Every business is profit driven and businesses that can achieve a consistent high profit margin indicate their ability to charge prices significantly exceeding its costs. Yet, customers are willing to pay.

This is also a demonstration of these companies' competitive advantage because elevated profit margins typically attract competitors. The ability to sustain such high profit margins implies that these firms possess the resilience to withstand competition effectively.

Furthermore, a substantial return on assets serves as a testament to efficient operations and capable management.

Within the S&P 500 index's constituent stocks, I applied the following filters:

A minimum average net profit margin of 20% over the past decade.

A return on assets of at least 20% over the past ten years.

A gross profitability level of no less than 30%.

After employing these criteria, I identified six stocks that met the specified conditions within the S&P 500 index. Remarkably, the two most profitable companies among them are also part of Berkshire Hathaway's investment portfolio.

#6 Yum! Brands (YUM)

Average Net Profit Margin (10 years) = 22%

Average Return on Assets (10 years) = 22%

Gross Profitability = 59%

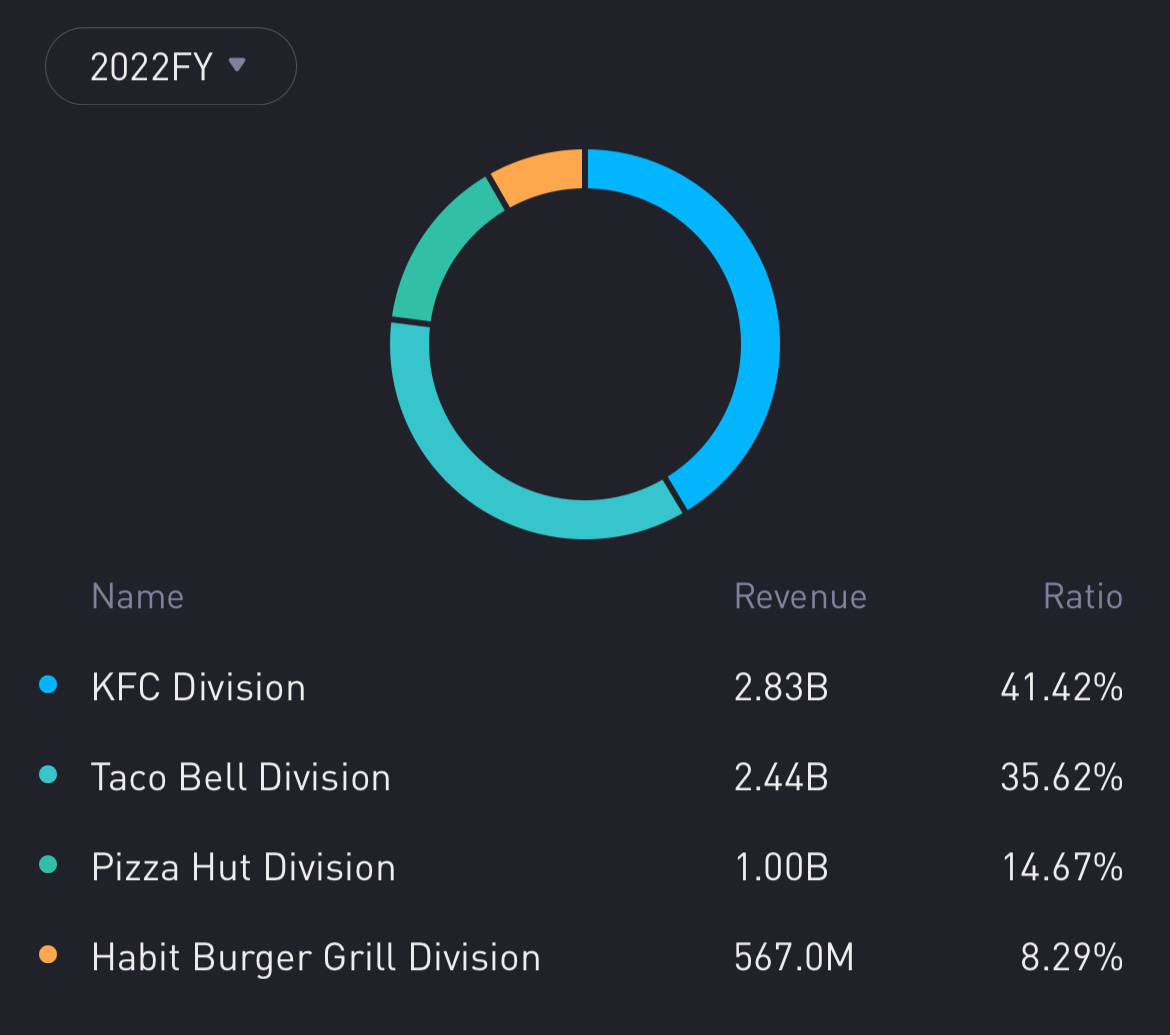

Yum! Brands is the proprietor of several well-recognized fast-food restaurant chains, including KFC, Taco Bell, and Pizza Hut. Among these, KFC stands out as the primary revenue generator. Despite the emergence of numerous competitors offering fried chicken options, it remains challenging to supplant the enduring association between fried chicken and KFC.

While revenue growth has decelerated to single-digit percentages, the company's stock price has exhibited remarkable performance over the past decade, delivering a total return of 195%, equivalent to an annualized rate of 11.4%.