2024’s Top-Performing U.S. Fashion Stocks: Hoka Leads the Pack

It’s the Christmas season, and some of you might be searching for gifts, with clothing or footwear being a popular category. This year, luxury brand stocks have faced significant challenges—even the mighty LVMH couldn’t escape the downturn.

On the other hand, U.S. fashion stocks have had a mixed but largely positive year. Several have outperformed, with five achieving returns of over 50%, far surpassing the S&P 500. Yet, some laggards, like Nike and Lululemon, have seen declines of more than 20%. Let’s delve into the highlights and lowlights.

Deckers Outdoor (DECK): A Standout Performer

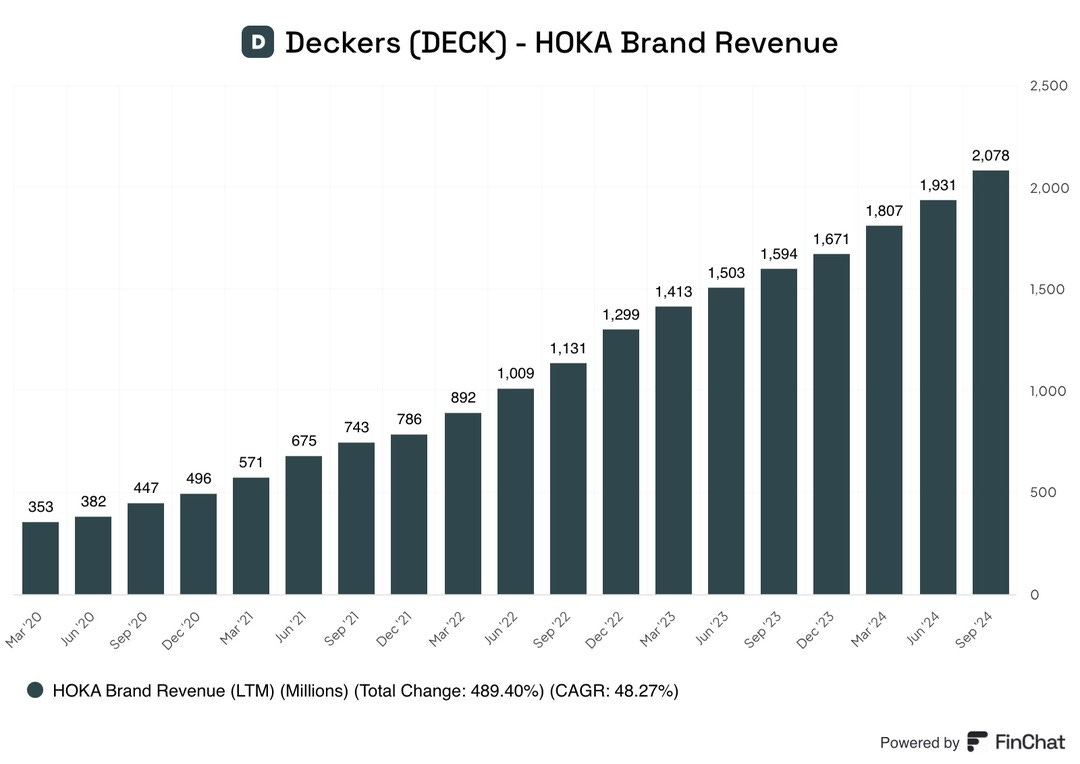

The top performer on the list, Deckers, surged an impressive 82% year-to-date, driven by the explosive popularity of its Hoka running shoes. Hoka has proven resilient, even in markets like China, where consumer spending has discouragingly low. Over the past four years, Hoka's revenue has grown at a remarkable 48% annually, crossing $2 billion in annual sales and now accounting for 33% of Deckers’ total revenue. With no signs of slowing down, the stock’s exceptional performance appears justified.

Tapestry (TPR) and Capri (CPRI): M&A Drama

Tapestry, the parent company of Coach and Kate Spade, saw its stock rise 29% over the past month, despite flat revenue growth in FY25 Q1. The stock's rally is largely attributed to relief over the failed acquisition of Capri, which owns Michael Kors, Versace, and Jimmy Choo. Investors were reassured that Tapestry dodged acquiring a struggling company. Capri’s stock initially plunged 50% on the failed merger news but has since recovered, gaining 12% in the last month as it rides broader market optimism.

Lululemon (LULU): Slowing Growth

Lululemon faced investor backlash this year due to slowing revenue growth. In Q1 FY24, revenue grew 19% year-on-year, but this slowed to just 7% in Q2. However, its Q3 guidance of 6–7% suggests that the deceleration may have stabilized. China remains a bright spot, with 34% year-on-year revenue growth in Q2. Meanwhile, the Rest of the World segment saw 24% growth, though revenue from the Americas lagged at just 1%. Concerns over Chinese consumption persist but appear tempered by strong international performance.

Nike (NKE): Facing Multiple Challenges

Nike struggled this year, grappling with increased competition from younger brands like Lululemon in athleisure and Hoka and On in running shoes. On, a Switzerland-based footwear brand, reported a stellar 30% year-on-year revenue growth in Q3 FY24. In China, Nike is also losing ground to local competitors such as Anta and Li Ning. Nike’s Q1 FY25 results revealed a 10% revenue decline year-on-year. To turn things around, Nike appointed a new CEO in October 2024, but reversing its fortunes will be a tall order given the challenges on multiple fronts.

Takeaways for the Holiday Shopper

This rundown highlights where the growth and opportunities lie among fashion stocks—and perhaps which brands to consider for your Christmas shopping list. 😊