I typically don’t cover newly launched ETFs—mostly because they don’t have a track record, and there's no guarantee they’ll gather enough assets to stay viable in the long run.

But I’m making an exception this time. These two new ETFs resemble my own approach to growth investing. When I saw them, I had that “why didn’t anyone create this earlier?” moment.

When I think about growth stocks, I’m not chasing the sexy, high-flying young companies. Sure, those can deliver big gains quickly, but most of them burn out. They go through a phase of explosive growth and hype, then taper off just as fast.

What I’m after is sustainable growth. Not 50% or even 20% per year, but steady, double-digit growth—say, in the low teens—compounded over a long period. That’s the real magic of compounding: consistency over time. High growth is exciting, but rarely lasts.

It’s a less sexy approach, but one where time does most of the heavy lifting. That’s why when someone asked Buffett why more people don’t follow his strategy, he replied, “Because no one wants to get rich slowly.” As Morgan Housel puts it in The Psychology of Money: “His skill is investing, but his secret is time.”

So how do you identify sustainable growth? Buffett looks for businesses with durable competitive advantages—companies that competitors can't easily chip away at. If he doesn’t have a high degree of confidence that a company will be significantly larger in the future, he won’t buy—even if it looks cheap.

Aside from the popular MOAT ETF, another ETF that reflects Buffett’s philosophy is the Dividend Aristocrats. These are companies that have raised dividends for at least 25 consecutive years. To do that, the underlying business must be growing steadily. But my issue with Dividend Aristocrats is that most of the companies grow slowly—usually in the single digits.

Consistency is good, but consistent growth in the 10–15% range over decades is even better. That’s the sweet spot.

Also, not all great growth stocks pay dividends. And companies that do pay dividends tend to grow more slowly. So a better measure is Free Cash Flow (FCF), which is closest to what Buffett calls “owner’s earnings.” A company that grows FCF consistently is far more valuable than one that just grows revenue or even profits. As the saying goes: Revenue is vanity, profit is sanity, cash flow is reality.

Cash flow pays the bills. It pays shareholders. It’s the lifeblood of a business.

S&P Global has defined a new class of companies called Free Cash Flow Aristocrats—businesses that:

Have generated positive FCF for at least 10 consecutive years,

Maintain high FCF margins, and

Have strong FCF return on invested capital.

The last two focus on business quality, not just survivability.

Thankfully, you don’t need to manually screen for these companies—there are now two new ETFs that track the S&P FCF Aristocrats indices. That makes them incredibly convenient to own.

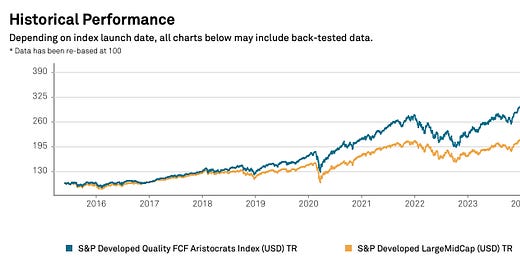

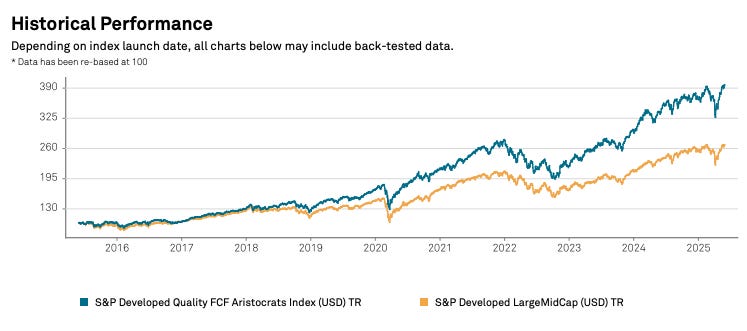

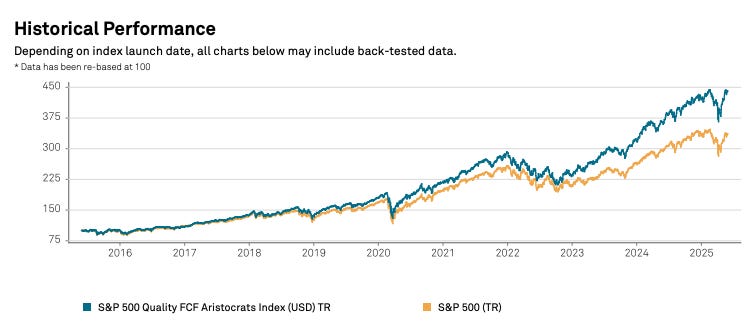

While they are new and lack trading history, the underlying indices have 10 years of backtested data. The results are impressive:

Global index: 14.26% annual return over the last 10 years.

US version: 15.72% annual return—outperforming the S&P 500’s 13.16% by 2.5% a year.

Here are the two ETFs: