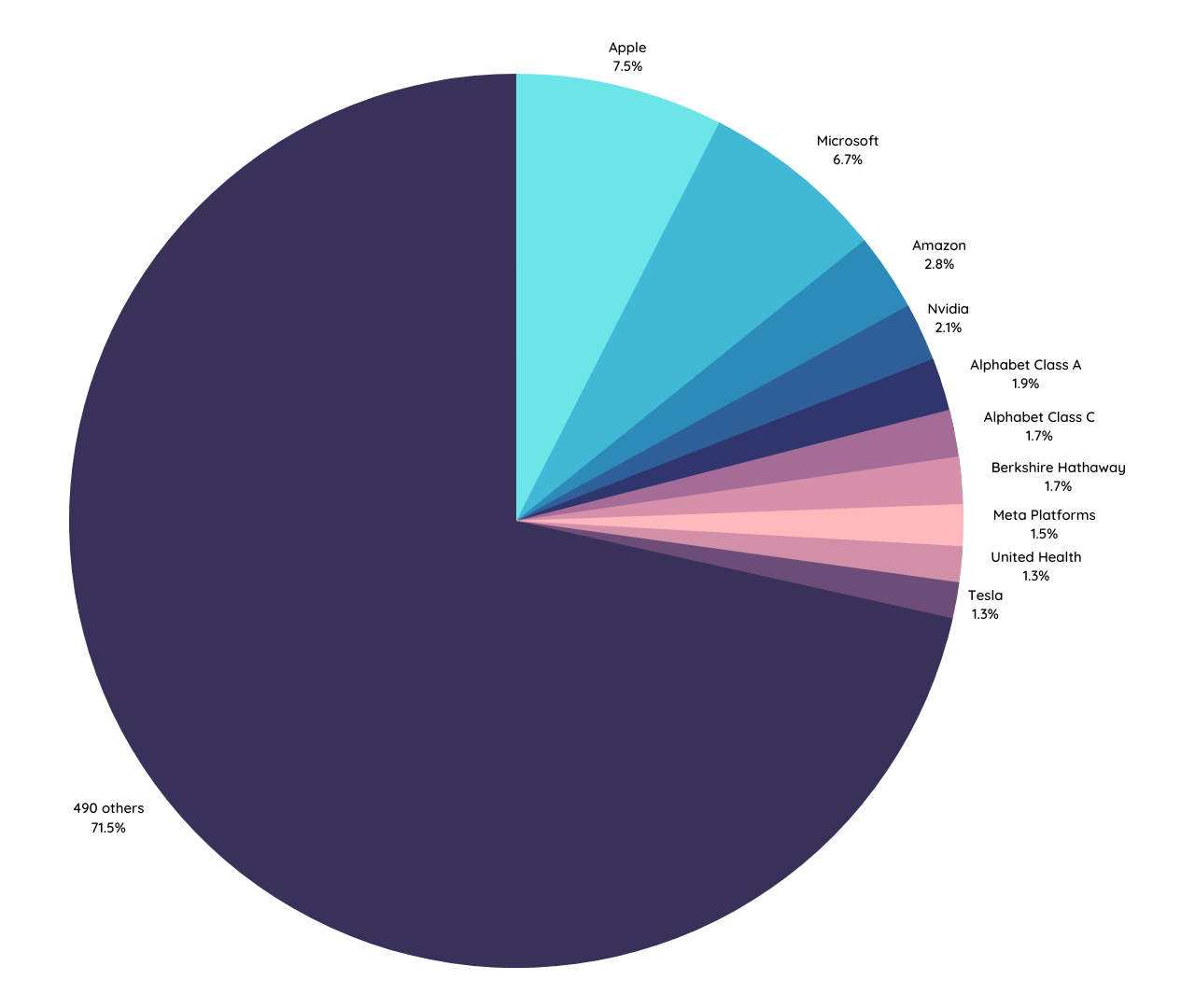

First we have to understand that the S&P 500 Index is a capitalization-weighted index. This means that the larger companies will get a bigger weightage in the index.

For instance, the top 10 stocks in the S&P 500 index account for nearly 30% of the index's weight, while the remaining 490 stocks share the remaining 70%.

This means that the performance of these megacap stocks can have a big impact on the overall performance of the index.

Financial research has found that smaller companies tend to deliver higher returns than bigger companies. This might come as a surprise to investors because most would think that bigger is better.

Therefore, one way to improve the returns of the S&P 500 index is to shift more weightage to the smaller component stocks in the index.

Instead of using a market-weighted index, use an equal-weighted index, which gives equal weight to all companies in the index. You don't need to do any mathematical calculations to do this, as there is an ETF that does it for you.

The Invesco S&P 500 Equal Weight ETF (RSP) is an ETF that tracks the S&P 500 index, but it gives equal weight to all stocks in the index, regardless of their size.

That means that Apple (AAPL) and DISH Network (DISH) will each receive an equal allocation of 0.2%. This is regardless of their market capitalization or any other factors.

The result is an outperformance against the original S&P 500.