We’ve discussed moat stocks periodically on Finbite Insights, and we believe Morningstar does a commendable job identifying these quality stocks that can perform well over the long term.

However, we’ve also observed that Morningstar tends to adopt a conservative approach when valuing these stocks. Typically, stocks with a 4- or 5-star rating from Morningstar are considered buyable, but this often means their prices must have fallen significantly. The challenge is that the stock’s downtrend might not yet be over.

Take Estee Lauder (EL) as an example. Morningstar rates it as a 5-star, wide-moat stock, yet its price has been in a prolonged decline since peaking at $350. Even if you had purchased it at $150—a price that might seem like a bargain after a 57% drop from its peak—you would still be down 50% today, with shares trading at $74.62. Moreover, the stock shows no signs of a rebound and could decline further.

This illustrates that even a fundamentally strong stock at an attractive price doesn’t necessarily make for a good entry point. Incorporating technical analysis can significantly improve entry timing, reducing the risk of catching a falling knife.

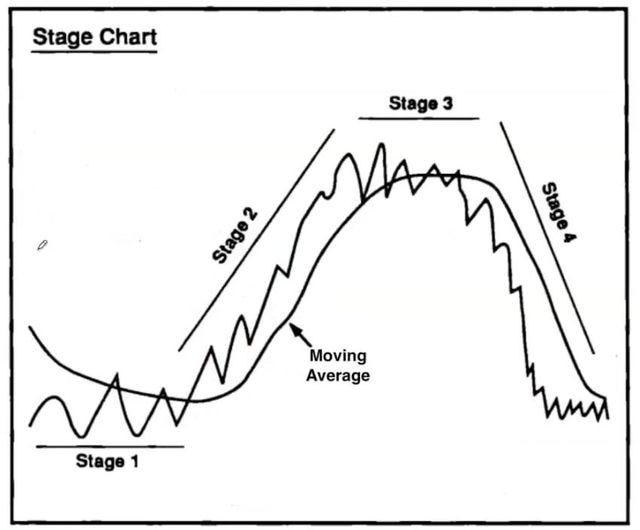

We can use Stan Weinstein’s stage chart to guide us:

Stage 1 (Accumulation): Price moves sideways; low market interest and volatility.

Stage 2 (Advancing): Strong upward trend as optimism grows; increasing interest from investors; higher prices draw attention.

Stage 3 (Distribution): Price levels off as early investors sell to latecomers; momentum slows; sentiment still optimistic but cracks appear.

Stage 4 (Declining): Sustained downward trend as pessimism takes over; widespread selling and lower prices dominate.

Referring back to the Estee Lauder chart, you’ll notice the stock is currently in Stage 4—a downtrending phase. This is not an ideal time to speculate where the bottom might be, as it’s impossible to predict in advance, and what seems low can always go lower than expected.

Even when a stock enters Stage 1, where prices move sideways, it might still not be the right time to buy. This phase can persist for years, leading to potential opportunity costs while holding the stock.

The optimal time to buy is during the early phases of Stage 2, where prices begin to trend upward. This timing should be paired with a valuation analysis to ensure the stock is undervalued.

With that in mind, let’s dive into the first example from the list of four stocks mentioned in this post:

#1 PayPal (PYPL)

We introduced PayPal as an investment idea on September 26, 2024, because the stock had entered Stage 2 after being heavily beaten down over the past few years. At that time, the price was $77.36. As of the last close on December 27, 2024, at $86.86, the stock has gained 12% over three months. [Read the earlier stock write-up for more details.]

Despite the recent price increase, PayPal remains undervalued, with Morningstar assigning it a 4-star valuation rating. The company also has a narrow moat, indicating that the business retains its quality and competitive advantages.

Importantly, the stock is still in the early stages of Stage 2, with the price far below its peak of around $300.