3M and General Electric Spinoffs to Join S&P 500

Industry giants 3M and General Electric are spinning off and listing units independently.

Solventum (SOLV), the healthcare spinoff from 3M, began trading last Wednesday. Initially issued at $80, its share price has fallen 14% to $69.55 in just three days.

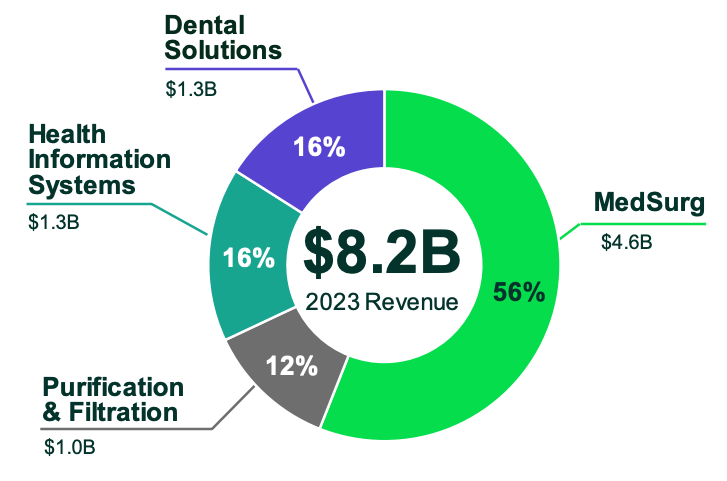

Solventum markets a diverse range of healthcare products, organized into four business segments. MedSurg offers a variety of products from advanced wound care to stethoscopes. The dental solutions segment provides aligners, composites, cements, and more. Health Information Systems delivers software solutions for clinics and hospitals, facilitating documentation and claims processing. Purification & Filtration, true to its name, produces filters and membranes for pharmaceuticals and beyond, including food and beverage applications.

Chances are, you have seen or even used some of their wound plasters or masks. These products are now under Solventum.

As a mature company, Solventum experiences modest growth rates, remaining within single-digit percentages. This scenario mirrors the classic fable of the tortoise versus the hare, demonstrating that a slow and steady pace can, at times, lead to a win. The key strategy lies in buying such stocks only when they are undervalued and offer a significant margin of safety and selling them once the stock price rebounds. Currently, Solventum finds itself in this very position.