Morningstar recently selected 10 undervalued stocks from the Morningstar Wide Moat Focus Index, and I wondered how these picks might perform in the following year. Thus, I looked back over the past two years. Although it's advisable to track for a longer period, I believe that examining a bullish year in 2023 and a bearish year in 2022 might suffice, given that this period marked a significant market transition.

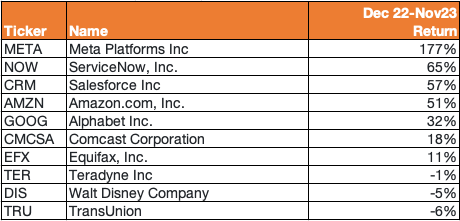

First, let's analyze Morningstar's December 2022 picks. The ten stocks are as follows:

Meta Platforms (META)

Teradyne (TER)

Comcast (CMCSA)

Amazon (AMZN)

Walt Disney (DIS)

TransUnion (TRU)

Salesforce CRM

Alphabet (GOOG)

ServiceNow (NOW)

Equifax (EFX)

Below is the performance of each individual stock between December 2022 and November 2023.

These stocks performed well in 2023, with Meta being one of the best performers in the US stock market, yielding a 177% return. This significantly boosted the overall performance of the group. Furthermore, half of the stocks delivered returns of 32% or more, outperforming the S&P 500 over the same period. Additionally, three stocks saw a decline but were down by less than 10%.

If you had purchased all ten of these stocks and equally weighted them in a portfolio, you would have generated almost a 40% return over the year! This is more than double the returns of the 50-stock VanEck Morningstar Wide Moat ETF (MOAT), which was at 15%, and the S&P 500 ETF (SPY) at 14%.

Of course, it's also important to evaluate how these picks perform in a down year.

In January 2022, Morningstar identified the following 10 undervalued wide moat stocks: